Adjusting Entries Round to two decimal places 27 The rent p

| Adjusting Entries - Round to two decimal places. | |

| 27. | The rent payment made on June 17 (3600 )was for June and July. Expense the amount associated with one month\'s rent. |

| 28. | A physical inventory showed that only $259.00 worth of office supplies remained on hand as of June 30. |

| 29. | The annual interest rate on the mortgage payable was 9.00 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. |

| 30. | Record a journal entry to reflect that one half month\'s insurance has expired. |

| 31. | A review of Byte’s job worksheets show that there are unbilled revenues in the amount of $5,625.00 for the period of June 28-30. |

| The fixed assets have estimated useful lives as follows: | |

| Building - 31.5 years | |

| Computer Equipment - 5.0 years | |

| 32. | Office Equipment - 7.0 years |

| Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building’s scrap value is $500.00. The office equipment has a scrap value of $350.00. The computer equipment has no scrap value. Calculate the depreciation for one month. | |

| 33. | A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. |

| 34. | The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. |

| Closing Entries | |

| 35. | Close the revenue accounts. |

| 36. | Close the expense accounts. |

| 37. | Close the income summary account. |

| 38. | Close the withdrawals account. |

| Adjusting Entries - Round to two decimal places. | |

| 27. | The rent payment made on June 17 (3600 )was for June and July. Expense the amount associated with one month\'s rent. |

| 28. | A physical inventory showed that only $259.00 worth of office supplies remained on hand as of June 30. |

| 29. | The annual interest rate on the mortgage payable was 9.00 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. |

| 30. | Record a journal entry to reflect that one half month\'s insurance has expired. |

| 31. | A review of Byte’s job worksheets show that there are unbilled revenues in the amount of $5,625.00 for the period of June 28-30. |

| The fixed assets have estimated useful lives as follows: | |

| Building - 31.5 years | |

| Computer Equipment - 5.0 years | |

| 32. | Office Equipment - 7.0 years |

| Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building’s scrap value is $500.00. The office equipment has a scrap value of $350.00. The computer equipment has no scrap value. Calculate the depreciation for one month. | |

