Exercise 91 Pacelli Company issued 10year 0 bonds with a par

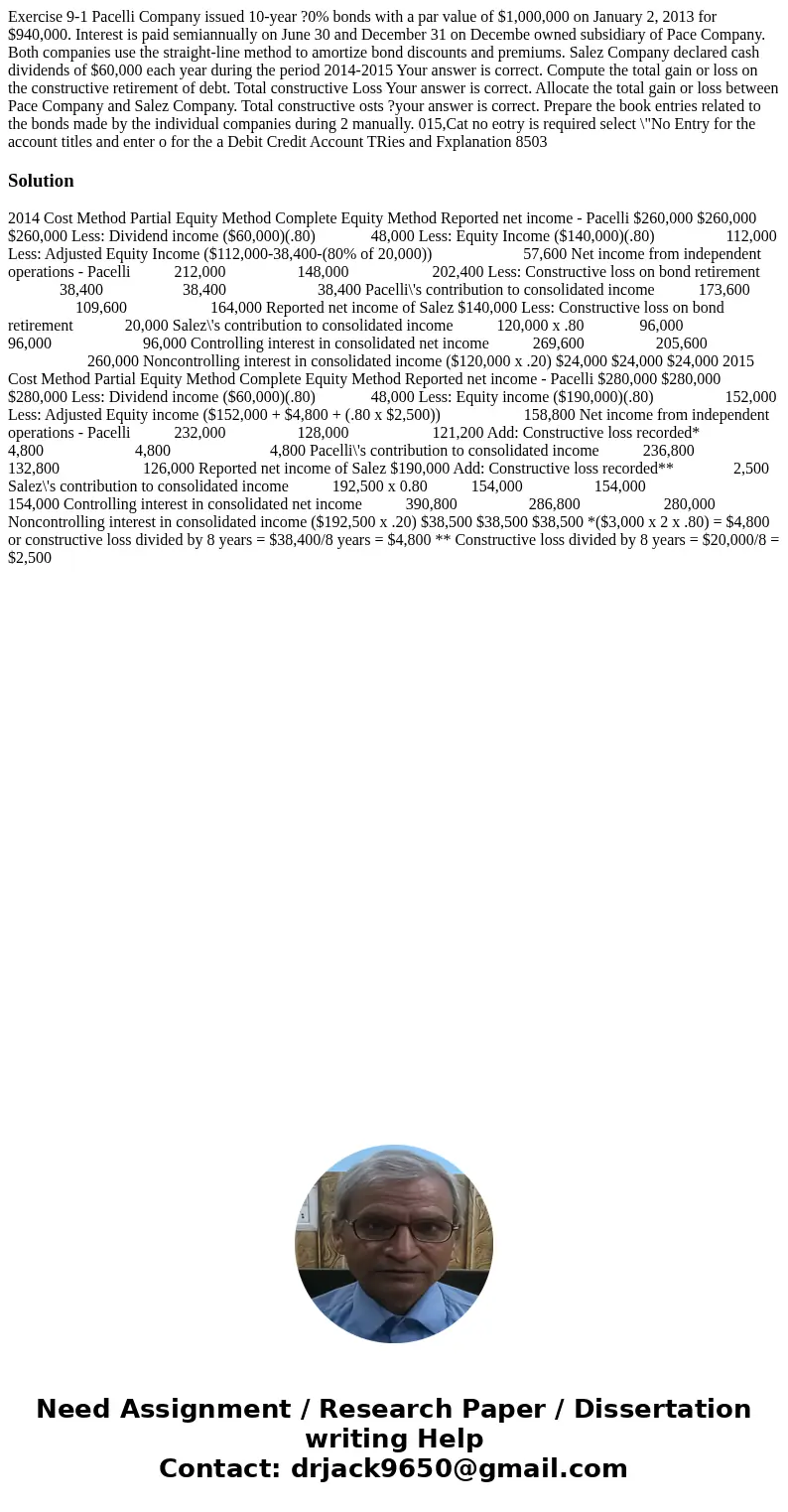

Exercise 9-1 Pacelli Company issued 10-year ?0% bonds with a par value of $1,000,000 on January 2, 2013 for $940,000. Interest is paid semiannually on June 30 and December 31 on Decembe owned subsidiary of Pace Company. Both companies use the straight-line method to amortize bond discounts and premiums. Salez Company declared cash dividends of $60,000 each year during the period 2014-2015 Your answer is correct. Compute the total gain or loss on the constructive retirement of debt. Total constructive Loss Your answer is correct. Allocate the total gain or loss between Pace Company and Salez Company. Total constructive osts ?your answer is correct. Prepare the book entries related to the bonds made by the individual companies during 2 manually. 015,Cat no eotry is required select \"No Entry for the account titles and enter o for the a Debit Credit Account TRies and Fxplanation 8503

Solution

2014 Cost Method Partial Equity Method Complete Equity Method Reported net income - Pacelli $260,000 $260,000 $260,000 Less: Dividend income ($60,000)(.80) 48,000 Less: Equity Income ($140,000)(.80) 112,000 Less: Adjusted Equity Income ($112,000-38,400-(80% of 20,000)) 57,600 Net income from independent operations - Pacelli 212,000 148,000 202,400 Less: Constructive loss on bond retirement 38,400 38,400 38,400 Pacelli\'s contribution to consolidated income 173,600 109,600 164,000 Reported net income of Salez $140,000 Less: Constructive loss on bond retirement 20,000 Salez\'s contribution to consolidated income 120,000 x .80 96,000 96,000 96,000 Controlling interest in consolidated net income 269,600 205,600 260,000 Noncontrolling interest in consolidated income ($120,000 x .20) $24,000 $24,000 $24,000 2015 Cost Method Partial Equity Method Complete Equity Method Reported net income - Pacelli $280,000 $280,000 $280,000 Less: Dividend income ($60,000)(.80) 48,000 Less: Equity income ($190,000)(.80) 152,000 Less: Adjusted Equity income ($152,000 + $4,800 + (.80 x $2,500)) 158,800 Net income from independent operations - Pacelli 232,000 128,000 121,200 Add: Constructive loss recorded* 4,800 4,800 4,800 Pacelli\'s contribution to consolidated income 236,800 132,800 126,000 Reported net income of Salez $190,000 Add: Constructive loss recorded** 2,500 Salez\'s contribution to consolidated income 192,500 x 0.80 154,000 154,000 154,000 Controlling interest in consolidated net income 390,800 286,800 280,000 Noncontrolling interest in consolidated income ($192,500 x .20) $38,500 $38,500 $38,500 *($3,000 x 2 x .80) = $4,800 or constructive loss divided by 8 years = $38,400/8 years = $4,800 ** Constructive loss divided by 8 years = $20,000/8 = $2,500

Homework Sourse

Homework Sourse