USF manufactures and sells desktop organizing systems There

USF manufactures and sells desktop organizing systems. There are three global locations:

China – responsible for the internally manufactured mechanical components of the systems. These are mostly made from standardized pieces of metal and wood sourced locally. The workers are non-union and there is typically a high volume of turnover in any given year.

Variable Costs = 1,000 yuan

Fixed Costs = 1,800 yuan

Market Price for components = 3,600 yuan

Tax rate = 20%

8 yuan = $1 CDN

South Korea – responsible for assembling sub-component pieces that include the internally generated mechanical components (highly technical and made with custom machinery) as well as outsourced mechanical components that come from various suppliers around the world. The workers are non-union and there is very little turnover in any given year.

Variable Costs = 360,000 won

Fixed Costs = 480,000 won

Market Price for assemble pieces = 1,560,000 won

Tax rate = 20%

1,200 won = $1 CDN

Canada – responsible for packaging and distributing to North American markets. The workers are unionized and have had a history of voting to strike when ratifying contracts.

Variable Costs = $100

Fixed Costs = $200

Selling Price = $3,200

Tax rate = 30%

Discuss the difference between transfers made at market price versus transfer prices designed to maximize profits. Show calculations for the profit maximizing scenario.

Include other factors that should be considered if looking to maximize profits.

Solution

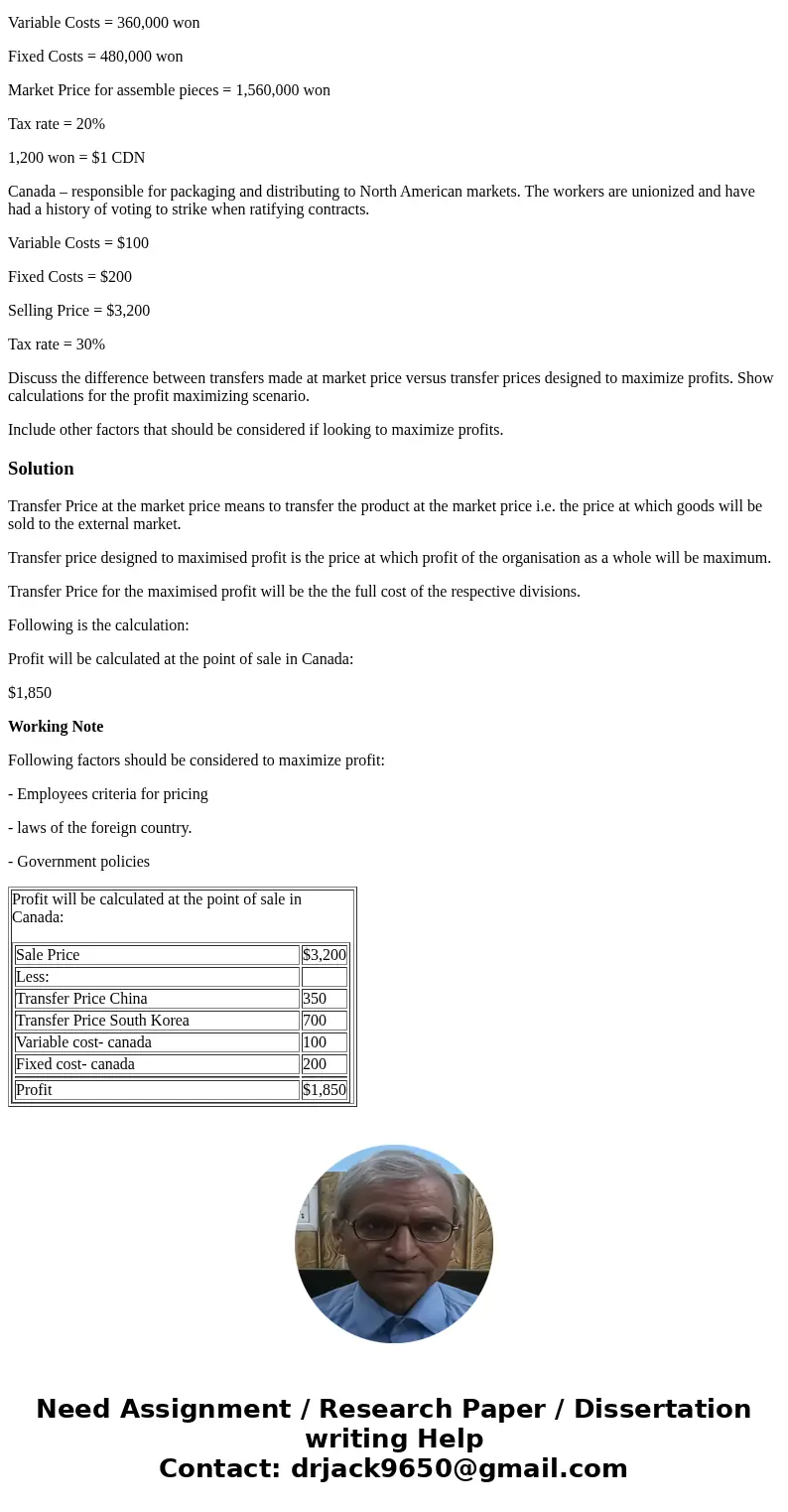

Transfer Price at the market price means to transfer the product at the market price i.e. the price at which goods will be sold to the external market.

Transfer price designed to maximised profit is the price at which profit of the organisation as a whole will be maximum.

Transfer Price for the maximised profit will be the the full cost of the respective divisions.

Following is the calculation:

Profit will be calculated at the point of sale in Canada:

$1,850

Working Note

Following factors should be considered to maximize profit:

- Employees criteria for pricing

- laws of the foreign country.

- Government policies

| Profit will be calculated at the point of sale in Canada:

|

Homework Sourse

Homework Sourse