Managing your finances is an important part of your life bot

Managing your finances is an important part of your life, both personally and professionally. Knowing your finances are under control can ease stresses in our everyday lives. This week you will create a budget for yourself. To avoid sharing personal information, we have set a salary for you to work within. You can also do this for yourself with all of your personal income information.

Complete sample budget (see link below) – your new job pays $32,000 gross per year, remember to include your payment to student loans (use avg. of $150 per month), allow for groceries, transportation and entertainment, in addition to regular monthly needs. If you have children, include child care.

Here is a link to a website that should assist you with this assignment:

http://us.thesalarycalculator.co.uk/salary.php

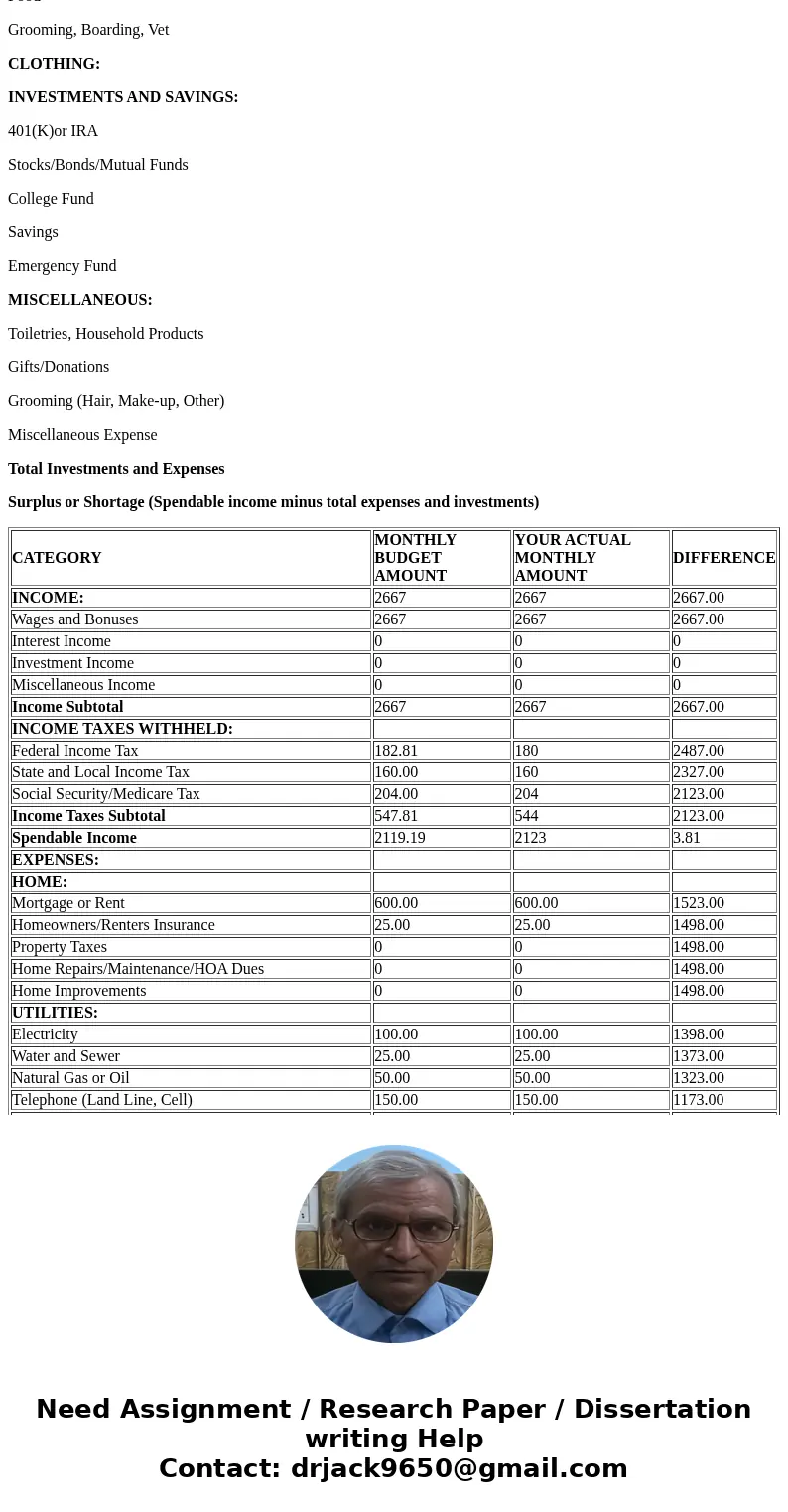

CATEGORY

MONTHLY BUDGET AMOUNT

YOUR ACTUAL MONTHLY AMOUNT

DIFFERENCE

INCOME:

