PROBLEMS 1 Rosotti Corporation began operations on January 1

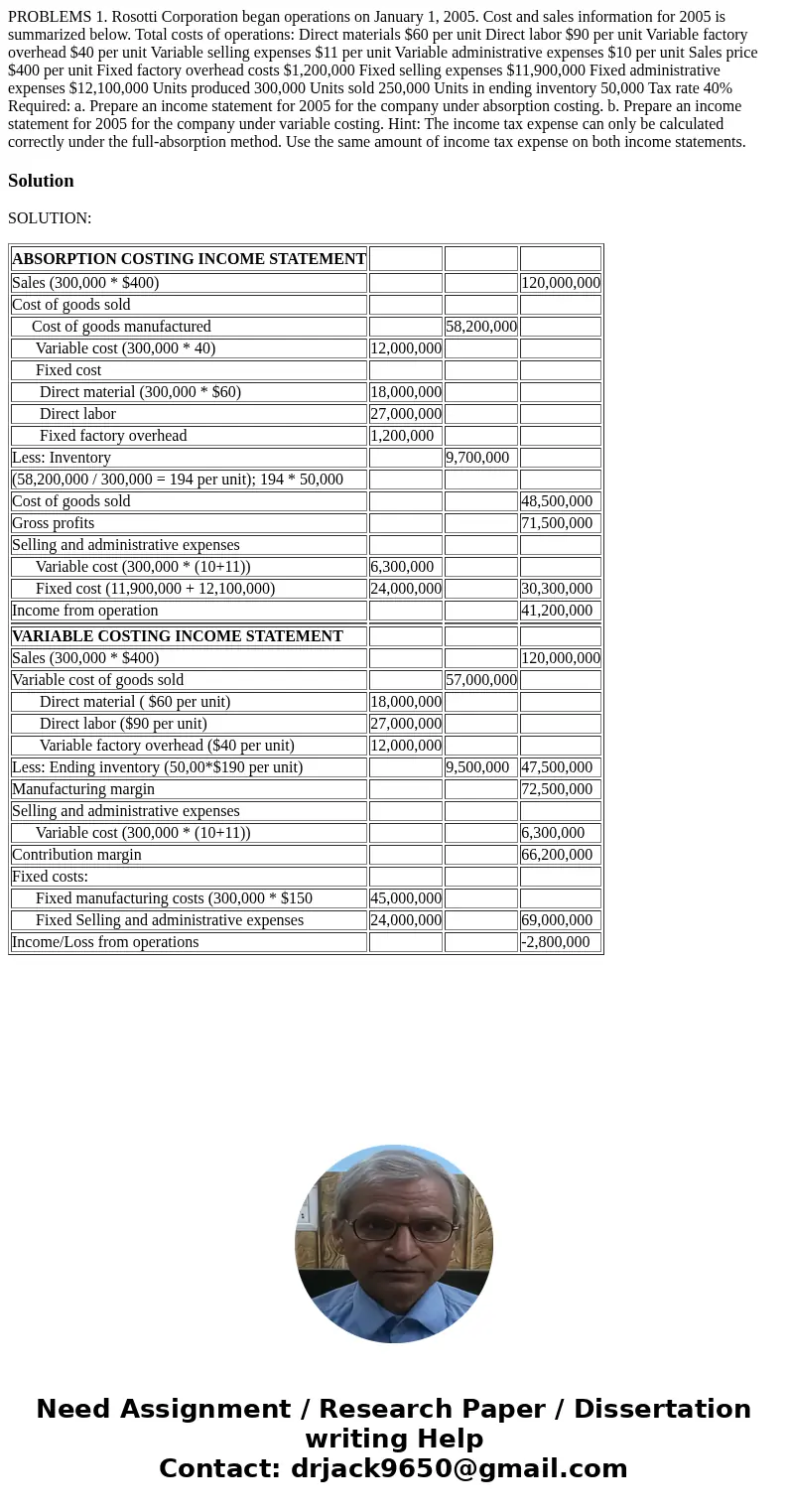

PROBLEMS 1. Rosotti Corporation began operations on January 1, 2005. Cost and sales information for 2005 is summarized below. Total costs of operations: Direct materials $60 per unit Direct labor $90 per unit Variable factory overhead $40 per unit Variable selling expenses $11 per unit Variable administrative expenses $10 per unit Sales price $400 per unit Fixed factory overhead costs $1,200,000 Fixed selling expenses $11,900,000 Fixed administrative expenses $12,100,000 Units produced 300,000 Units sold 250,000 Units in ending inventory 50,000 Tax rate 40% Required: a. Prepare an income statement for 2005 for the company under absorption costing. b. Prepare an income statement for 2005 for the company under variable costing. Hint: The income tax expense can only be calculated correctly under the full-absorption method. Use the same amount of income tax expense on both income statements.

Solution

SOLUTION:

| ABSORPTION COSTING INCOME STATEMENT | |||

| Sales (300,000 * $400) | 120,000,000 | ||

| Cost of goods sold | |||

| Cost of goods manufactured | 58,200,000 | ||

| Variable cost (300,000 * 40) | 12,000,000 | ||

| Fixed cost | |||

| Direct material (300,000 * $60) | 18,000,000 | ||

| Direct labor | 27,000,000 | ||

| Fixed factory overhead | 1,200,000 | ||

| Less: Inventory | 9,700,000 | ||

| (58,200,000 / 300,000 = 194 per unit); 194 * 50,000 | |||

| Cost of goods sold | 48,500,000 | ||

| Gross profits | 71,500,000 | ||

| Selling and administrative expenses | |||

| Variable cost (300,000 * (10+11)) | 6,300,000 | ||

| Fixed cost (11,900,000 + 12,100,000) | 24,000,000 | 30,300,000 | |

| Income from operation | 41,200,000 | ||

| VARIABLE COSTING INCOME STATEMENT | |||

| Sales (300,000 * $400) | 120,000,000 | ||

| Variable cost of goods sold | 57,000,000 | ||

| Direct material ( $60 per unit) | 18,000,000 | ||

| Direct labor ($90 per unit) | 27,000,000 | ||

| Variable factory overhead ($40 per unit) | 12,000,000 | ||

| Less: Ending inventory (50,00*$190 per unit) | 9,500,000 | 47,500,000 | |

| Manufacturing margin | 72,500,000 | ||

| Selling and administrative expenses | |||

| Variable cost (300,000 * (10+11)) | 6,300,000 | ||

| Contribution margin | 66,200,000 | ||

| Fixed costs: | |||

| Fixed manufacturing costs (300,000 * $150 | 45,000,000 | ||

| Fixed Selling and administrative expenses | 24,000,000 | 69,000,000 | |

| Income/Loss from operations | -2,800,000 |

Homework Sourse

Homework Sourse