Whitmire Painting and Wall Decor is considering expanding it

Whitmire Painting and Wall Decor is considering expanding its range of options to include chair stops with differential painting. The cost of adding this feature would is $5,000 per year. They expect that profits would be $60,000 with this feature in a strong economy but only $20,000 a year in a weak economy. Not adding this feature would not change the cost of operations but they expect profits to remain at $50,000 in a good economy and $30,000 in a bad economy. The chances of a good economy is 45% while a bad economy is 55%.

The expected value of expanding the store is [ Select ] [\"$39, 000\", \"$41,000\", \"$42,000\", \"$38,000\"] and the expected value of not expanding would be [ Select ] [\"$42,000\", \"$39,000\", \"$41,000\", \"$38,000\"] . Based on this information Whitmire Painting and Wall Decor should [ Select ] [\"expand\", \"not expand\"] their offerings. (pick out of the select, the first two is either of the four numbers that it shows but which one? and the last select is two options)

Solution

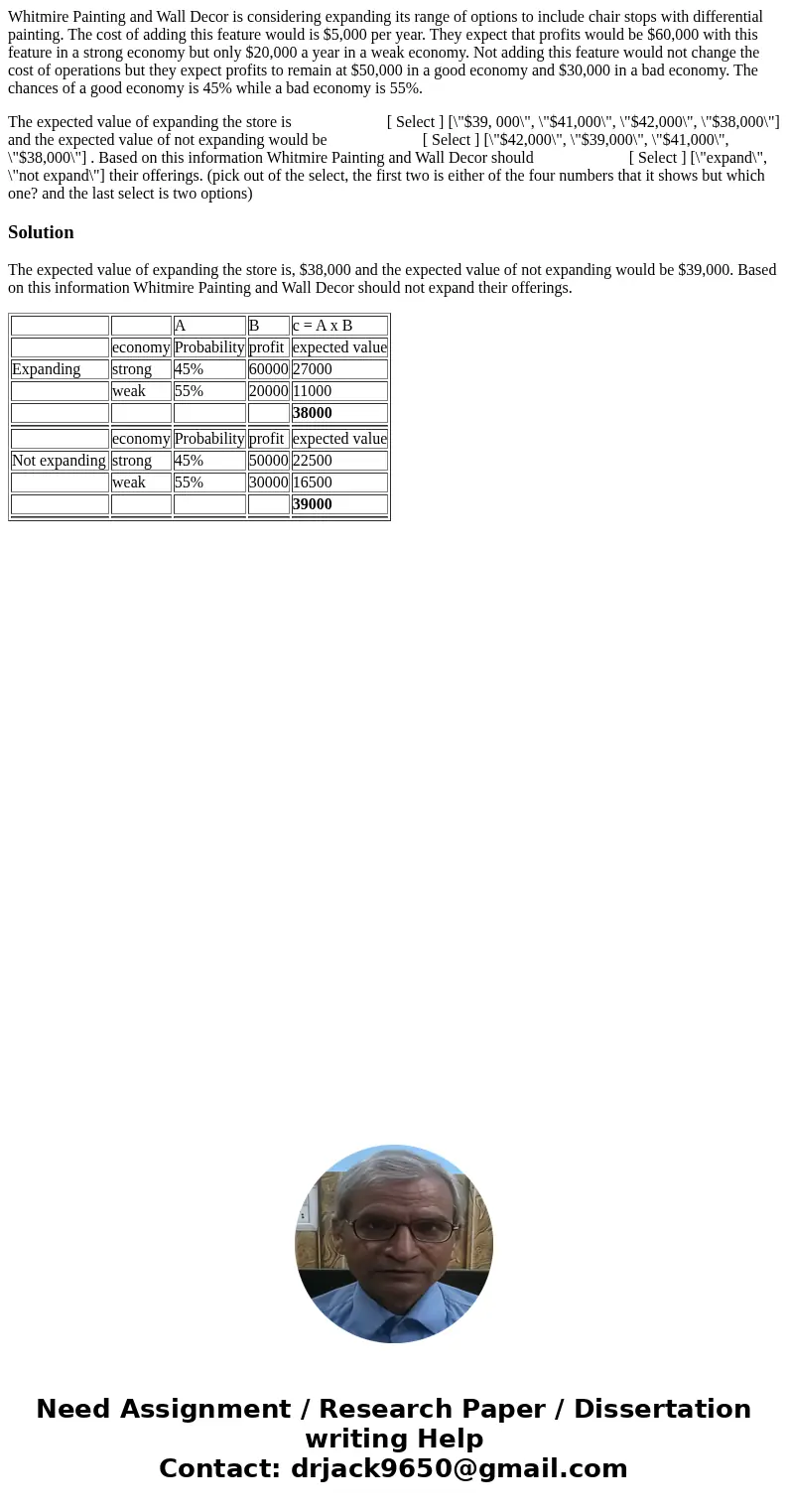

The expected value of expanding the store is, $38,000 and the expected value of not expanding would be $39,000. Based on this information Whitmire Painting and Wall Decor should not expand their offerings.

| A | B | c = A x B | ||

| economy | Probability | profit | expected value | |

| Expanding | strong | 45% | 60000 | 27000 |

| weak | 55% | 20000 | 11000 | |

| 38000 | ||||

| economy | Probability | profit | expected value | |

| Not expanding | strong | 45% | 50000 | 22500 |

| weak | 55% | 30000 | 16500 | |

| 39000 | ||||

Homework Sourse

Homework Sourse