| 33. | A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. |

| 34. | The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. |

| Closing Entries | |

| 35. | Close the revenue accounts. |

| 36. | Close the expense accounts. |

| 37. | Close the income summary account. |

| 38. | Close the withdrawals account. |

Solution

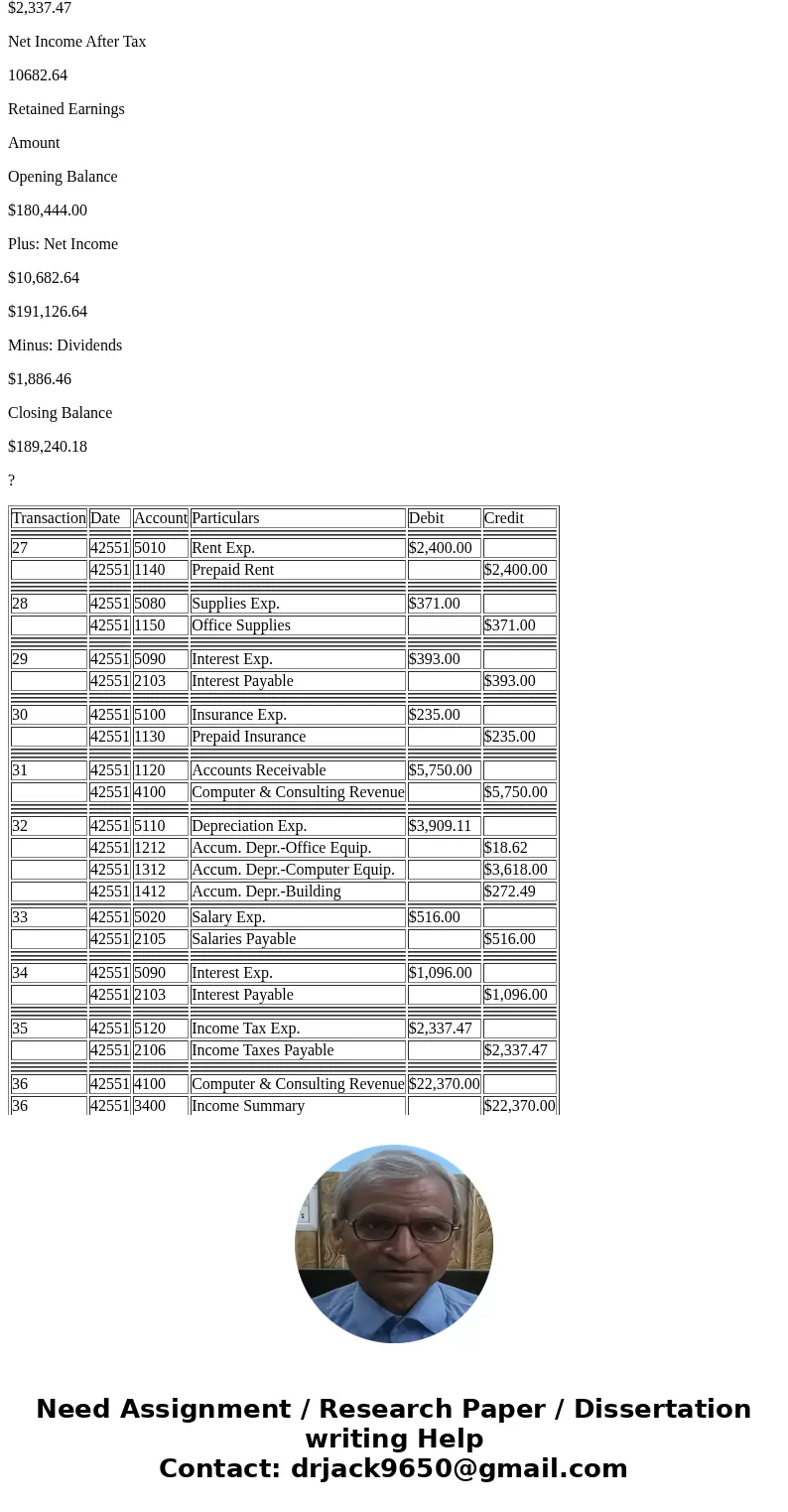

SOLUTION:

Income statement

Revenues

Computer & Consulting Revenue

$22,370.00

Exp.enses

Rent Exp.

$2,400.00

Salary Exp.

$2,236.00

Advertising Exp..

$350.00

Repair and Maint. Exp..

$1,190.00

Oil & Gas Exp.

$840.00

Supplies Exp.

$371.00

Interest Exp.

$1,489.00

Insurance Exp.

$235.00

Depreciation Exp.

$3,909.11

Total

$13,020.11

Net Income Before Tax

$13,020.11

Income Tax Exp..

$2,337.47

Net Income After Tax

10682.64

Retained Earnings

Amount

Opening Balance

$180,444.00

Plus: Net Income

$10,682.64

$191,126.64

Minus: Dividends

$1,886.46

Closing Balance

$189,240.18

?