2667

2667

2667.00

Wages and Bonuses

2667

2667

2667.00

Interest Income

0

0

0

Investment Income

0

0

0

Miscellaneous Income

0

0

0

Income Subtotal

2667

2667

2667.00

INCOME TAXES WITHHELD:

Federal Income Tax

182.81

180

2487.00

State and Local Income Tax

160.00

160

2327.00

Social Security/Medicare Tax

204.00

204

2123.00

Income Taxes Subtotal

547.81

544

2123.00

Spendable Income

2119.19

2123

3.81

EXPENSES:

HOME:

Mortgage or Rent

600.00

600.00

1523.00

Homeowners/Renters Insurance

25.00

25.00

1498.00

Property Taxes

0

0

1498.00

Home Repairs/Maintenance/HOA Dues

0

0

1498.00

Home Improvements

0

0

1498.00

UTILITIES:

Electricity

100.00

100.00

1398.00

Water and Sewer

25.00

25.00

1373.00

Natural Gas or Oil

50.00

50.00

1323.00

Telephone (Land Line, Cell)

150.00

150.00

1173.00

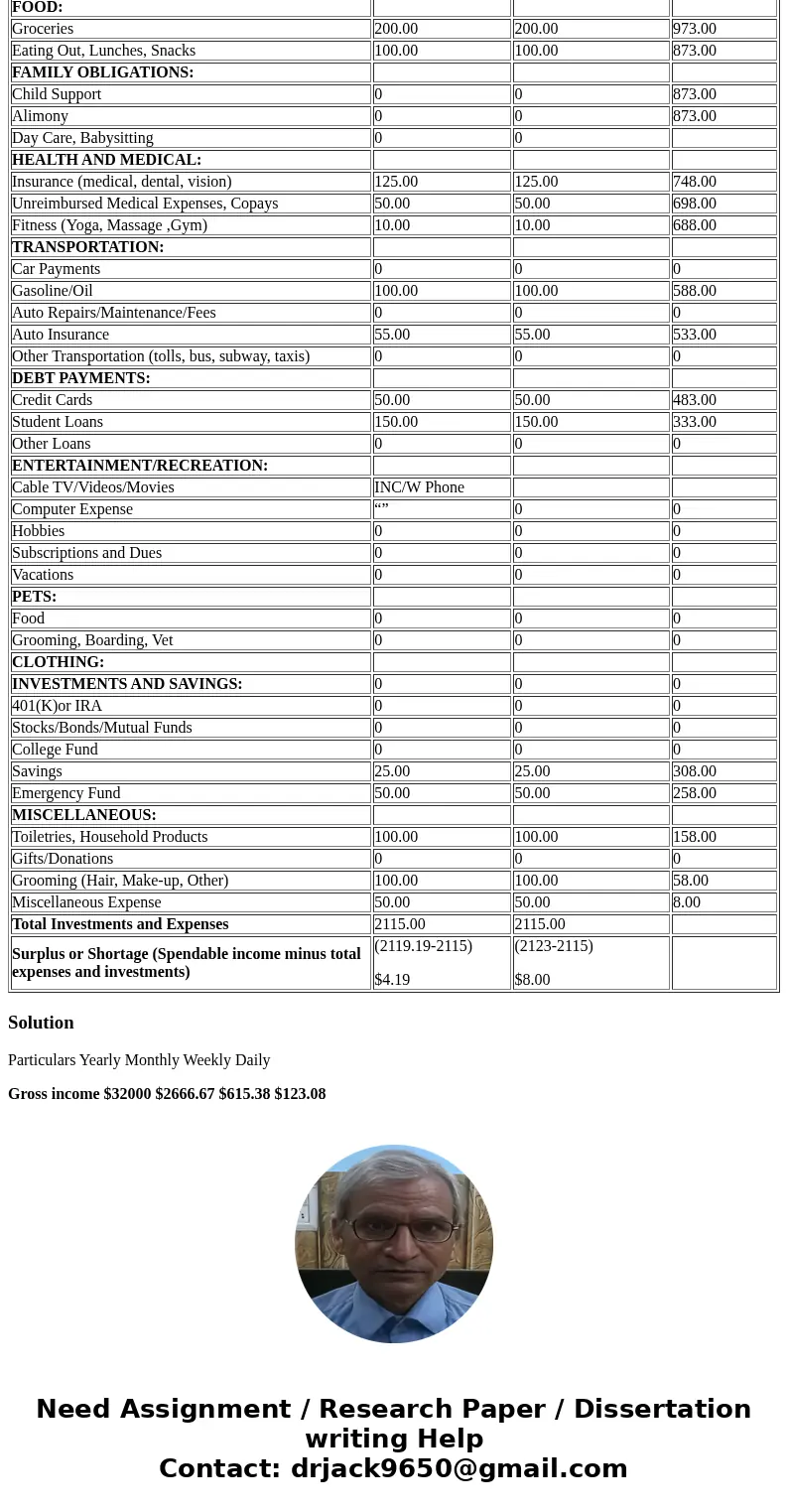

FOOD:

