0 41 MWC Corp is currently in the sixth year of its existenc

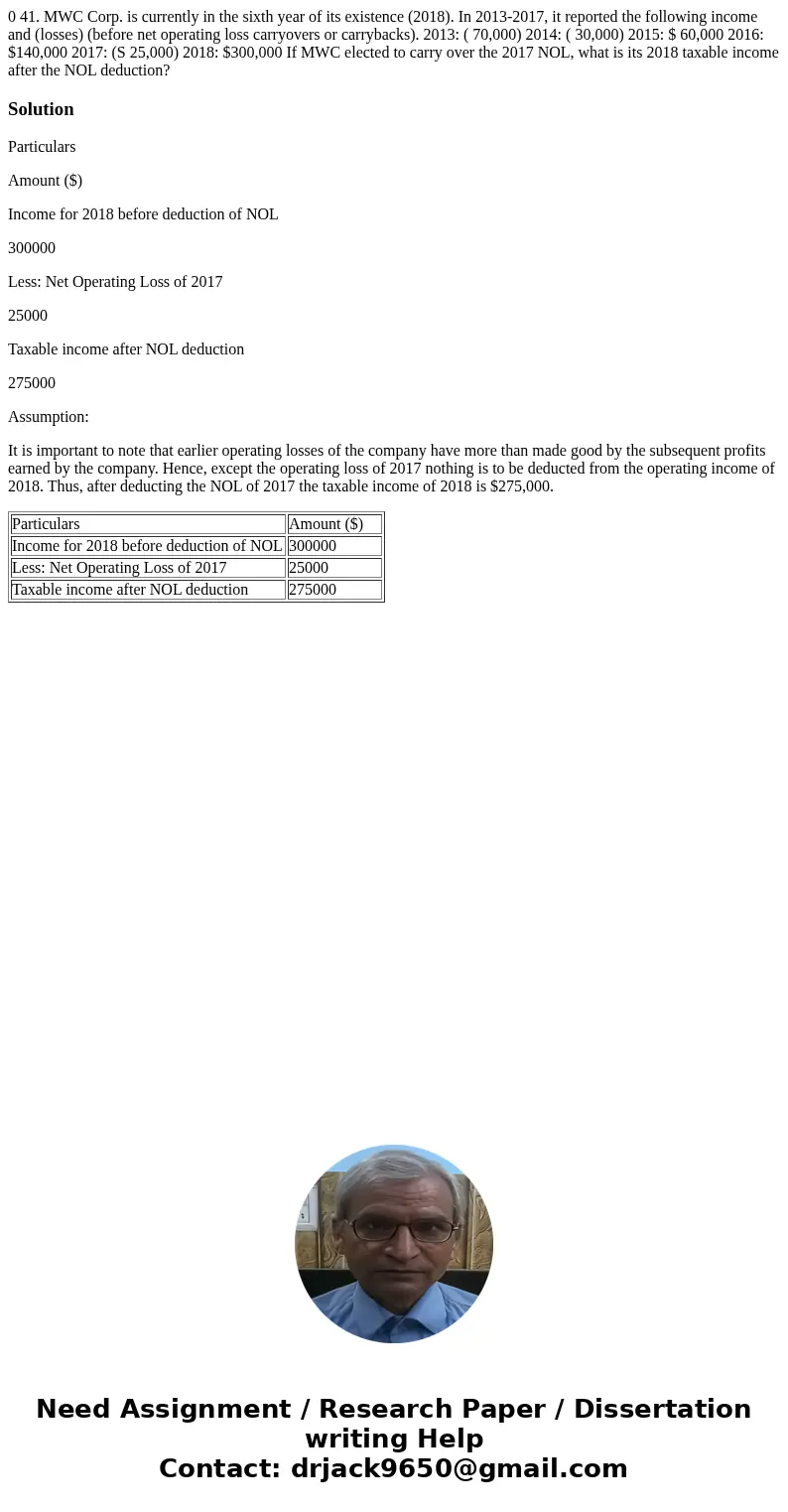

0 41. MWC Corp. is currently in the sixth year of its existence (2018). In 2013-2017, it reported the following income and (losses) (before net operating loss carryovers or carrybacks). 2013: ( 70,000) 2014: ( 30,000) 2015: $ 60,000 2016: $140,000 2017: (S 25,000) 2018: $300,000 If MWC elected to carry over the 2017 NOL, what is its 2018 taxable income after the NOL deduction?

Solution

Particulars

Amount ($)

Income for 2018 before deduction of NOL

300000

Less: Net Operating Loss of 2017

25000

Taxable income after NOL deduction

275000

Assumption:

It is important to note that earlier operating losses of the company have more than made good by the subsequent profits earned by the company. Hence, except the operating loss of 2017 nothing is to be deducted from the operating income of 2018. Thus, after deducting the NOL of 2017 the taxable income of 2018 is $275,000.

| Particulars | Amount ($) |

| Income for 2018 before deduction of NOL | 300000 |

| Less: Net Operating Loss of 2017 | 25000 |

| Taxable income after NOL deduction | 275000 |

Homework Sourse

Homework Sourse