On May of the ay had 03000 n oosis in Worh in Proceay 1 was

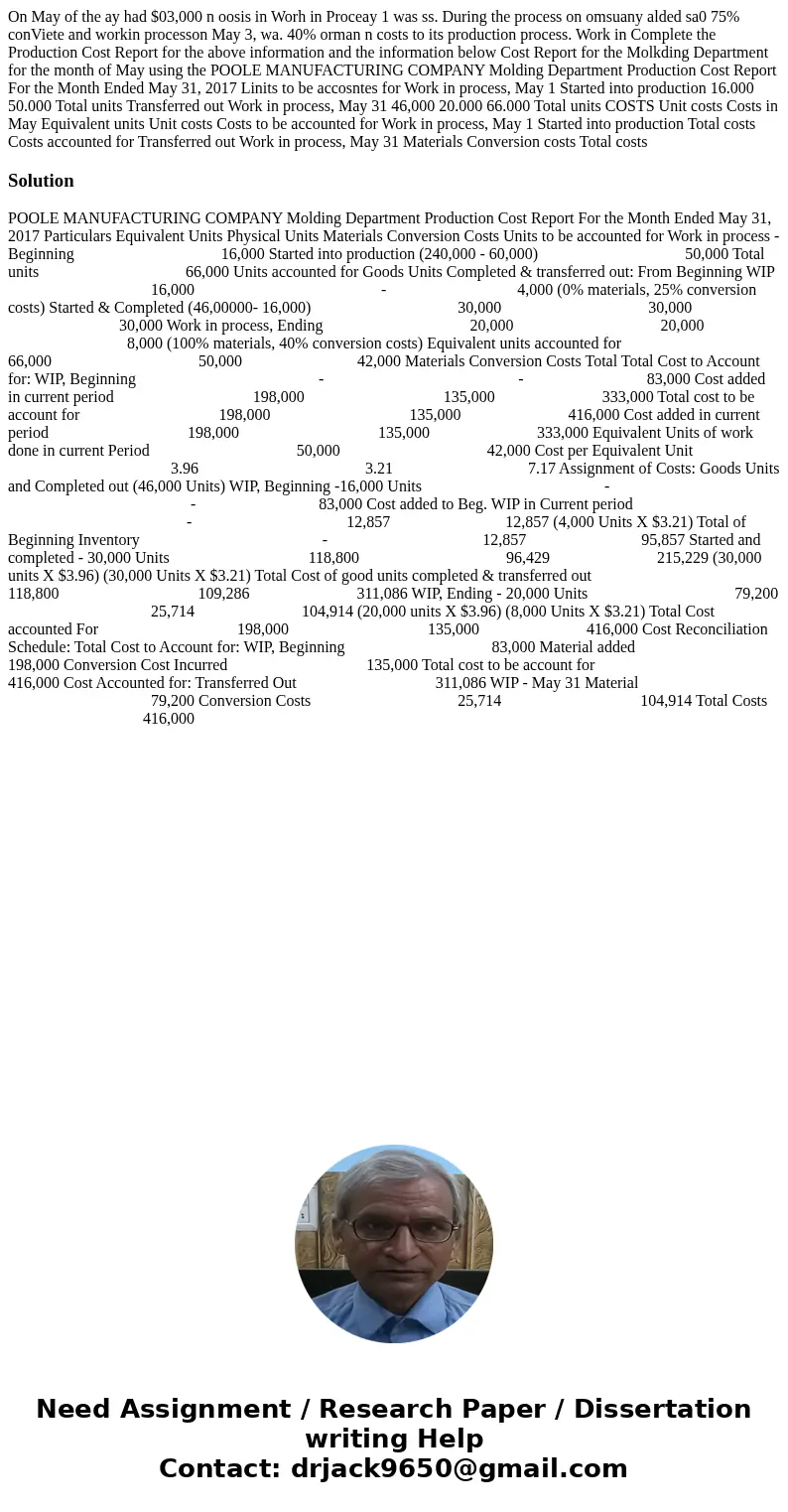

On May of the ay had $03,000 n oosis in Worh in Proceay 1 was ss. During the process on omsuany alded sa0 75% conViete and workin processon May 3, wa. 40% orman n costs to its production process. Work in Complete the Production Cost Report for the above information and the information below Cost Report for the Molkding Department for the month of May using the POOLE MANUFACTURING COMPANY Molding Department Production Cost Report For the Month Ended May 31, 2017 Linits to be accosntes for Work in process, May 1 Started into production 16.000 50.000 Total units Transferred out Work in process, May 31 46,000 20.000 66.000 Total units COSTS Unit costs Costs in May Equivalent units Unit costs Costs to be accounted for Work in process, May 1 Started into production Total costs Costs accounted for Transferred out Work in process, May 31 Materials Conversion costs Total costs

Solution

POOLE MANUFACTURING COMPANY Molding Department Production Cost Report For the Month Ended May 31, 2017 Particulars Equivalent Units Physical Units Materials Conversion Costs Units to be accounted for Work in process - Beginning 16,000 Started into production (240,000 - 60,000) 50,000 Total units 66,000 Units accounted for Goods Units Completed & transferred out: From Beginning WIP 16,000 - 4,000 (0% materials, 25% conversion costs) Started & Completed (46,00000- 16,000) 30,000 30,000 30,000 Work in process, Ending 20,000 20,000 8,000 (100% materials, 40% conversion costs) Equivalent units accounted for 66,000 50,000 42,000 Materials Conversion Costs Total Total Cost to Account for: WIP, Beginning - - 83,000 Cost added in current period 198,000 135,000 333,000 Total cost to be account for 198,000 135,000 416,000 Cost added in current period 198,000 135,000 333,000 Equivalent Units of work done in current Period 50,000 42,000 Cost per Equivalent Unit 3.96 3.21 7.17 Assignment of Costs: Goods Units and Completed out (46,000 Units) WIP, Beginning -16,000 Units - - 83,000 Cost added to Beg. WIP in Current period - 12,857 12,857 (4,000 Units X $3.21) Total of Beginning Inventory - 12,857 95,857 Started and completed - 30,000 Units 118,800 96,429 215,229 (30,000 units X $3.96) (30,000 Units X $3.21) Total Cost of good units completed & transferred out 118,800 109,286 311,086 WIP, Ending - 20,000 Units 79,200 25,714 104,914 (20,000 units X $3.96) (8,000 Units X $3.21) Total Cost accounted For 198,000 135,000 416,000 Cost Reconciliation Schedule: Total Cost to Account for: WIP, Beginning 83,000 Material added 198,000 Conversion Cost Incurred 135,000 Total cost to be account for 416,000 Cost Accounted for: Transferred Out 311,086 WIP - May 31 Material 79,200 Conversion Costs 25,714 104,914 Total Costs 416,000

Homework Sourse

Homework Sourse