Problem 211A Part Level Submission Cook Farm Supply Company

Problem 21-1A (Part Level Submission)

Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2017.

Type of Inventory

January 1

April 1

July 1

Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $300,000 in quarter 1 and $422,500 in quarter 2.

| 1. | Sales: quarter 1, 28,600 bags; quarter 2, 42,600 bags. Selling price is $63 per bag. | |

| 2. | Direct materials: each bag of Snare requires 5 pounds of Gumm at a cost of $3.8 per pound and 6 pounds of Tarr at $1.75 per pound. | |

| 3. | Desired inventory levels: |

Solution

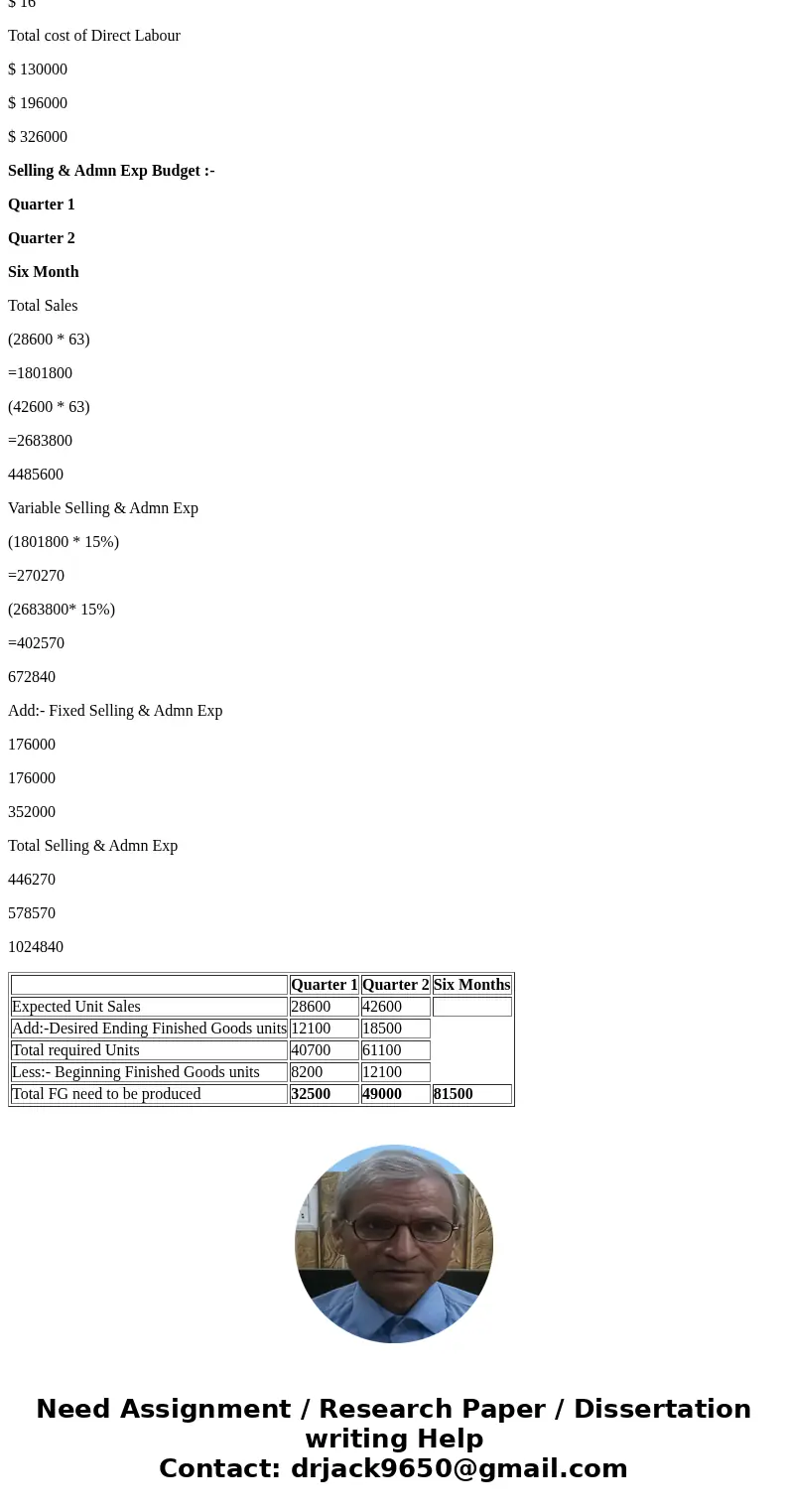

Production Budget :-

Quarter 1

Quarter 2

Six Months

Expected Unit Sales

28600

42600

Add:-Desired Ending Finished Goods units

12100

18500

Total required Units

40700

61100

Less:- Beginning Finished Goods units

8200

12100

Total FG need to be produced

32500

49000

81500

Direct Material Budget – Gumm:-

Quarter 1

Quarter 2

Six Month

Total Finished Goods needs to produced

32500

49000

Pound required for 1 unit of Finished goods

5

5

Total Pounds need for Production

(32800 * 5)

=164000

(49800 * 5)

=249000

Add:-Desired Ending Inventory

10300

13400

Total Required Units

174300

262400

Less:- Beginning Inventory Units

-9400

-10300

Total Direct Material need to purchase

164900

252100

Rate per Pound

$ 3.8

$ 3.8

Total cost of Direct Material Purchase

$ 626620

$ 957980

$1584600

Direct Labour Budget :-

Quarter 1

Quarter 2

Six Month

Total Finished Goods needs to produced

32500

49000

Direct Labour hour per unit

0.25

0.25

Total Time required for production (hours)

8125

12250

Rate per Labour hour

$ 16

$ 16

Total cost of Direct Labour

$ 130000

$ 196000

$ 326000

Selling & Admn Exp Budget :-

Quarter 1

Quarter 2

Six Month

Total Sales

(28600 * 63)

=1801800

(42600 * 63)

=2683800

4485600

Variable Selling & Admn Exp

(1801800 * 15%)

=270270

(2683800* 15%)

=402570

672840

Add:- Fixed Selling & Admn Exp

176000

176000

352000

Total Selling & Admn Exp

446270

578570

1024840

| Quarter 1 | Quarter 2 | Six Months | |

| Expected Unit Sales | 28600 | 42600 | |

| Add:-Desired Ending Finished Goods units | 12100 | 18500 | |

| Total required Units | 40700 | 61100 | |

| Less:- Beginning Finished Goods units | 8200 | 12100 | |

| Total FG need to be produced | 32500 | 49000 | 81500 |

Homework Sourse

Homework Sourse