| Transaction | Date | Account | Particulars | Debit | Credit |

| 27 | 42551 | 5010 | Rent Exp. | $2,400.00 | |

| 42551 | 1140 | Prepaid Rent | $2,400.00 | ||

| 28 | 42551 | 5080 | Supplies Exp. | $371.00 | |

| 42551 | 1150 | Office Supplies | $371.00 | ||

| 29 | 42551 | 5090 | Interest Exp. | $393.00 | |

| 42551 | 2103 | Interest Payable | $393.00 | ||

| 30 | 42551 | 5100 | Insurance Exp. | $235.00 | |

| 42551 | 1130 | Prepaid Insurance | $235.00 | ||

| 31 | 42551 | 1120 | Accounts Receivable | $5,750.00 | |

| 42551 | 4100 | Computer & Consulting Revenue | $5,750.00 | ||

| 32 | 42551 | 5110 | Depreciation Exp. | $3,909.11 | |

| 42551 | 1212 | Accum. Depr.-Office Equip. | $18.62 | ||

| 42551 | 1312 | Accum. Depr.-Computer Equip. | $3,618.00 | ||

| 42551 | 1412 | Accum. Depr.-Building | $272.49 | ||

| 33 | 42551 | 5020 | Salary Exp. | $516.00 | |

| 42551 | 2105 | Salaries Payable | $516.00 | ||

| 34 | 42551 | 5090 | Interest Exp. | $1,096.00 | |

| 42551 | 2103 | Interest Payable | $1,096.00 | ||

| 35 | 42551 | 5120 | Income Tax Exp. | $2,337.47 | |

| 42551 | 2106 | Income Taxes Payable | $2,337.47 | ||

| 36 | 42551 | 4100 | Computer & Consulting Revenue | $22,370.00 | |

| 36 | 42551 | 3400 | Income Summary | $22,370.00 | |

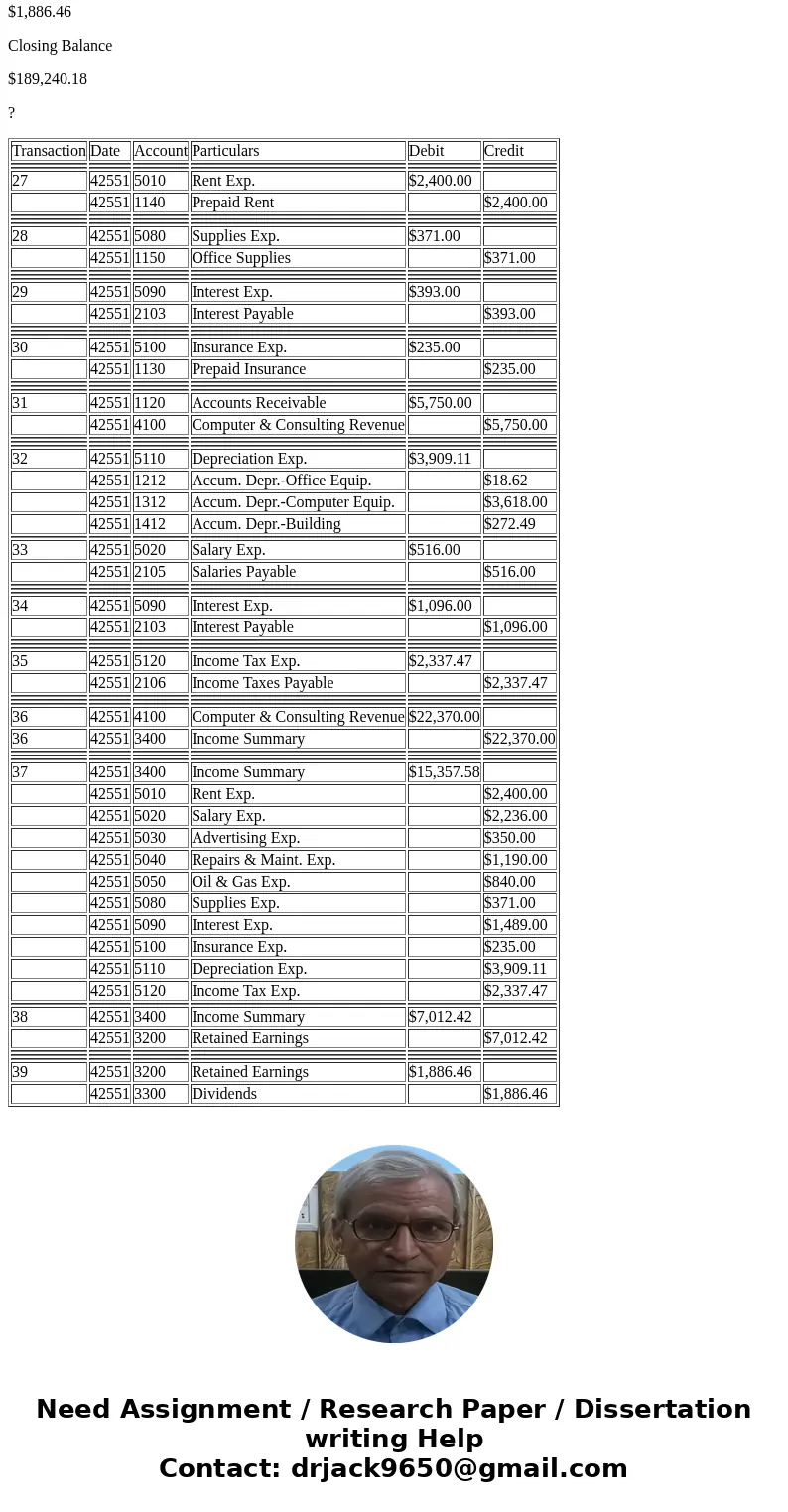

| 37 | 42551 | 3400 | Income Summary | $15,357.58 | |

| 42551 | 5010 | Rent Exp. | $2,400.00 | ||

| 42551 | 5020 | Salary Exp. | $2,236.00 | ||

| 42551 | 5030 | Advertising Exp. | $350.00 | ||

| 42551 | 5040 | Repairs & Maint. Exp. | $1,190.00 | ||

| 42551 | 5050 | Oil & Gas Exp. | $840.00 | ||

| 42551 | 5080 | Supplies Exp. | $371.00 | ||

| 42551 | 5090 | Interest Exp. | $1,489.00 | ||

| 42551 | 5100 | Insurance Exp. | $235.00 | ||

| 42551 | 5110 | Depreciation Exp. | $3,909.11 | ||

| 42551 | 5120 | Income Tax Exp. | $2,337.47 | ||

| 38 | 42551 | 3400 | Income Summary | $7,012.42 | |

| 42551 | 3200 | Retained Earnings | $7,012.42 | ||

| 39 | 42551 | 3200 | Retained Earnings | $1,886.46 | |

| 42551 | 3300 | Dividends | $1,886.46 |

Homework Sourse

Homework Sourse