Statement of Cash Flows Angelas Cleaning Consortium Comparat

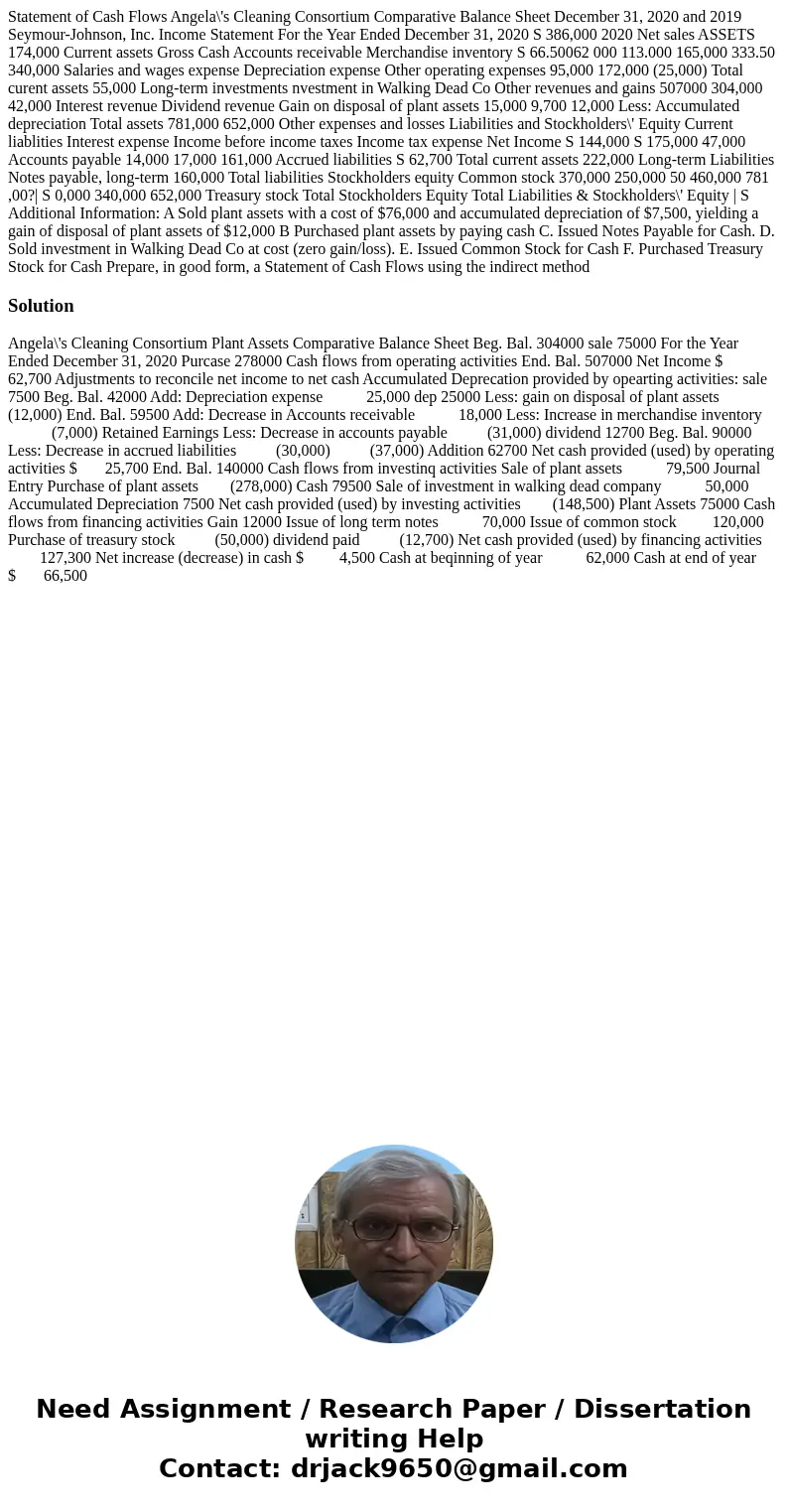

Statement of Cash Flows Angela\'s Cleaning Consortium Comparative Balance Sheet December 31, 2020 and 2019 Seymour-Johnson, Inc. Income Statement For the Year Ended December 31, 2020 S 386,000 2020 Net sales ASSETS 174,000 Current assets Gross Cash Accounts receivable Merchandise inventory S 66.50062 000 113.000 165,000 333.50 340,000 Salaries and wages expense Depreciation expense Other operating expenses 95,000 172,000 (25,000) Total curent assets 55,000 Long-term investments nvestment in Walking Dead Co Other revenues and gains 507000 304,000 42,000 Interest revenue Dividend revenue Gain on disposal of plant assets 15,000 9,700 12,000 Less: Accumulated depreciation Total assets 781,000 652,000 Other expenses and losses Liabilities and Stockholders\' Equity Current liablities Interest expense Income before income taxes Income tax expense Net Income S 144,000 S 175,000 47,000 Accounts payable 14,000 17,000 161,000 Accrued liabilities S 62,700 Total current assets 222,000 Long-term Liabilities Notes payable, long-term 160,000 Total liabilities Stockholders equity Common stock 370,000 250,000 50 460,000 781 ,00?| S 0,000 340,000 652,000 Treasury stock Total Stockholders Equity Total Liabilities & Stockholders\' Equity | S Additional Information: A Sold plant assets with a cost of $76,000 and accumulated depreciation of $7,500, yielding a gain of disposal of plant assets of $12,000 B Purchased plant assets by paying cash C. Issued Notes Payable for Cash. D. Sold investment in Walking Dead Co at cost (zero gain/loss). E. Issued Common Stock for Cash F. Purchased Treasury Stock for Cash Prepare, in good form, a Statement of Cash Flows using the indirect method

Solution

Angela\'s Cleaning Consortium Plant Assets Comparative Balance Sheet Beg. Bal. 304000 sale 75000 For the Year Ended December 31, 2020 Purcase 278000 Cash flows from operating activities End. Bal. 507000 Net Income $ 62,700 Adjustments to reconcile net income to net cash Accumulated Deprecation provided by opearting activities: sale 7500 Beg. Bal. 42000 Add: Depreciation expense 25,000 dep 25000 Less: gain on disposal of plant assets (12,000) End. Bal. 59500 Add: Decrease in Accounts receivable 18,000 Less: Increase in merchandise inventory (7,000) Retained Earnings Less: Decrease in accounts payable (31,000) dividend 12700 Beg. Bal. 90000 Less: Decrease in accrued liabilities (30,000) (37,000) Addition 62700 Net cash provided (used) by operating activities $ 25,700 End. Bal. 140000 Cash flows from investinq activities Sale of plant assets 79,500 Journal Entry Purchase of plant assets (278,000) Cash 79500 Sale of investment in walking dead company 50,000 Accumulated Depreciation 7500 Net cash provided (used) by investing activities (148,500) Plant Assets 75000 Cash flows from financing activities Gain 12000 Issue of long term notes 70,000 Issue of common stock 120,000 Purchase of treasury stock (50,000) dividend paid (12,700) Net cash provided (used) by financing activities 127,300 Net increase (decrease) in cash $ 4,500 Cash at beqinning of year 62,000 Cash at end of year $ 66,500

Homework Sourse

Homework Sourse