please use the information provided to fill in the chart cor

please use the information provided to fill in the chart correctly

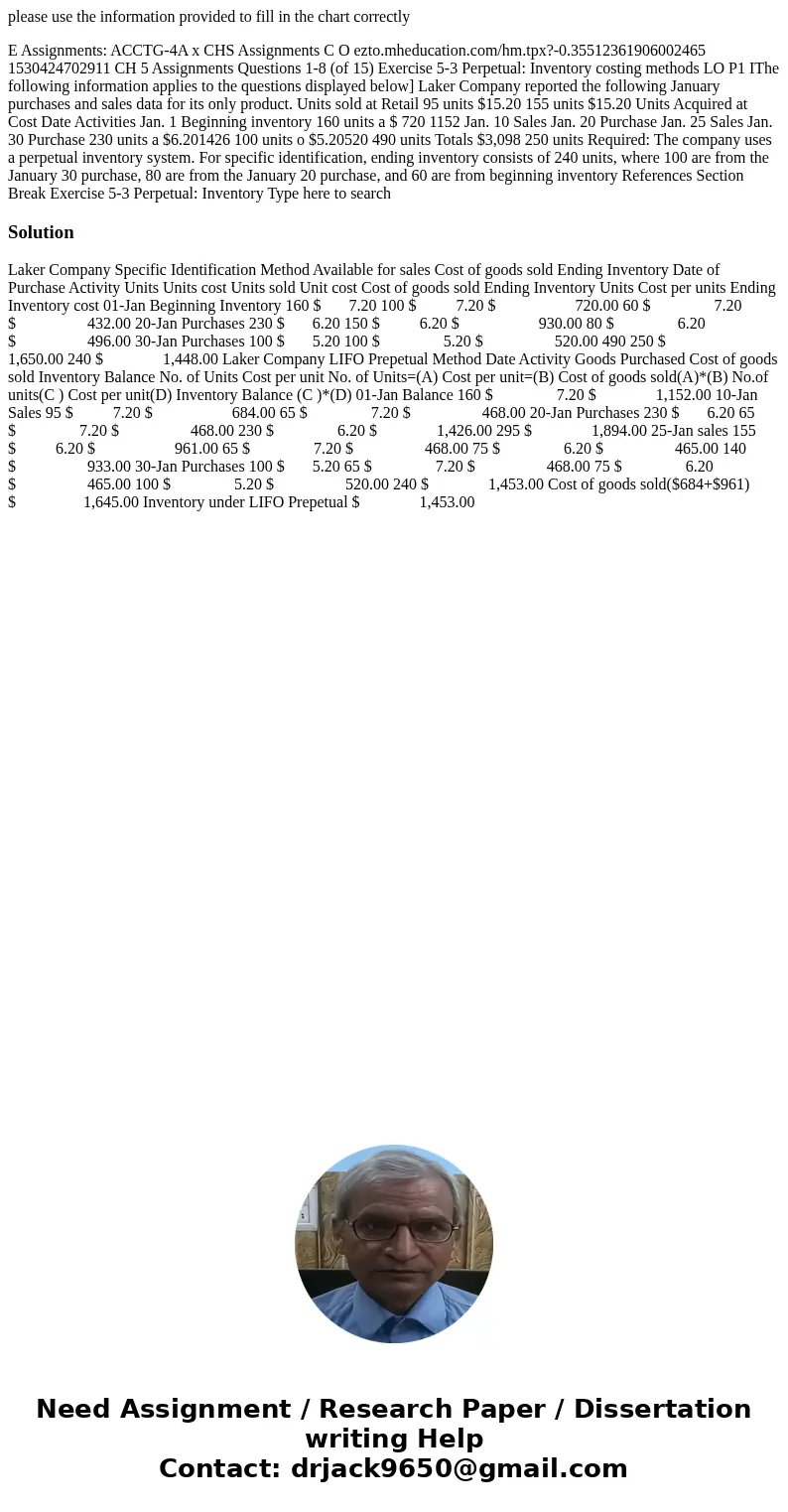

E Assignments: ACCTG-4A x CHS Assignments C O ezto.mheducation.com/hm.tpx?-0.35512361906002465 1530424702911 CH 5 Assignments Questions 1-8 (of 15) Exercise 5-3 Perpetual: Inventory costing methods LO P1 IThe following information applies to the questions displayed below] Laker Company reported the following January purchases and sales data for its only product. Units sold at Retail 95 units $15.20 155 units $15.20 Units Acquired at Cost Date Activities Jan. 1 Beginning inventory 160 units a $ 720 1152 Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase 230 units a $6.201426 100 units o $5.20520 490 units Totals $3,098 250 units Required: The company uses a perpetual inventory system. For specific identification, ending inventory consists of 240 units, where 100 are from the January 30 purchase, 80 are from the January 20 purchase, and 60 are from beginning inventory References Section Break Exercise 5-3 Perpetual: Inventory Type here to searchSolution

Laker Company Specific Identification Method Available for sales Cost of goods sold Ending Inventory Date of Purchase Activity Units Units cost Units sold Unit cost Cost of goods sold Ending Inventory Units Cost per units Ending Inventory cost 01-Jan Beginning Inventory 160 $ 7.20 100 $ 7.20 $ 720.00 60 $ 7.20 $ 432.00 20-Jan Purchases 230 $ 6.20 150 $ 6.20 $ 930.00 80 $ 6.20 $ 496.00 30-Jan Purchases 100 $ 5.20 100 $ 5.20 $ 520.00 490 250 $ 1,650.00 240 $ 1,448.00 Laker Company LIFO Prepetual Method Date Activity Goods Purchased Cost of goods sold Inventory Balance No. of Units Cost per unit No. of Units=(A) Cost per unit=(B) Cost of goods sold(A)*(B) No.of units(C ) Cost per unit(D) Inventory Balance (C )*(D) 01-Jan Balance 160 $ 7.20 $ 1,152.00 10-Jan Sales 95 $ 7.20 $ 684.00 65 $ 7.20 $ 468.00 20-Jan Purchases 230 $ 6.20 65 $ 7.20 $ 468.00 230 $ 6.20 $ 1,426.00 295 $ 1,894.00 25-Jan sales 155 $ 6.20 $ 961.00 65 $ 7.20 $ 468.00 75 $ 6.20 $ 465.00 140 $ 933.00 30-Jan Purchases 100 $ 5.20 65 $ 7.20 $ 468.00 75 $ 6.20 $ 465.00 100 $ 5.20 $ 520.00 240 $ 1,453.00 Cost of goods sold($684+$961) $ 1,645.00 Inventory under LIFO Prepetual $ 1,453.00

Homework Sourse

Homework Sourse