5 Houghton Company began business on January 12015 by issuin

Solution

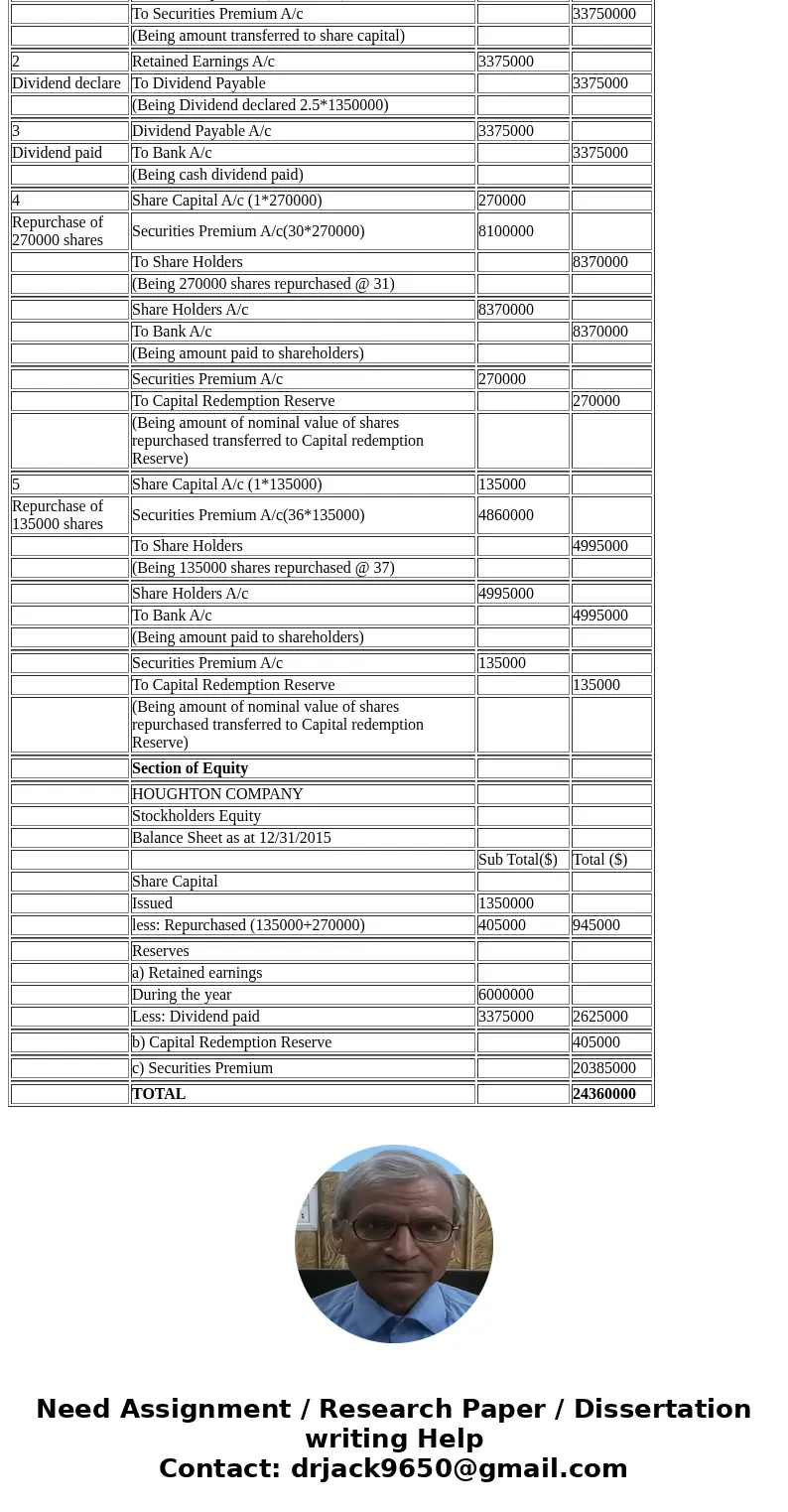

JOURNAL ENTRY WORKSHEET

Transaction

General Journal

Debit ($)

Credit ($)

1

Bank A/c

35100000

Issue of Shares

To Share Application A/c

35100000

(Being Share application Received $26 for 1350000 shares)

