Q TR MR TC MC ATC 0 0 100 1 200 200 200 100 200 2 400 200

Q TR MR TC MC ATC

0 0 - 100 - -

1 200 200 200 100 200

2 400 200 350 150 175

3 600 200 550 200 183.3

4 800 200 800 250 200

5 1000 200 1100 300 220

Quantity of Visits (Q)

Total Revenue (TR)

Marginal Revenue (MR)

Total Costs (TC)

Marginal Cost (MC)

Average Total Cost (ATC)

In a MS Word document, define total revenue (TR), marginal revenue (MR), and the profit-maximizing rule for a single investor-owned firm. Then calculate MR, MC, and ATC for Table 3.1. Next, give the profit-maximizing level of output (Q).

Now, assume the firm is a tax-exempt agency. One possibility is that tax-exempt agencies maximize output. Define the output-maximization rule and then give the output-maximizing level of output (Q) given Table 3.1. What happens to the supply curve for an output-maximizing firm if it increases the quality of their visits?

Check my calculation for MR, MC, ATC.

Solution

Q

TR

MR

TC

MC

ATC

Profit

0

0

100

-100

1

200

200

200

100

200

0

2

400

200

350

150

175

50

3

600

200

550

200

183.3333

50

4

800

200

800

250

200

0

5

1000

200

1100

300

220

-100

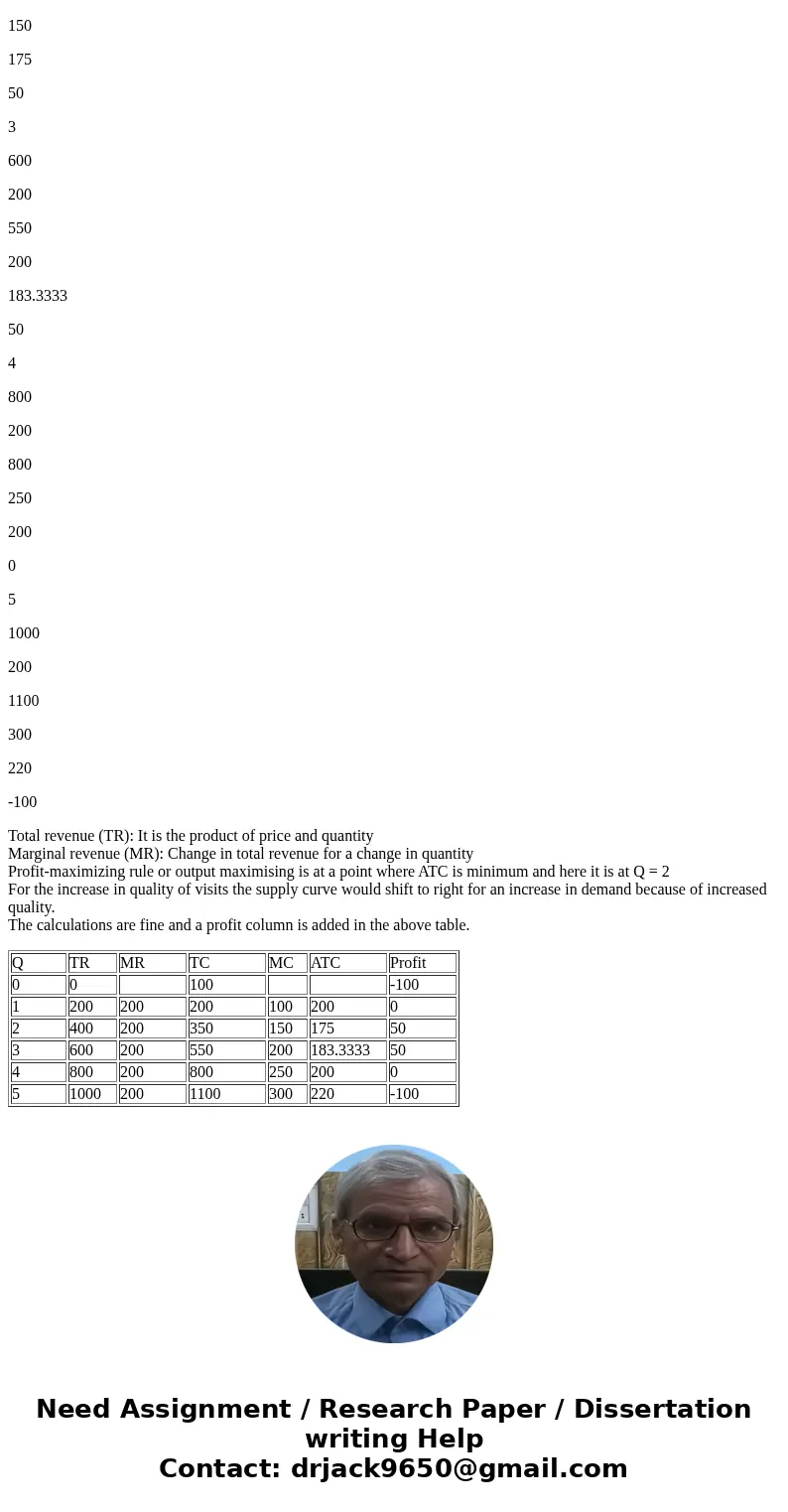

Total revenue (TR): It is the product of price and quantity

Marginal revenue (MR): Change in total revenue for a change in quantity

Profit-maximizing rule or output maximising is at a point where ATC is minimum and here it is at Q = 2

For the increase in quality of visits the supply curve would shift to right for an increase in demand because of increased quality.

The calculations are fine and a profit column is added in the above table.

| Q | TR | MR | TC | MC | ATC | Profit |

| 0 | 0 | 100 | -100 | |||

| 1 | 200 | 200 | 200 | 100 | 200 | 0 |

| 2 | 400 | 200 | 350 | 150 | 175 | 50 |

| 3 | 600 | 200 | 550 | 200 | 183.3333 | 50 |

| 4 | 800 | 200 | 800 | 250 | 200 | 0 |

| 5 | 1000 | 200 | 1100 | 300 | 220 | -100 |

Homework Sourse

Homework Sourse