Suppose that under the Plan of Repayment one should pay off

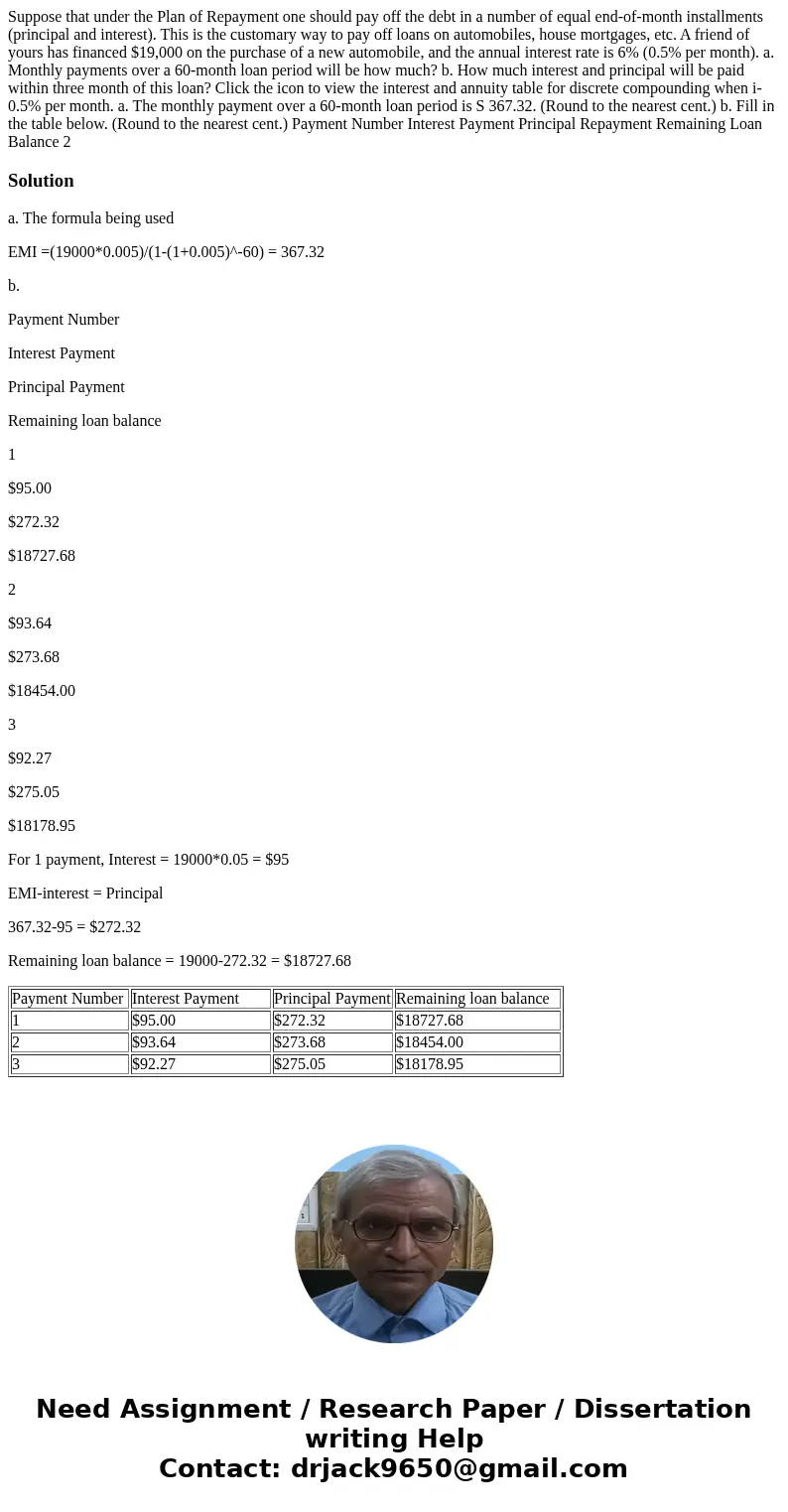

Suppose that under the Plan of Repayment one should pay off the debt in a number of equal end-of-month installments (principal and interest). This is the customary way to pay off loans on automobiles, house mortgages, etc. A friend of yours has financed $19,000 on the purchase of a new automobile, and the annual interest rate is 6% (0.5% per month). a. Monthly payments over a 60-month loan period will be how much? b. How much interest and principal will be paid within three month of this loan? Click the icon to view the interest and annuity table for discrete compounding when i-0.5% per month. a. The monthly payment over a 60-month loan period is S 367.32. (Round to the nearest cent.) b. Fill in the table below. (Round to the nearest cent.) Payment Number Interest Payment Principal Repayment Remaining Loan Balance 2

Solution

a. The formula being used

EMI =(19000*0.005)/(1-(1+0.005)^-60) = 367.32

b.

Payment Number

Interest Payment

Principal Payment

Remaining loan balance

1

$95.00

$272.32

$18727.68

2

$93.64

$273.68

$18454.00

3

$92.27

$275.05

$18178.95

For 1 payment, Interest = 19000*0.05 = $95

EMI-interest = Principal

367.32-95 = $272.32

Remaining loan balance = 19000-272.32 = $18727.68

| Payment Number | Interest Payment | Principal Payment | Remaining loan balance |

| 1 | $95.00 | $272.32 | $18727.68 |

| 2 | $93.64 | $273.68 | $18454.00 |

| 3 | $92.27 | $275.05 | $18178.95 |

Homework Sourse

Homework Sourse