Kermit is considering purchasing a new computer system The p

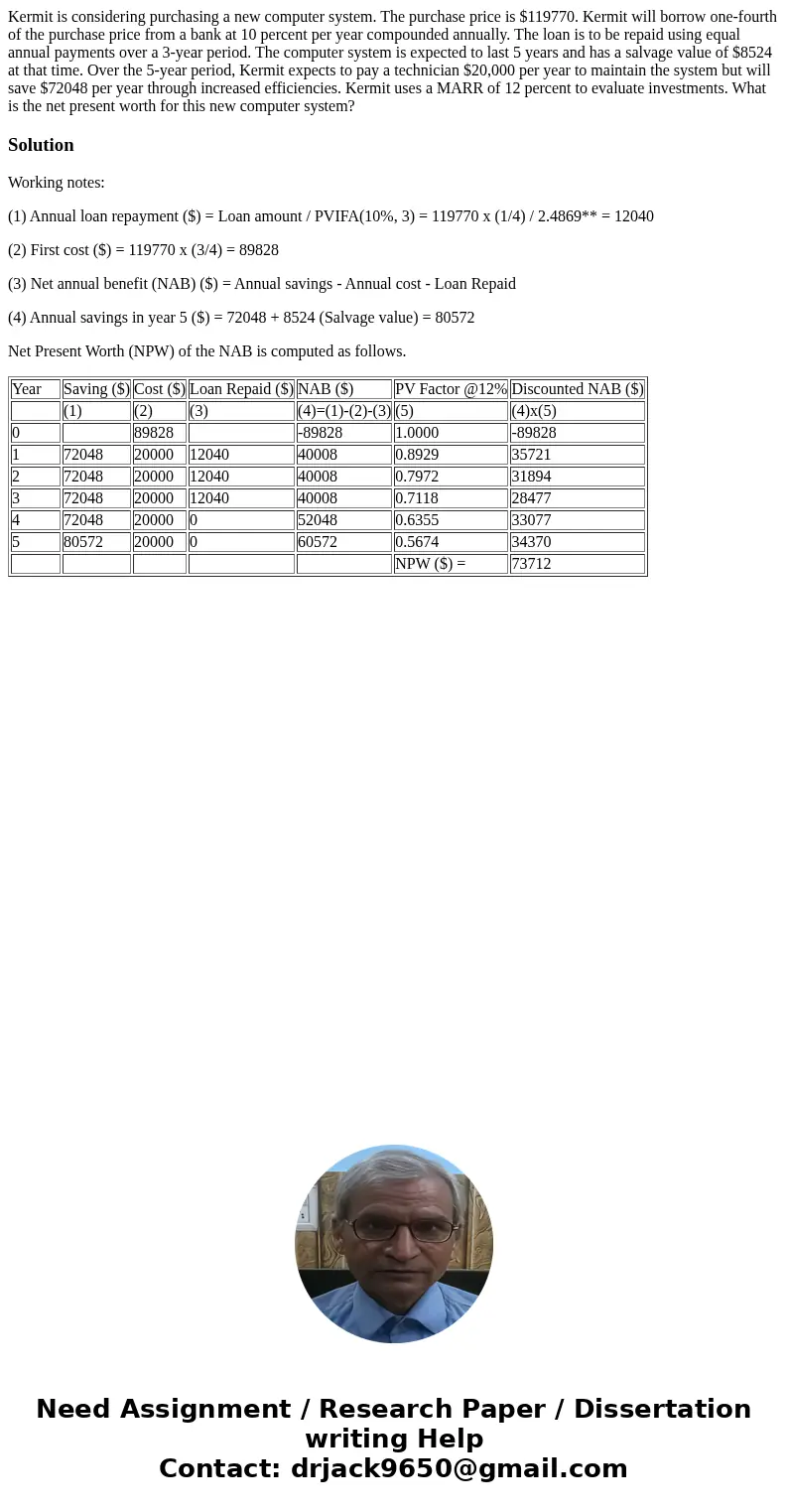

Kermit is considering purchasing a new computer system. The purchase price is $119770. Kermit will borrow one-fourth of the purchase price from a bank at 10 percent per year compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer system is expected to last 5 years and has a salvage value of $8524 at that time. Over the 5-year period, Kermit expects to pay a technician $20,000 per year to maintain the system but will save $72048 per year through increased efficiencies. Kermit uses a MARR of 12 percent to evaluate investments. What is the net present worth for this new computer system?

Solution

Working notes:

(1) Annual loan repayment ($) = Loan amount / PVIFA(10%, 3) = 119770 x (1/4) / 2.4869** = 12040

(2) First cost ($) = 119770 x (3/4) = 89828

(3) Net annual benefit (NAB) ($) = Annual savings - Annual cost - Loan Repaid

(4) Annual savings in year 5 ($) = 72048 + 8524 (Salvage value) = 80572

Net Present Worth (NPW) of the NAB is computed as follows.

| Year | Saving ($) | Cost ($) | Loan Repaid ($) | NAB ($) | PV Factor @12% | Discounted NAB ($) |

| (1) | (2) | (3) | (4)=(1)-(2)-(3) | (5) | (4)x(5) | |

| 0 | 89828 | -89828 | 1.0000 | -89828 | ||

| 1 | 72048 | 20000 | 12040 | 40008 | 0.8929 | 35721 |

| 2 | 72048 | 20000 | 12040 | 40008 | 0.7972 | 31894 |

| 3 | 72048 | 20000 | 12040 | 40008 | 0.7118 | 28477 |

| 4 | 72048 | 20000 | 0 | 52048 | 0.6355 | 33077 |

| 5 | 80572 | 20000 | 0 | 60572 | 0.5674 | 34370 |

| NPW ($) = | 73712 |

Homework Sourse

Homework Sourse