Exercise 2312 Kirkland Company combines its operating expens

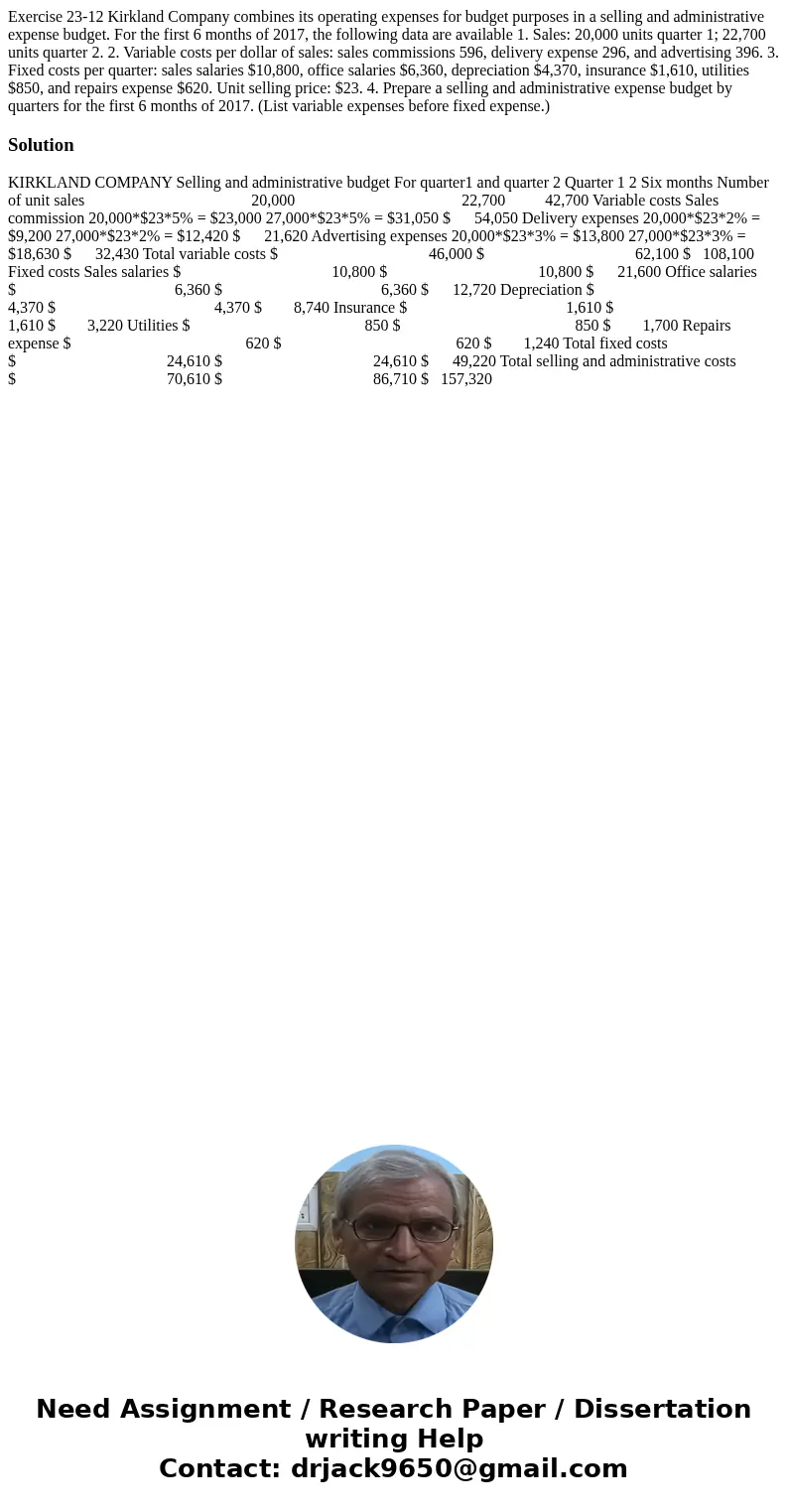

Exercise 23-12 Kirkland Company combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first 6 months of 2017, the following data are available 1. Sales: 20,000 units quarter 1; 22,700 units quarter 2. 2. Variable costs per dollar of sales: sales commissions 596, delivery expense 296, and advertising 396. 3. Fixed costs per quarter: sales salaries $10,800, office salaries $6,360, depreciation $4,370, insurance $1,610, utilities $850, and repairs expense $620. Unit selling price: $23. 4. Prepare a selling and administrative expense budget by quarters for the first 6 months of 2017. (List variable expenses before fixed expense.)

Solution

KIRKLAND COMPANY Selling and administrative budget For quarter1 and quarter 2 Quarter 1 2 Six months Number of unit sales 20,000 22,700 42,700 Variable costs Sales commission 20,000*$23*5% = $23,000 27,000*$23*5% = $31,050 $ 54,050 Delivery expenses 20,000*$23*2% = $9,200 27,000*$23*2% = $12,420 $ 21,620 Advertising expenses 20,000*$23*3% = $13,800 27,000*$23*3% = $18,630 $ 32,430 Total variable costs $ 46,000 $ 62,100 $ 108,100 Fixed costs Sales salaries $ 10,800 $ 10,800 $ 21,600 Office salaries $ 6,360 $ 6,360 $ 12,720 Depreciation $ 4,370 $ 4,370 $ 8,740 Insurance $ 1,610 $ 1,610 $ 3,220 Utilities $ 850 $ 850 $ 1,700 Repairs expense $ 620 $ 620 $ 1,240 Total fixed costs $ 24,610 $ 24,610 $ 49,220 Total selling and administrative costs $ 70,610 $ 86,710 $ 157,320

Homework Sourse

Homework Sourse