2 Richmond Rentals is preparing adjusting journal entries as

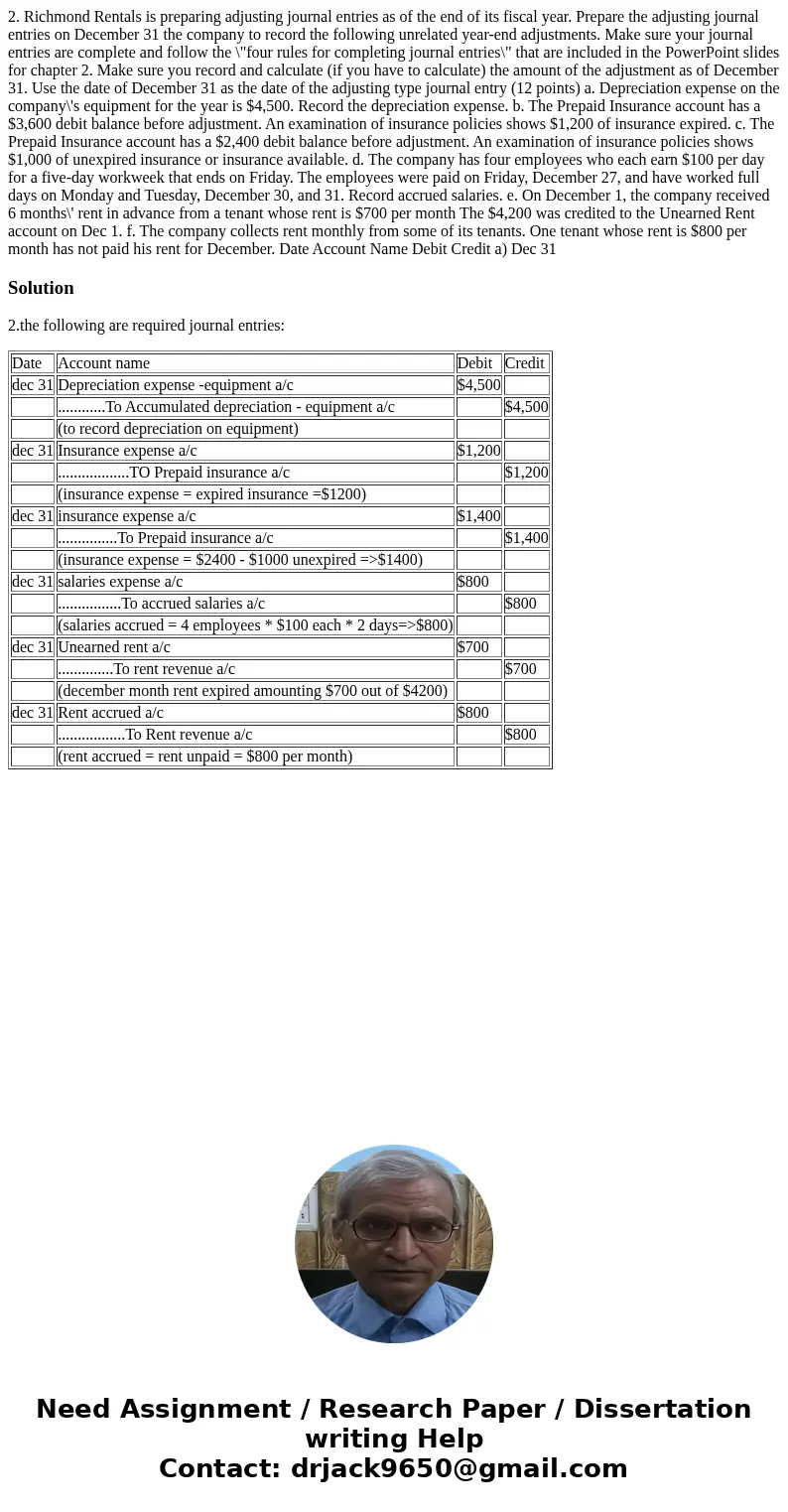

2. Richmond Rentals is preparing adjusting journal entries as of the end of its fiscal year. Prepare the adjusting journal entries on December 31 the company to record the following unrelated year-end adjustments. Make sure your journal entries are complete and follow the \"four rules for completing journal entries\" that are included in the PowerPoint slides for chapter 2. Make sure you record and calculate (if you have to calculate) the amount of the adjustment as of December 31. Use the date of December 31 as the date of the adjusting type journal entry (12 points) a. Depreciation expense on the company\'s equipment for the year is $4,500. Record the depreciation expense. b. The Prepaid Insurance account has a $3,600 debit balance before adjustment. An examination of insurance policies shows $1,200 of insurance expired. c. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $1,000 of unexpired insurance or insurance available. d. The company has four employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid on Friday, December 27, and have worked full days on Monday and Tuesday, December 30, and 31. Record accrued salaries. e. On December 1, the company received 6 months\' rent in advance from a tenant whose rent is $700 per month The $4,200 was credited to the Unearned Rent account on Dec 1. f. The company collects rent monthly from some of its tenants. One tenant whose rent is $800 per month has not paid his rent for December. Date Account Name Debit Credit a) Dec 31

Solution

2.the following are required journal entries:

| Date | Account name | Debit | Credit |

| dec 31 | Depreciation expense -equipment a/c | $4,500 | |

| ............To Accumulated depreciation - equipment a/c | $4,500 | ||

| (to record depreciation on equipment) | |||

| dec 31 | Insurance expense a/c | $1,200 | |

| ..................TO Prepaid insurance a/c | $1,200 | ||

| (insurance expense = expired insurance =$1200) | |||

| dec 31 | insurance expense a/c | $1,400 | |

| ...............To Prepaid insurance a/c | $1,400 | ||

| (insurance expense = $2400 - $1000 unexpired =>$1400) | |||

| dec 31 | salaries expense a/c | $800 | |

| ................To accrued salaries a/c | $800 | ||

| (salaries accrued = 4 employees * $100 each * 2 days=>$800) | |||

| dec 31 | Unearned rent a/c | $700 | |

| ..............To rent revenue a/c | $700 | ||

| (december month rent expired amounting $700 out of $4200) | |||

| dec 31 | Rent accrued a/c | $800 | |

| .................To Rent revenue a/c | $800 | ||

| (rent accrued = rent unpaid = $800 per month) |

Homework Sourse

Homework Sourse