PROBLEM II On January 1 2010 Warren Corporation had 800000 s

PROBLEM II On January 1, 2010, Warren Corporation had 800,000 shares of common stock outstanding On March 1, the corporation issued 200,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 3-for-1 stock split. On October 1, the corporation purchased on the market 300,000 of its own outstanding shares and retired them. 10,000 shares of 8% S100 par value, nos preferred stock were outstanding convertible into 40,000 shares of common). No dividends were declared or paid on either the preferred or common stock in 2010 Net income for 2010 was S4-700,000. Tax rate was 30%. convertible bonds, 9%. S 300,000 face amount , convertible into 25,000 common shares Also outstanding at January 1,2010 were incentive stockoptions granted to key executives on January 1, 2005. The options are exercisable as of January 1, 2009, for 40,000 common shares at an exercise price of S20 per share . During 2010, the average market price of the common shares was $50 per share. . . . Required: 1) Determine the Basic Earnings Per Share for 2010. 2) Determine the Diluted Earnings Per Share for 2010

Solution

Options :

Short-cut Method :

Shares 40,000

Price 20

Mkt Price 50

So Options will be = 40,000 * 30/50 = 24,000 shares

Bonds :

Bonds Face value 300,000

9% interest

Tax rate 30%

Valye after Tax = 300,000 - 90,000 = 210,000

Interest after Tax = 210,000 * 9% = 18,900

Convertible Shares = 40,000

* Cumulative convertible preferred shares are anti-dilutive, so don\'t include.

Provide Feedback.................

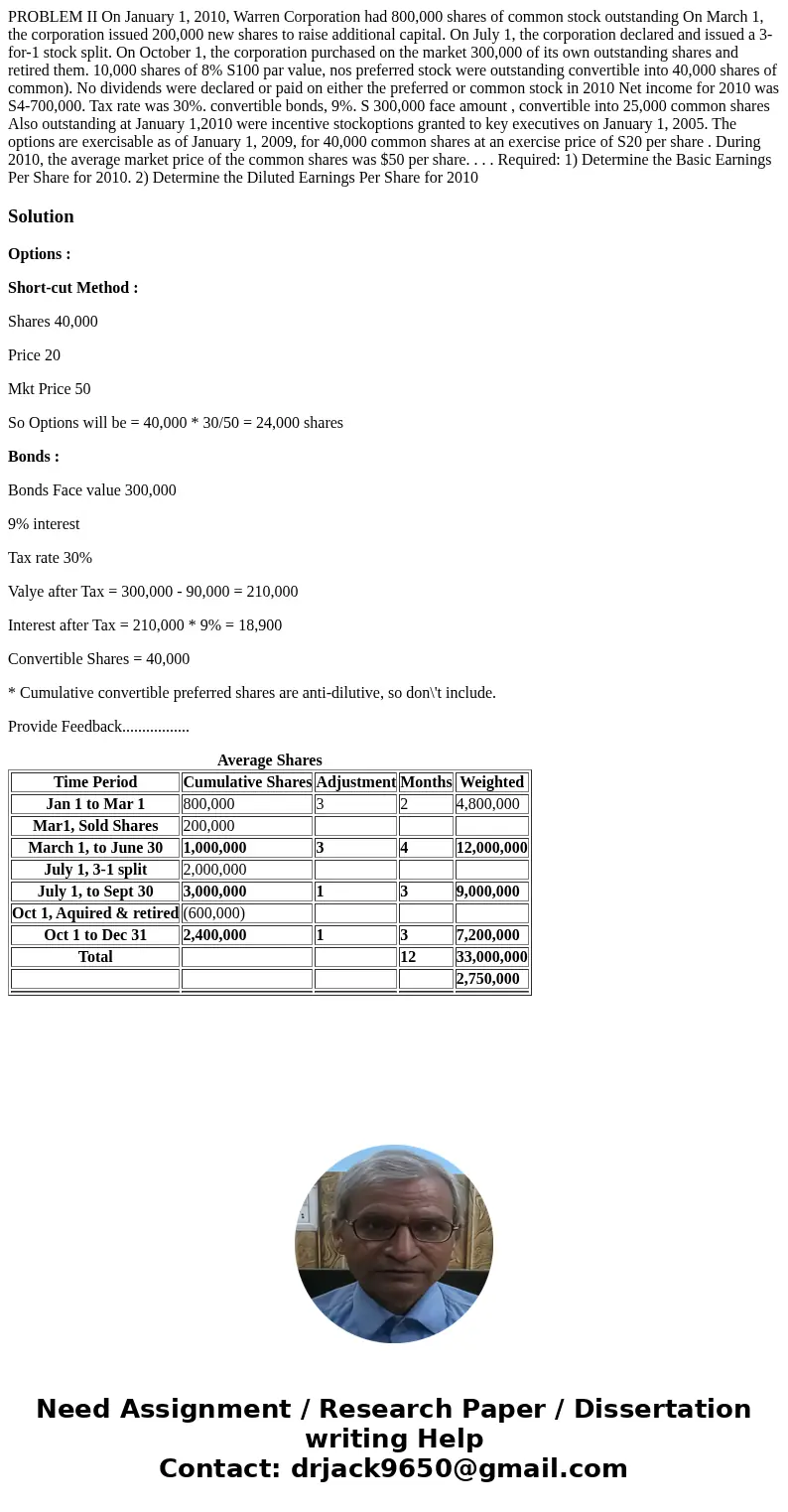

| Time Period | Cumulative Shares | Adjustment | Months | Weighted |

|---|---|---|---|---|

| Jan 1 to Mar 1 | 800,000 | 3 | 2 | 4,800,000 |

| Mar1, Sold Shares | 200,000 | |||

| March 1, to June 30 | 1,000,000 | 3 | 4 | 12,000,000 |

| July 1, 3-1 split | 2,000,000 | |||

| July 1, to Sept 30 | 3,000,000 | 1 | 3 | 9,000,000 |

| Oct 1, Aquired & retired | (600,000) | |||

| Oct 1 to Dec 31 | 2,400,000 | 1 | 3 | 7,200,000 |

| Total | 12 | 33,000,000 | ||

| 2,750,000 | ||||

Homework Sourse

Homework Sourse