recorded by the bank as i Learning Objective s 78 Proparing

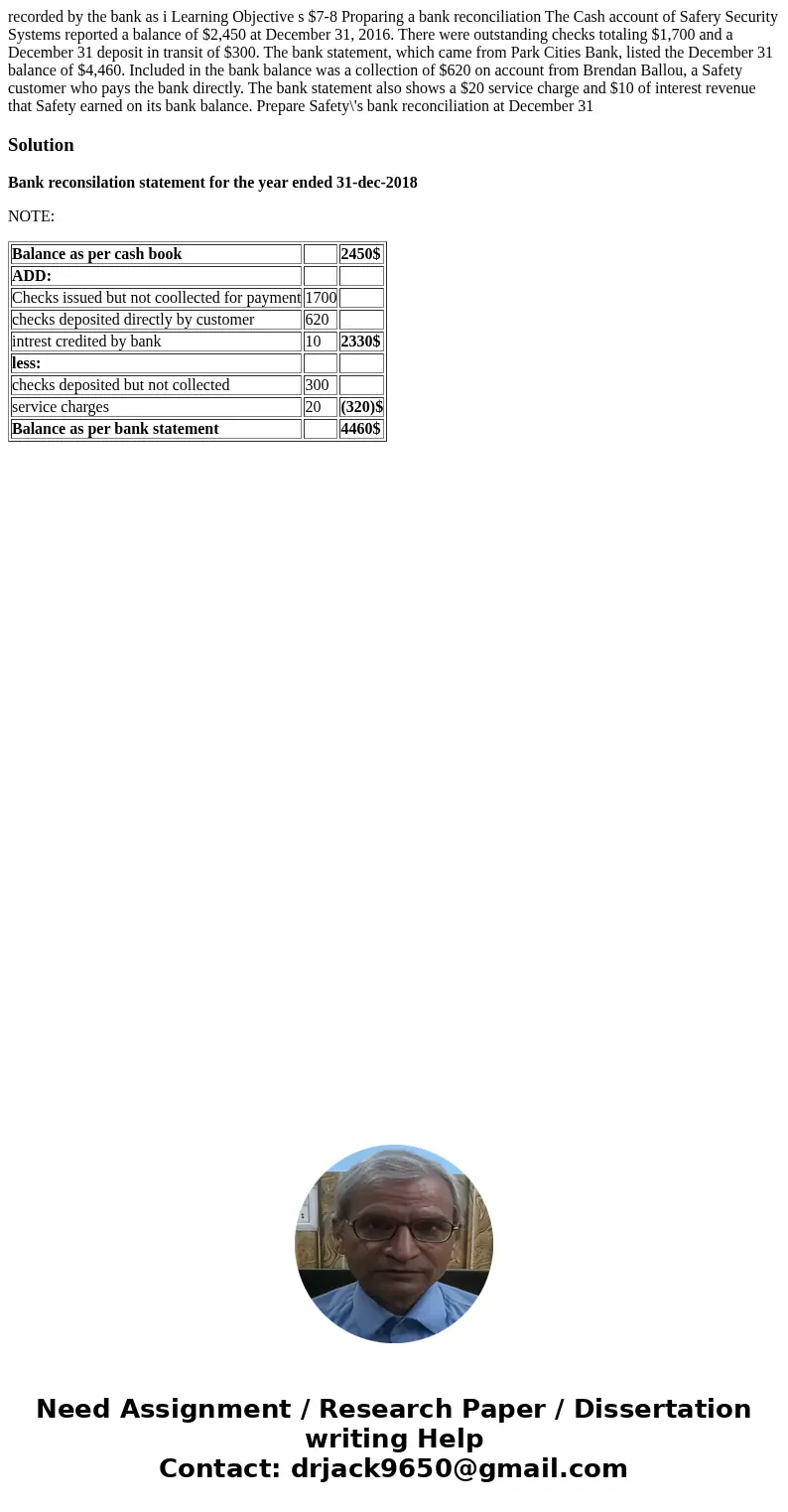

recorded by the bank as i Learning Objective s $7-8 Proparing a bank reconciliation The Cash account of Safery Security Systems reported a balance of $2,450 at December 31, 2016. There were outstanding checks totaling $1,700 and a December 31 deposit in transit of $300. The bank statement, which came from Park Cities Bank, listed the December 31 balance of $4,460. Included in the bank balance was a collection of $620 on account from Brendan Ballou, a Safety customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Safety earned on its bank balance. Prepare Safety\'s bank reconciliation at December 31

Solution

Bank reconsilation statement for the year ended 31-dec-2018

NOTE:

| Balance as per cash book | 2450$ | |

| ADD: | ||

| Checks issued but not coollected for payment | 1700 | |

| checks deposited directly by customer | 620 | |

| intrest credited by bank | 10 | 2330$ |

| less: | ||

| checks deposited but not collected | 300 | |

| service charges | 20 | (320)$ |

| Balance as per bank statement | 4460$ |

Homework Sourse

Homework Sourse