On May 1, 2013, Brussels Enterprises issues bonds dated January 1. 2013, that have a $3.400,000 par value, mature in 20 years, and pay 9% interest semiannually on June 30 and December 31 . The bonds are sold at par plus four months\' accrued interest 1. How much accrued interest do the bond purchasers pay Brussels on May 1. 2013? (Do not round 3,400,000 I cash 4.5% 153,000 Period 153,000XY 26s 102, 2 Prepare Brussels journal entries for the following (a) The issuance of bonds on May 1.2013. (Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the issue of bonds with a par value of $3,400,000 cash plus four months\' accrued interest on May 1, 2013. Note: Enter debits before credits. Debit Credit May 01, 2013 Cash 3,400,000 nterest expense 102,000 20

1) Semi-annual interest rate = 9%*6/12 = 4.5%

Accrued interest on bonds = Bonds face value*semi-annual Interest rate*4/6

= $3,400,000*4.5%*4/6 = $102,000

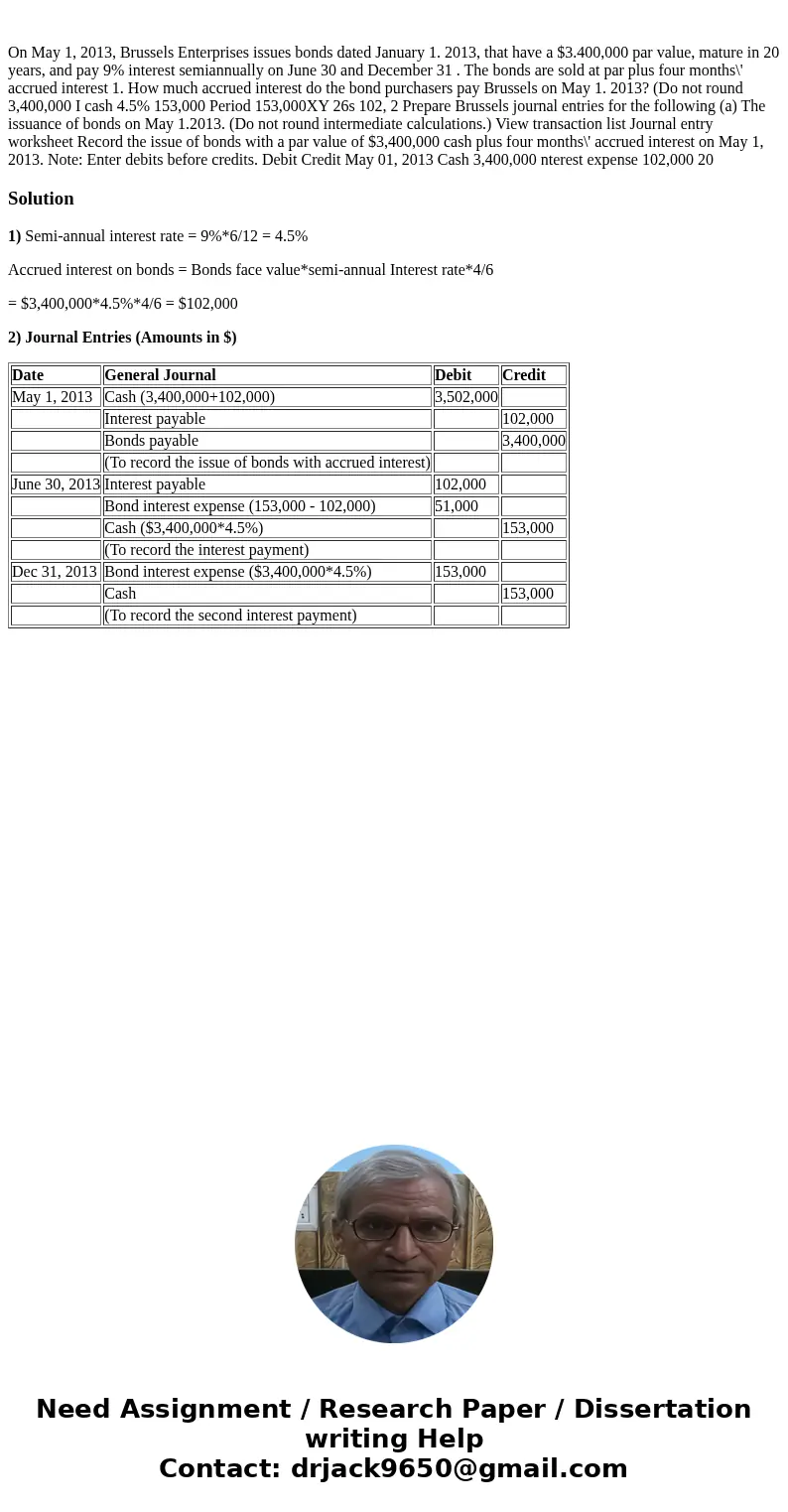

2) Journal Entries (Amounts in $)

| Date | General Journal | Debit | Credit |

| May 1, 2013 | Cash (3,400,000+102,000) | 3,502,000 | |

| Interest payable | | 102,000 |

| Bonds payable | | 3,400,000 |

| (To record the issue of bonds with accrued interest) | | |

| June 30, 2013 | Interest payable | 102,000 | |

| Bond interest expense (153,000 - 102,000) | 51,000 | |

| Cash ($3,400,000*4.5%) | | 153,000 |

| (To record the interest payment) | | |

| Dec 31, 2013 | Bond interest expense ($3,400,000*4.5%) | 153,000 | |

| Cash | | 153,000 |

| (To record the second interest payment) | | |

Homework Sourse

Homework Sourse