Question 2 Real Investment Decisions 15 points Halliburton i

Question 2: Real Investment Decisions (15 points) Halliburton is considering an investment in a new machine with a price of $20 million to replace its existing machine. The current machine has a book value of S8 million and a market value of S5 million. The new machine is expected to have a four-year life, and the old machine has four years left in which it can be used. If the firm replaces the old machine with the new machine, it expects to save $7.2 million in operating costs each year over the next four years. Both machines will have no salvage value in four years. If the firm purchases the new machine, it will also need an investment of S300,000 in net working capital. The required return on the investment is 10 percent, and the tax rate is 35 percent. What are the NPV and IRR of the decision to replace the old machine?

Solution

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

Also please give your positive rating.

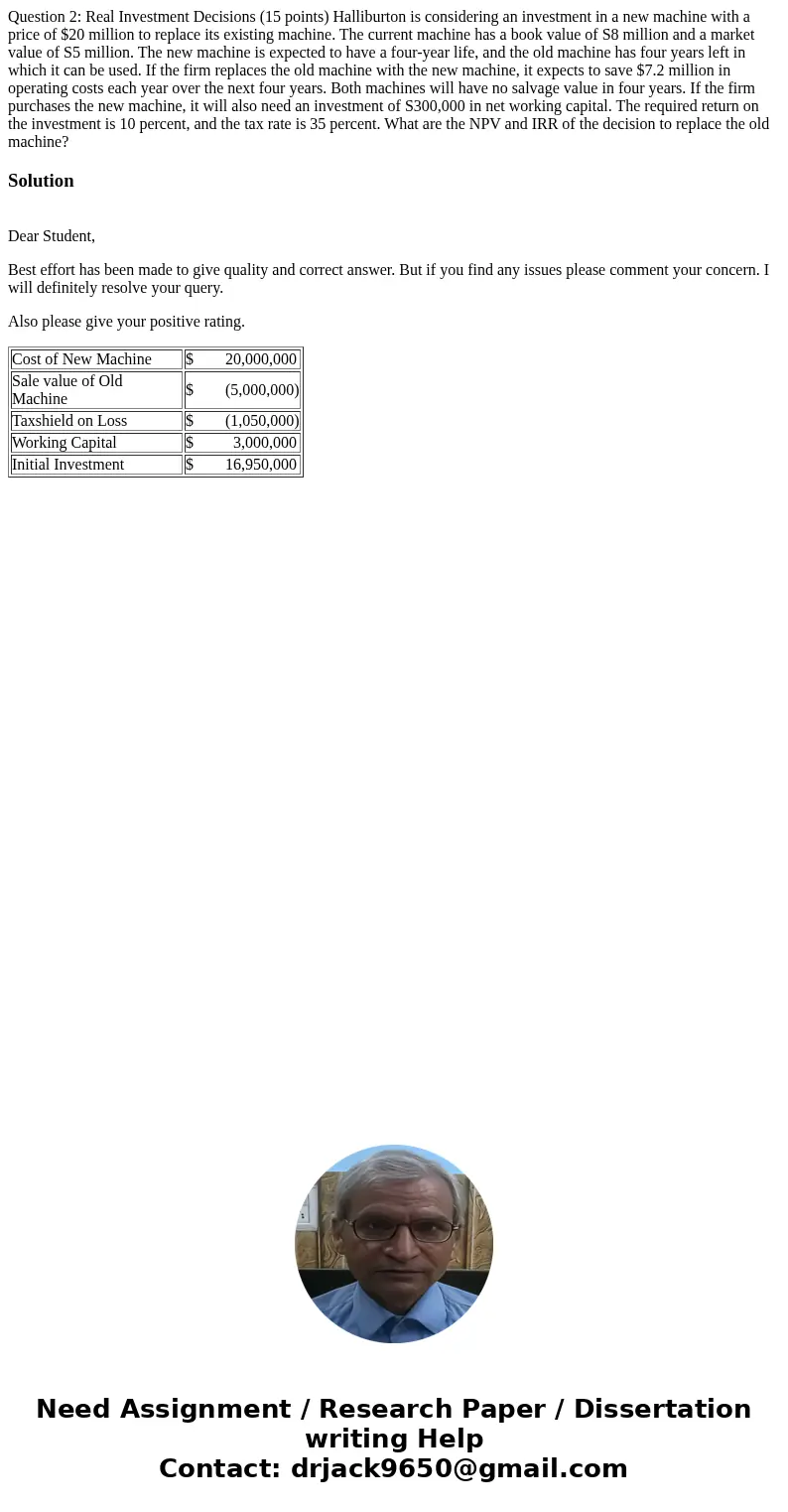

| Cost of New Machine | $ 20,000,000 |

| Sale value of Old Machine | $ (5,000,000) |

| Taxshield on Loss | $ (1,050,000) |

| Working Capital | $ 3,000,000 |

| Initial Investment | $ 16,950,000 |

Homework Sourse

Homework Sourse