Groceries

200.00

200.00

973.00

Eating Out, Lunches, Snacks

100.00

100.00

873.00

FAMILY OBLIGATIONS:

Child Support

0

0

873.00

Alimony

0

0

873.00

Day Care, Babysitting

0

0

HEALTH AND MEDICAL:

Insurance (medical, dental, vision)

125.00

125.00

748.00

Unreimbursed Medical Expenses, Copays

50.00

50.00

698.00

Fitness (Yoga, Massage ,Gym)

10.00

10.00

688.00

TRANSPORTATION:

Car Payments

0

0

0

Gasoline/Oil

100.00

100.00

588.00

Auto Repairs/Maintenance/Fees

0

0

0

Auto Insurance

55.00

55.00

533.00

Other Transportation (tolls, bus, subway, taxis)

0

0

0

DEBT PAYMENTS:

Credit Cards

50.00

50.00

483.00

Student Loans

150.00

150.00

333.00

Other Loans

0

0

0

ENTERTAINMENT/RECREATION:

Cable TV/Videos/Movies

INC/W Phone

Computer Expense

“”

0

0

Hobbies

0

0

0

Subscriptions and Dues

0

0

0

Vacations

0

0

0

PETS:

Food

0

0

0

Grooming, Boarding, Vet

0

0

0

CLOTHING:

INVESTMENTS AND SAVINGS:

0

0

0

401(K)or IRA

0

0

0

Stocks/Bonds/Mutual Funds

0

0

0

College Fund

0

0

0

Savings

25.00

25.00

308.00

Emergency Fund

50.00

50.00

258.00

MISCELLANEOUS:

Toiletries, Household Products

100.00

100.00

158.00

Gifts/Donations

0

0

0

Grooming (Hair, Make-up, Other)

100.00

100.00

58.00

Miscellaneous Expense

50.00

50.00

8.00

Total Investments and Expenses

2115.00

2115.00

Surplus or Shortage (Spendable income minus total expenses and investments)

(2119.19-2115)

$4.19

(2123-2115)

$8.00

CATEGORY

MONTHLY BUDGET AMOUNT

MONTHLY ACTUAL AMOUNT

DIFFERENCE

INCOME:

Wages and Bonuses

Interest Income

Investment Income

Miscellaneous Income

Income Subtotal

INCOME TAXES WITHHELD:

Federal Income Tax

State and Local Income Tax

Social Security/Medicare Tax

Income Taxes Subtotal

Spendable Income

EXPENSES:

HOME:

Mortgage or Rent

Homeowners/Renters Insurance

Property Taxes

Home Repairs/Maintenance/HOA Dues

Home Improvements

UTILITIES:

Electricity

Water and Sewer

Natural Gas or Oil

Telephone (Land Line, Cell)

FOOD:

Groceries

Eating Out, Lunches, Snacks

FAMILY OBLIGATIONS:

Child Support

Alimony

Day Care, Babysitting

HEALTH AND MEDICAL:

Insurance (medical, dental, vision)

Unreimbursed Medical Expenses, Copays

Fitness (Yoga, Massage ,Gym)

TRANSPORTATION:

Car Payments

Gasoline/Oil

Auto Repairs/Maintenance/Fees

Auto Insurance

Other Transportation (tolls, bus, subway, taxis)

DEBT PAYMENTS:

Credit Cards

Student Loans

Other Loans

ENTERTAINMENT/RECREATION:

Cable TV/Videos/Movies

Computer Expense

Hobbies

Subscriptions and Dues

Vacations

PETS:

Food

Grooming, Boarding, Vet

CLOTHING:

INVESTMENTS AND SAVINGS:

401(K)or IRA

Stocks/Bonds/Mutual Funds

College Fund

Savings

Emergency Fund

MISCELLANEOUS:

Toiletries, Household Products

Gifts/Donations

Grooming (Hair, Make-up, Other)

