Explain and show work Perez Company is considering the addit

Explain and show work

Perez Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products follow Skin Cream 124,000 Relevant Information Bath Oil 204,000 Color Gel 84,000 13 Budgeted sales in units (a) Expected sales price (b) Variable costs per unit (c) Income statements Sales revenue (ax b) Variable costs (a x c) Contribution margin Fixed costs $868,000 620,000 $155, 000 $1,224,000 612,000 $ 147,000 $1,092,000 (612,000) (756,000) (248,000) 336,000 (104,000 $ 232,000 (465,000)465.00 Net income Required: a. Determine the margin of safety as a percentage for each product. b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume c. For each product, determine the percentage change in net income that results from the 20 percent increase in sales d. Which product has the highest operating leverage? e. Assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? f. Assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?Solution

(a) Calculation of margin of safety percentage

For skin cream

Contribution margin ratio = Contribution margin/Sales

= 620,000/868,000

= 71.43%

Margin of safety = Profit/Contribution margin ratio

= 155,000/71.43%

= $217,000

Margin of safety (%) = Margin of safety/Sales

= 217,000/868,000

= 25%

For bath oil

Contribution margin ratio = Contribution margin/Sales

= 612,000/1,224,000

= 50%

Margin of safety = Profit/Contribution margin ratio

= 147,000/50%

= $294,000

Margin of safety (%) = Margin of safety/Sales

= 294,000/1,224,000

= 24.02%

For color gel

Contribution margin ratio = Contribution margin/Sales

= 336,000/1,092,000

= 30.77%

Margin of safety = Profit/Contribution margin ratio

= 232,000/30.77%

= $754,000

Margin of safety (%) = Margin of safety/Sales

= 754,000/1,092,000

= 69.05%

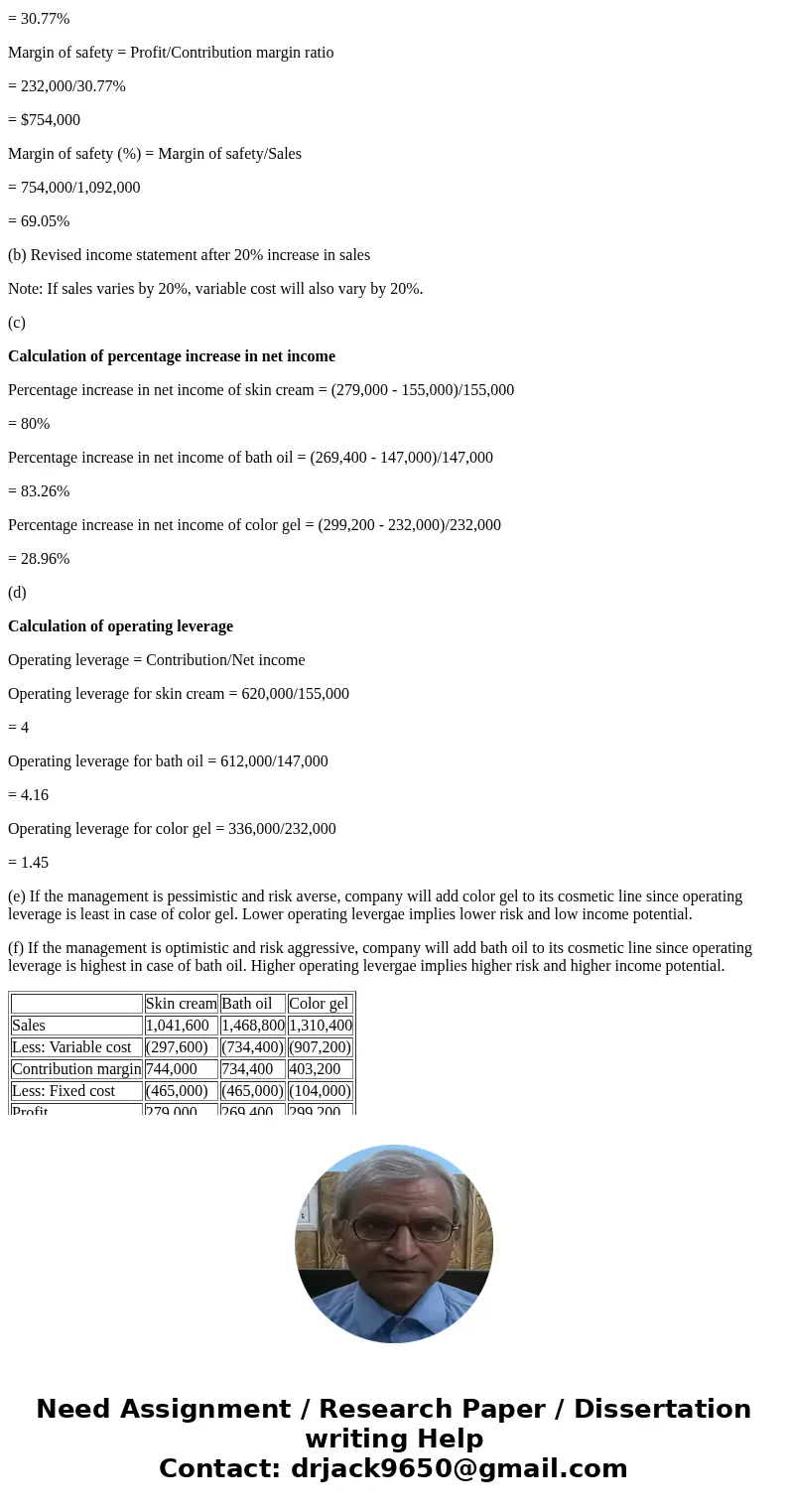

(b) Revised income statement after 20% increase in sales

Note: If sales varies by 20%, variable cost will also vary by 20%.

(c)

Calculation of percentage increase in net income

Percentage increase in net income of skin cream = (279,000 - 155,000)/155,000

= 80%

Percentage increase in net income of bath oil = (269,400 - 147,000)/147,000

= 83.26%

Percentage increase in net income of color gel = (299,200 - 232,000)/232,000

= 28.96%

(d)

Calculation of operating leverage

Operating leverage = Contribution/Net income

Operating leverage for skin cream = 620,000/155,000

= 4

Operating leverage for bath oil = 612,000/147,000

= 4.16

Operating leverage for color gel = 336,000/232,000

= 1.45

(e) If the management is pessimistic and risk averse, company will add color gel to its cosmetic line since operating leverage is least in case of color gel. Lower operating levergae implies lower risk and low income potential.

(f) If the management is optimistic and risk aggressive, company will add bath oil to its cosmetic line since operating leverage is highest in case of bath oil. Higher operating levergae implies higher risk and higher income potential.

| Skin cream | Bath oil | Color gel | |

| Sales | 1,041,600 | 1,468,800 | 1,310,400 |

| Less: Variable cost | (297,600) | (734,400) | (907,200) |

| Contribution margin | 744,000 | 734,400 | 403,200 |

| Less: Fixed cost | (465,000) | (465,000) | (104,000) |

| Profit | 279,000 | 269,400 | 299,200 |

Homework Sourse

Homework Sourse