ntstakeAssignment SessionL ocator assignmenttakeinprogressfa

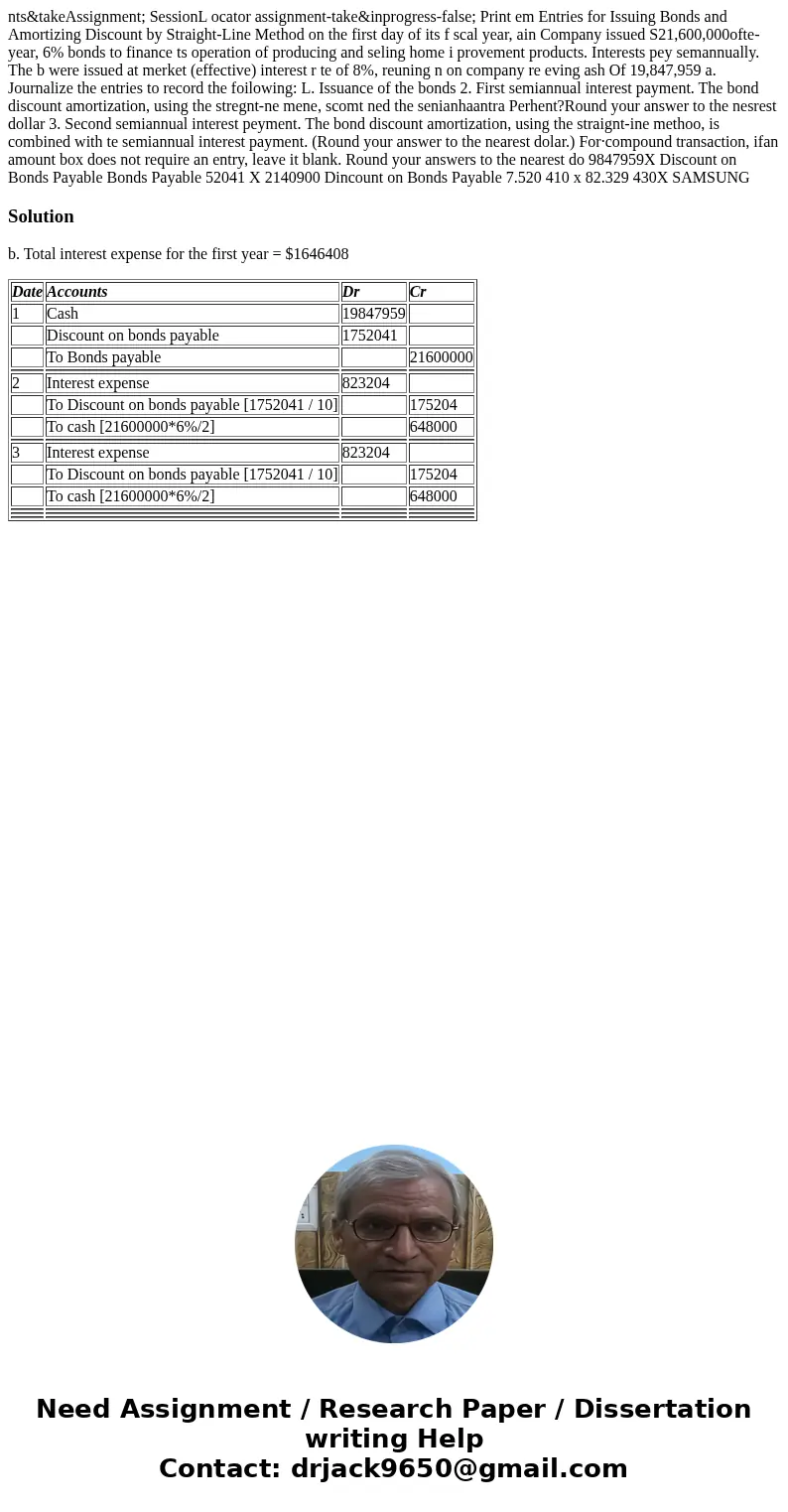

nts&takeAssignment; SessionL ocator assignment-take&inprogress-false; Print em Entries for Issuing Bonds and Amortizing Discount by Straight-Line Method on the first day of its f scal year, ain Company issued S21,600,000ofte-year, 6% bonds to finance ts operation of producing and seling home i provement products. Interests pey semannually. The b were issued at merket (effective) interest r te of 8%, reuning n on company re eving ash Of 19,847,959 a. Journalize the entries to record the foilowing: L. Issuance of the bonds 2. First semiannual interest payment. The bond discount amortization, using the stregnt-ne mene, scomt ned the senianhaantra Perhent?Round your answer to the nesrest dollar 3. Second semiannual interest peyment. The bond discount amortization, using the straignt-ine methoo, is combined with te semiannual interest payment. (Round your answer to the nearest dolar.) For·compound transaction, ifan amount box does not require an entry, leave it blank. Round your answers to the nearest do 9847959X Discount on Bonds Payable Bonds Payable 52041 X 2140900 Dincount on Bonds Payable 7.520 410 x 82.329 430X SAMSUNG

Solution

b. Total interest expense for the first year = $1646408

| Date | Accounts | Dr | Cr |

| 1 | Cash | 19847959 | |

| Discount on bonds payable | 1752041 | ||

| To Bonds payable | 21600000 | ||

| 2 | Interest expense | 823204 | |

| To Discount on bonds payable [1752041 / 10] | 175204 | ||

| To cash [21600000*6%/2] | 648000 | ||

| 3 | Interest expense | 823204 | |

| To Discount on bonds payable [1752041 / 10] | 175204 | ||

| To cash [21600000*6%/2] | 648000 | ||

Homework Sourse

Homework Sourse