Miscellaneous Expense

Total Investments and Expenses

Surplus or Shortage (Spendable income minus total expenses and investments)

| CATEGORY | MONTHLY BUDGET AMOUNT | YOUR ACTUAL MONTHLY AMOUNT | DIFFERENCE |

| INCOME: | 2667 | 2667 | 2667.00 |

| Wages and Bonuses | 2667 | 2667 | 2667.00 |

| Interest Income | 0 | 0 | 0 |

| Investment Income | 0 | 0 | 0 |

| Miscellaneous Income | 0 | 0 | 0 |

| Income Subtotal | 2667 | 2667 | 2667.00 |

| INCOME TAXES WITHHELD: | |||

| Federal Income Tax | 182.81 | 180 | 2487.00 |

| State and Local Income Tax | 160.00 | 160 | 2327.00 |

| Social Security/Medicare Tax | 204.00 | 204 | 2123.00 |

| Income Taxes Subtotal | 547.81 | 544 | 2123.00 |

| Spendable Income | 2119.19 | 2123 | 3.81 |

| EXPENSES: | |||

| HOME: | |||

| Mortgage or Rent | 600.00 | 600.00 | 1523.00 |

| Homeowners/Renters Insurance | 25.00 | 25.00 | 1498.00 |

| Property Taxes | 0 | 0 | 1498.00 |

| Home Repairs/Maintenance/HOA Dues | 0 | 0 | 1498.00 |

| Home Improvements | 0 | 0 | 1498.00 |

| UTILITIES: | |||

| Electricity | 100.00 | 100.00 | 1398.00 |

| Water and Sewer | 25.00 | 25.00 | 1373.00 |

| Natural Gas or Oil | 50.00 | 50.00 | 1323.00 |

| Telephone (Land Line, Cell) | 150.00 | 150.00 | 1173.00 |

| FOOD: | |||

| Groceries | 200.00 | 200.00 | 973.00 |

| Eating Out, Lunches, Snacks | 100.00 | 100.00 | 873.00 |

| FAMILY OBLIGATIONS: | |||

| Child Support | 0 | 0 | 873.00 |

| Alimony | 0 | 0 | 873.00 |

| Day Care, Babysitting | 0 | 0 | |

| HEALTH AND MEDICAL: | |||

| Insurance (medical, dental, vision) | 125.00 | 125.00 | 748.00 |

| Unreimbursed Medical Expenses, Copays | 50.00 | 50.00 | 698.00 |

| Fitness (Yoga, Massage ,Gym) | 10.00 | 10.00 | 688.00 |

| TRANSPORTATION: | |||

| Car Payments | 0 | 0 | 0 |

| Gasoline/Oil | 100.00 | 100.00 | 588.00 |

| Auto Repairs/Maintenance/Fees | 0 | 0 | 0 |

| Auto Insurance | 55.00 | 55.00 | 533.00 |

| Other Transportation (tolls, bus, subway, taxis) | 0 | 0 | 0 |

| DEBT PAYMENTS: | |||

| Credit Cards | 50.00 | 50.00 | 483.00 |

| Student Loans | 150.00 | 150.00 | 333.00 |

| Other Loans | 0 | 0 | 0 |

| ENTERTAINMENT/RECREATION: | |||

| Cable TV/Videos/Movies | INC/W Phone | ||

| Computer Expense | “” | 0 | 0 |

| Hobbies | 0 | 0 | 0 |

| Subscriptions and Dues | 0 | 0 | 0 |

| Vacations | 0 | 0 | 0 |

| PETS: | |||

| Food | 0 | 0 | 0 |

| Grooming, Boarding, Vet | 0 | 0 | 0 |

| CLOTHING: | |||

| INVESTMENTS AND SAVINGS: | 0 | 0 | 0 |

| 401(K)or IRA | 0 | 0 | 0 |

| Stocks/Bonds/Mutual Funds | 0 | 0 | 0 |

| College Fund | 0 | 0 | 0 |

| Savings | 25.00 | 25.00 | 308.00 |

| Emergency Fund | 50.00 | 50.00 | 258.00 |

| MISCELLANEOUS: | |||

| Toiletries, Household Products | 100.00 | 100.00 | 158.00 |

| Gifts/Donations | 0 | 0 | 0 |

| Grooming (Hair, Make-up, Other) | 100.00 | 100.00 | 58.00 |

| Miscellaneous Expense | 50.00 | 50.00 | 8.00 |

| Total Investments and Expenses | 2115.00 | 2115.00 | |

| Surplus or Shortage (Spendable income minus total expenses and investments) | (2119.19-2115) $4.19 | (2123-2115) $8.00 |

Solution

Particulars Yearly Monthly Weekly Daily

Gross income $32000 $2666.67 $615.38 $123.08

Taxable income $0.00 $0.00 $0.00 $0.00

Federal tax $0.00 $0.00 $0.00 $0.00

Social security $2448.00 $204.00 $47.08 $9.42

Deductions $25380 $2115 $488.08 $97.62

AMT $0.00 $0.00 $0.00 $0.00

State tax $0.00 $0.00 $0.00 $0.00

Take home $4172 $347.67 $80.23 $16.05

Homework Sourse

Homework Sourse