Exercise 810 Every year Sheffield Industries manufactures 82

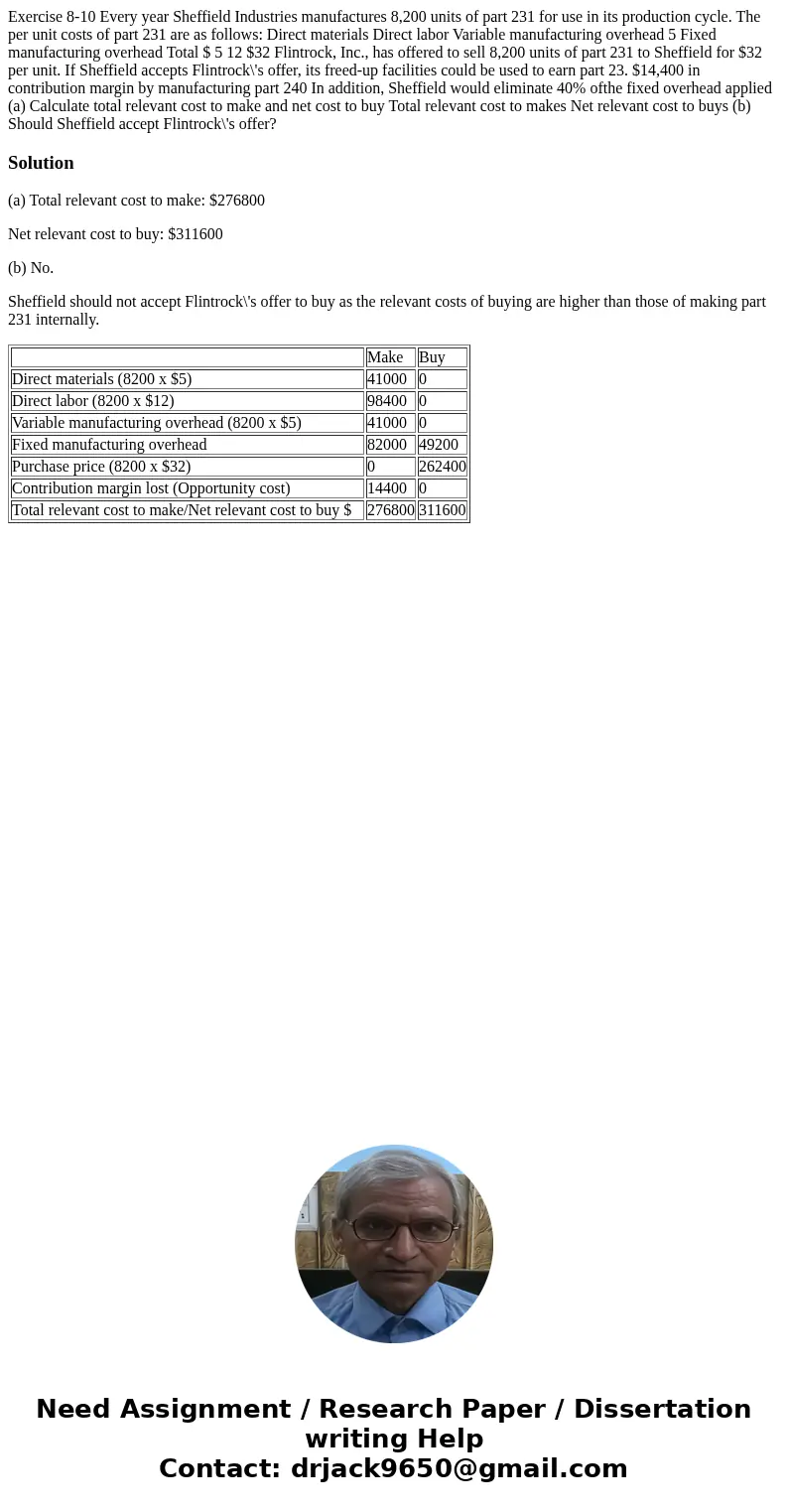

Exercise 8-10 Every year Sheffield Industries manufactures 8,200 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead 5 Fixed manufacturing overhead Total $ 5 12 $32 Flintrock, Inc., has offered to sell 8,200 units of part 231 to Sheffield for $32 per unit. If Sheffield accepts Flintrock\'s offer, its freed-up facilities could be used to earn part 23. $14,400 in contribution margin by manufacturing part 240 In addition, Sheffield would eliminate 40% ofthe fixed overhead applied (a) Calculate total relevant cost to make and net cost to buy Total relevant cost to makes Net relevant cost to buys (b) Should Sheffield accept Flintrock\'s offer?

Solution

(a) Total relevant cost to make: $276800

Net relevant cost to buy: $311600

(b) No.

Sheffield should not accept Flintrock\'s offer to buy as the relevant costs of buying are higher than those of making part 231 internally.

| Make | Buy | |

| Direct materials (8200 x $5) | 41000 | 0 |

| Direct labor (8200 x $12) | 98400 | 0 |

| Variable manufacturing overhead (8200 x $5) | 41000 | 0 |

| Fixed manufacturing overhead | 82000 | 49200 |

| Purchase price (8200 x $32) | 0 | 262400 |

| Contribution margin lost (Opportunity cost) | 14400 | 0 |

| Total relevant cost to make/Net relevant cost to buy $ | 276800 | 311600 |

Homework Sourse

Homework Sourse