Share Application A/c

35100000

To Share Capital A/c(1*1350000)

1350000

To Securities Premium A/c

33750000

(Being amount transferred to share capital)

2

Retained Earnings A/c

3375000

Dividend declare

To Dividend Payable

3375000

(Being Dividend declared 2.5*1350000)

3

Dividend Payable A/c

3375000

Dividend paid

To Bank A/c

3375000

(Being cash dividend paid)

4

Share Capital A/c (1*270000)

270000

Repurchase of 270000 shares

Securities Premium A/c(30*270000)

8100000

To Share Holders

8370000

(Being 270000 shares repurchased @ 31)

Share Holders A/c

8370000

To Bank A/c

8370000

(Being amount paid to shareholders)

Securities Premium A/c

270000

To Capital Redemption Reserve

270000

(Being amount of nominal value of shares repurchased transferred to Capital redemption Reserve)

5

Share Capital A/c (1*135000)

135000

Repurchase of 135000 shares

Securities Premium A/c(36*135000)

4860000

To Share Holders

4995000

(Being 135000 shares repurchased @ 37)

Share Holders A/c

4995000

To Bank A/c

4995000

(Being amount paid to shareholders)

Securities Premium A/c

135000

To Capital Redemption Reserve

135000

(Being amount of nominal value of shares repurchased transferred to Capital redemption Reserve)

Section of Equity

HOUGHTON COMPANY

Stockholders Equity

Balance Sheet as at 12/31/2015

Sub Total($)

Total ($)

Share Capital

Issued

1350000

less: Repurchased (135000+270000)

