QS 1310 Dividend allocation between classes of shareholders

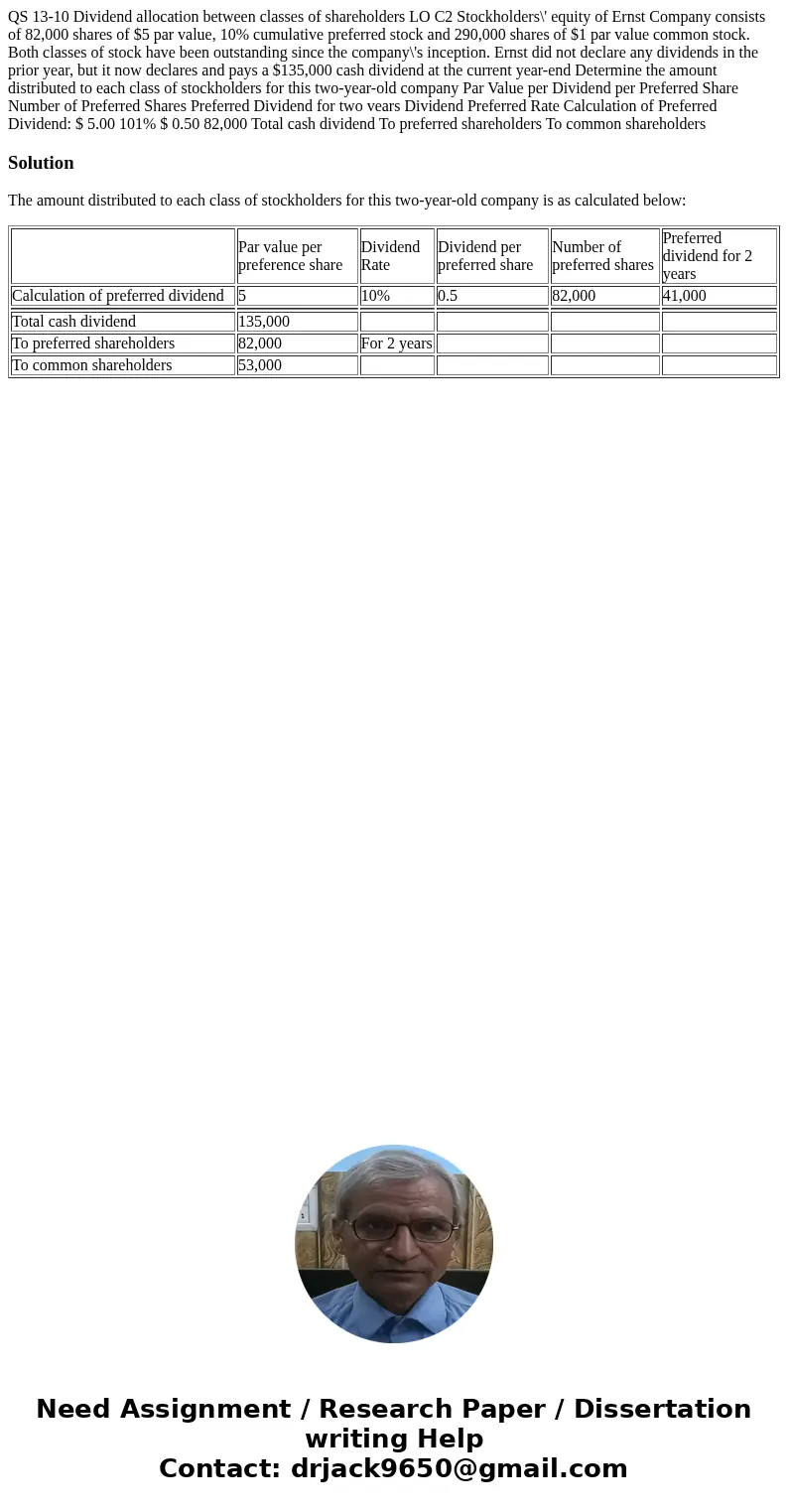

QS 13-10 Dividend allocation between classes of shareholders LO C2 Stockholders\' equity of Ernst Company consists of 82,000 shares of $5 par value, 10% cumulative preferred stock and 290,000 shares of $1 par value common stock. Both classes of stock have been outstanding since the company\'s inception. Ernst did not declare any dividends in the prior year, but it now declares and pays a $135,000 cash dividend at the current year-end Determine the amount distributed to each class of stockholders for this two-year-old company Par Value per Dividend per Preferred Share Number of Preferred Shares Preferred Dividend for two vears Dividend Preferred Rate Calculation of Preferred Dividend: $ 5.00 101% $ 0.50 82,000 Total cash dividend To preferred shareholders To common shareholders

Solution

The amount distributed to each class of stockholders for this two-year-old company is as calculated below:

| Par value per preference share | Dividend Rate | Dividend per preferred share | Number of preferred shares | Preferred dividend for 2 years | |

| Calculation of preferred dividend | 5 | 10% | 0.5 | 82,000 | 41,000 |

| Total cash dividend | 135,000 | ||||

| To preferred shareholders | 82,000 | For 2 years | |||

| To common shareholders | 53,000 |

Homework Sourse

Homework Sourse