Remaining Time 2 hours 56 minutes 34 seconds v Question Comp

Remaining Time: 2 hours, 56 minutes, 34 seconds v Question Completion Status: Words:0 QUESTION 13 Tennessee, Inc., has three divisions: Nash, Memp, and Knox. The results of July 31, 2018 are presented below Units sold Revenue Less variable costs Less direct foxed costs Less allocated foxed costs Net income 3,000 $71,000 32,000 14,000 6.000 $19.000 5,000 2,000 10,000 $50,000 26,000 19,000 $40,000 16,000 12,000 $161,000 74,000 45,000 $17.000) S 8.000 $ 20,000 alio ated costs wil oet feel e at it should be discs on eddine resse Tennessee allocates indirect fixed costs based on the number of units to be sold. Since the Memp alca es directs close s that sales at the Nash division wil ncrease by 12%, and that sales at the Knox division will stay the same. Instructions Present the analysis in a table. (a) Prepare an enalysis showing the effect of discontinuing the Memp division. b) Should Tennessee close the Memp division? Briefly indicate why or why not TTT Arial 3 (12p)TE E Chick Save and Submit to sove and submit. Click Save All Ansuers to save all anspers. Sa

Solution

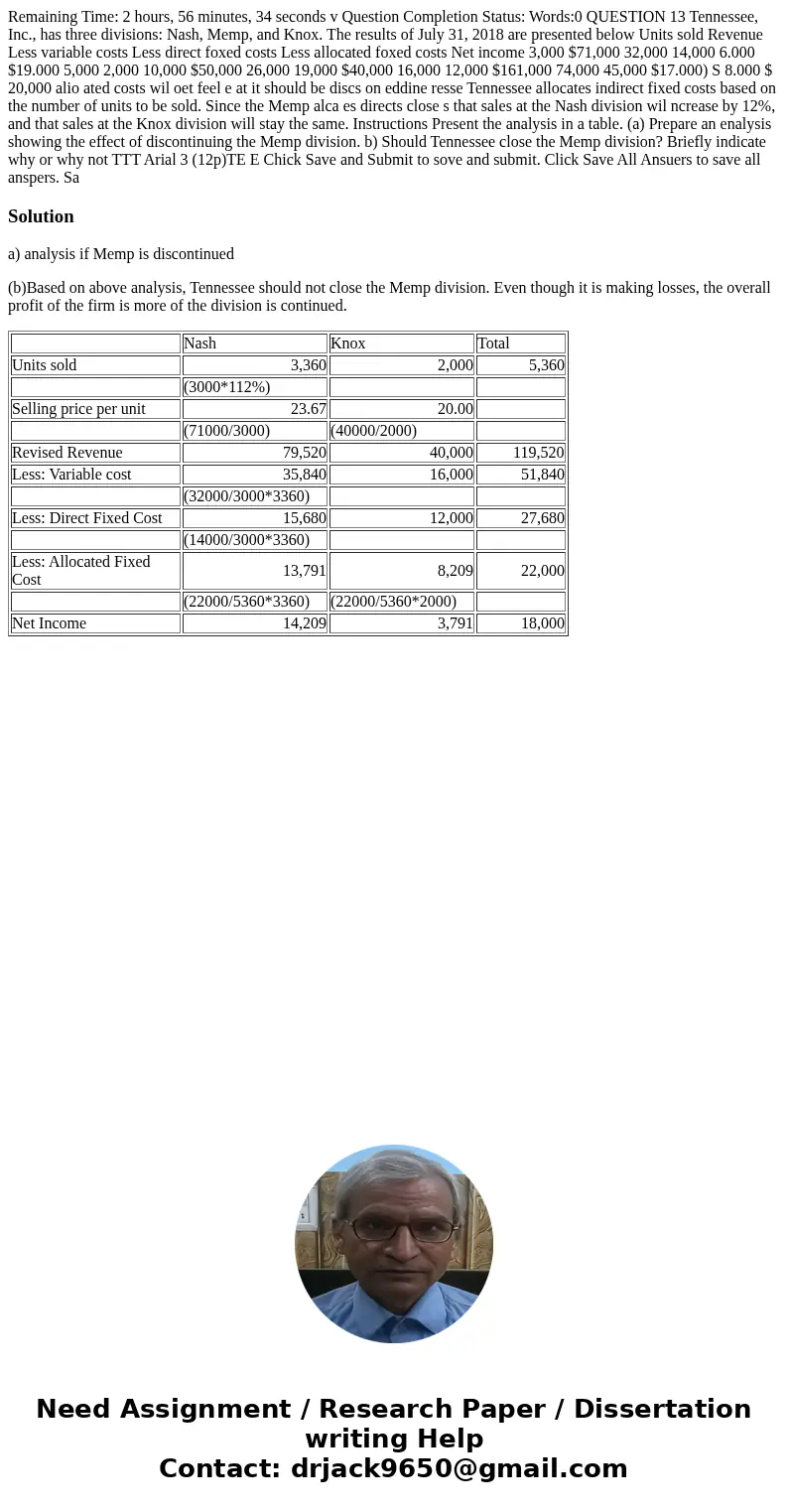

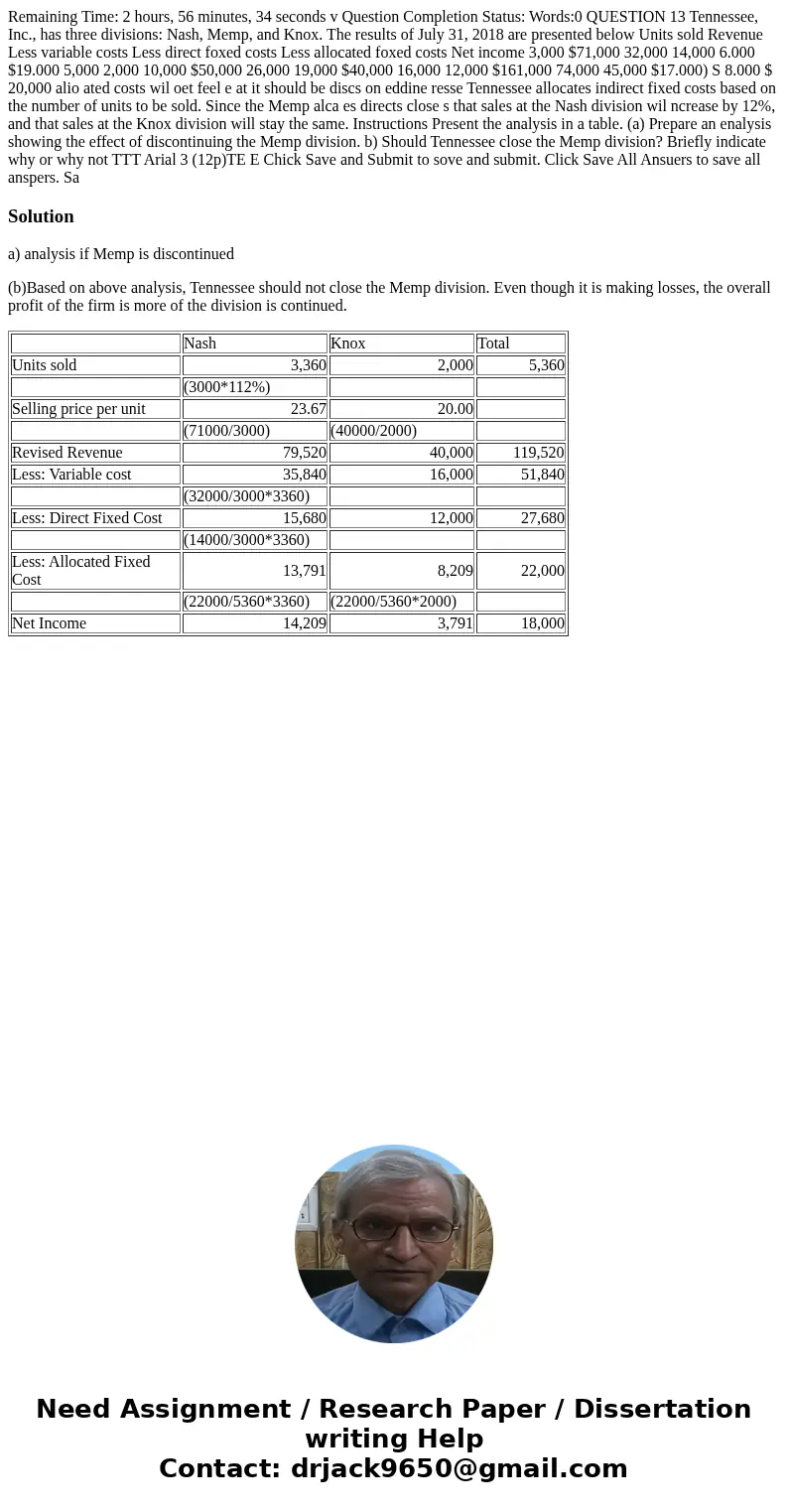

a) analysis if Memp is discontinued

(b)Based on above analysis, Tennessee should not close the Memp division. Even though it is making losses, the overall profit of the firm is more of the division is continued.

| Nash | Knox | Total | |

| Units sold | 3,360 | 2,000 | 5,360 |

| (3000*112%) | |||

| Selling price per unit | 23.67 | 20.00 | |

| (71000/3000) | (40000/2000) | ||

| Revised Revenue | 79,520 | 40,000 | 119,520 |

| Less: Variable cost | 35,840 | 16,000 | 51,840 |

| (32000/3000*3360) | |||

| Less: Direct Fixed Cost | 15,680 | 12,000 | 27,680 |

| (14000/3000*3360) | |||

| Less: Allocated Fixed Cost | 13,791 | 8,209 | 22,000 |

| (22000/5360*3360) | (22000/5360*2000) | ||

| Net Income | 14,209 | 3,791 | 18,000 |

Homework Sourse

Homework Sourse