405000

945000

Reserves

a) Retained earnings

During the year

6000000

Less: Dividend paid

3375000

2625000

b) Capital Redemption Reserve

405000

c) Securities Premium

20385000

TOTAL

24360000

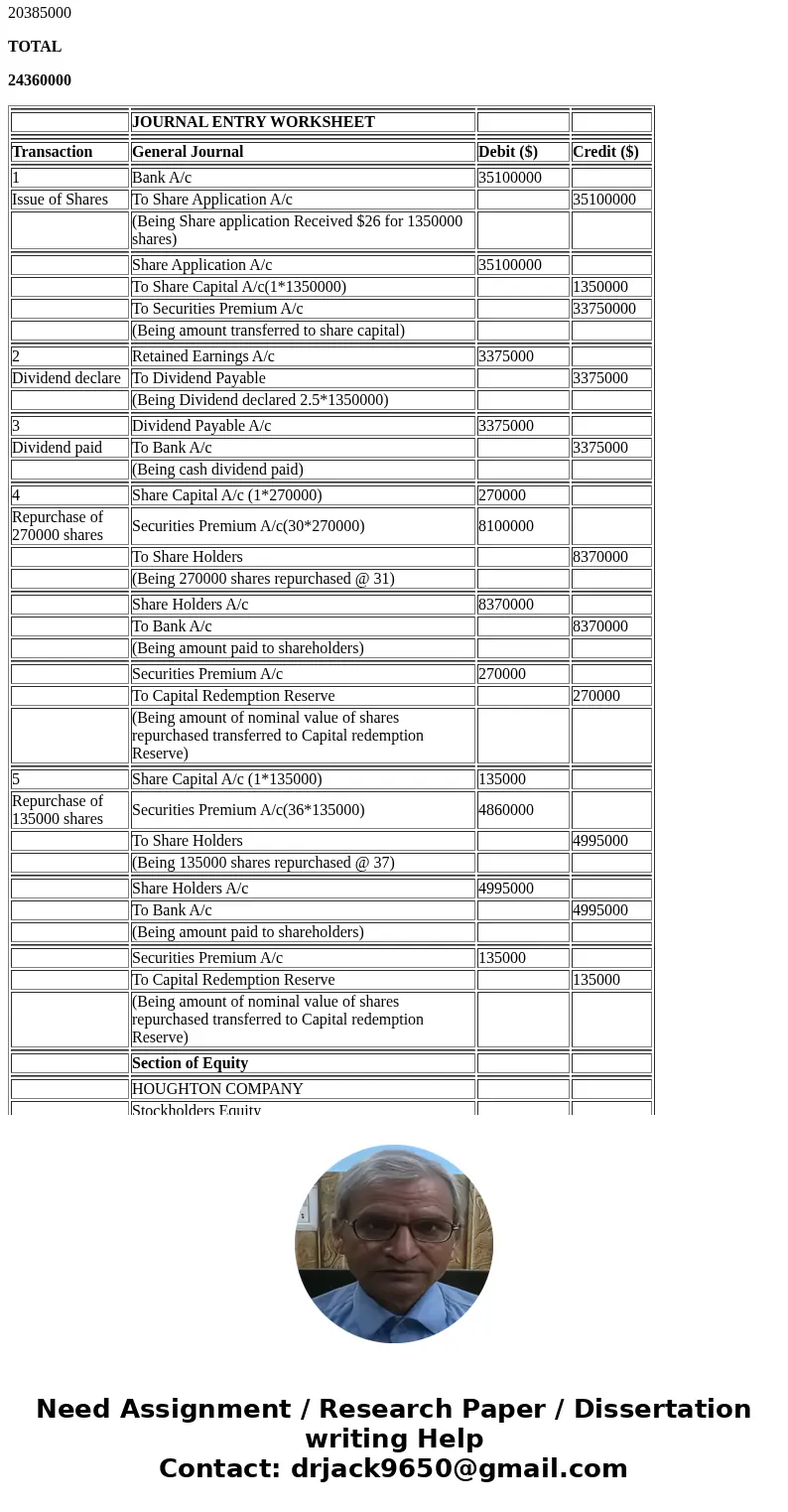

| JOURNAL ENTRY WORKSHEET | |||

| Transaction | General Journal | Debit ($) | Credit ($) |

| 1 | Bank A/c | 35100000 | |

| Issue of Shares | To Share Application A/c | 35100000 | |

| (Being Share application Received $26 for 1350000 shares) | |||

| Share Application A/c | 35100000 | ||

| To Share Capital A/c(1*1350000) | 1350000 | ||

| To Securities Premium A/c | 33750000 | ||

| (Being amount transferred to share capital) | |||

| 2 | Retained Earnings A/c | 3375000 | |

| Dividend declare | To Dividend Payable | 3375000 | |

| (Being Dividend declared 2.5*1350000) | |||

| 3 | Dividend Payable A/c | 3375000 | |

| Dividend paid | To Bank A/c | 3375000 | |

| (Being cash dividend paid) | |||

| 4 | Share Capital A/c (1*270000) | 270000 | |

| Repurchase of 270000 shares | Securities Premium A/c(30*270000) | 8100000 | |

| To Share Holders | 8370000 | ||

| (Being 270000 shares repurchased @ 31) | |||

| Share Holders A/c | 8370000 | ||

| To Bank A/c | 8370000 | ||

| (Being amount paid to shareholders) | |||

| Securities Premium A/c | 270000 | ||

| To Capital Redemption Reserve | 270000 | ||

| (Being amount of nominal value of shares repurchased transferred to Capital redemption Reserve) | |||

| 5 | Share Capital A/c (1*135000) | 135000 | |

| Repurchase of 135000 shares | Securities Premium A/c(36*135000) | 4860000 | |

| To Share Holders | 4995000 | ||

| (Being 135000 shares repurchased @ 37) | |||

| Share Holders A/c | 4995000 | ||

| To Bank A/c | 4995000 | ||

| (Being amount paid to shareholders) | |||

| Securities Premium A/c | 135000 | ||

| To Capital Redemption Reserve | 135000 | ||

| (Being amount of nominal value of shares repurchased transferred to Capital redemption Reserve) | |||

| Section of Equity | |||

| HOUGHTON COMPANY | |||

| Stockholders Equity | |||

| Balance Sheet as at 12/31/2015 | |||

| Sub Total($) | Total ($) | ||

| Share Capital | |||

| Issued | 1350000 | ||

| less: Repurchased (135000+270000) | 405000 | 945000 | |

| Reserves | |||

| a) Retained earnings | |||

| During the year | 6000000 | ||

| Less: Dividend paid | 3375000 | 2625000 | |

| b) Capital Redemption Reserve | 405000 | ||

| c) Securities Premium | 20385000 | ||

| TOTAL | 24360000 |

Homework Sourse

Homework Sourse