Score 0 of 1 pt 42 of 5 2 complete HW Score 20 1 of 5 pts P1

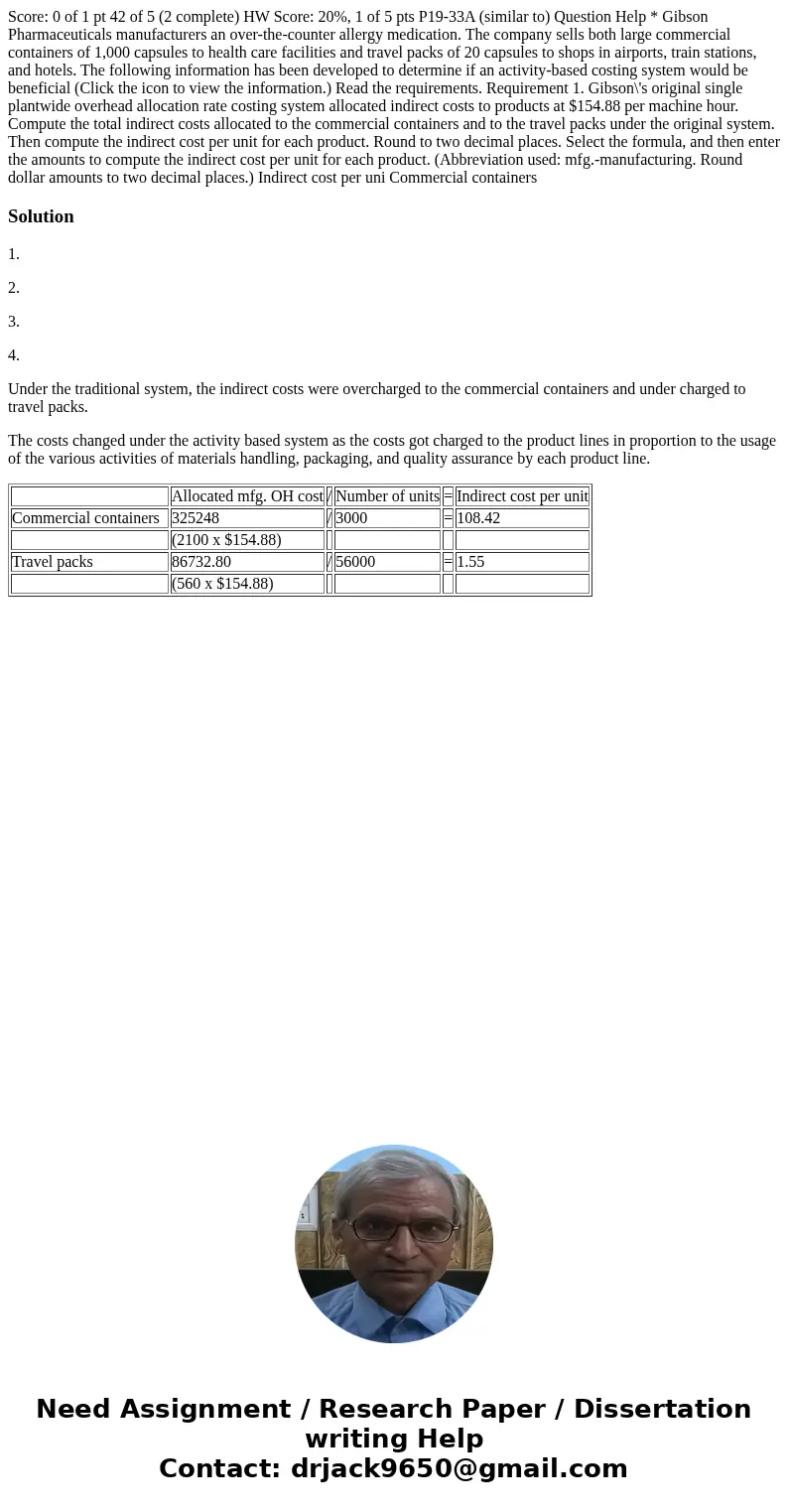

Score: 0 of 1 pt 42 of 5 (2 complete) HW Score: 20%, 1 of 5 pts P19-33A (similar to) Question Help * Gibson Pharmaceuticals manufacturers an over-the-counter allergy medication. The company sells both large commercial containers of 1,000 capsules to health care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. The following information has been developed to determine if an activity-based costing system would be beneficial (Click the icon to view the information.) Read the requirements. Requirement 1. Gibson\'s original single plantwide overhead allocation rate costing system allocated indirect costs to products at $154.88 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places. Select the formula, and then enter the amounts to compute the indirect cost per unit for each product. (Abbreviation used: mfg.-manufacturing. Round dollar amounts to two decimal places.) Indirect cost per uni Commercial containers

Solution

1.

2.

3.

4.

Under the traditional system, the indirect costs were overcharged to the commercial containers and under charged to travel packs.

The costs changed under the activity based system as the costs got charged to the product lines in proportion to the usage of the various activities of materials handling, packaging, and quality assurance by each product line.

| Allocated mfg. OH cost | / | Number of units | = | Indirect cost per unit | |

| Commercial containers | 325248 | / | 3000 | = | 108.42 |

| (2100 x $154.88) | |||||

| Travel packs | 86732.80 | / | 56000 | = | 1.55 |

| (560 x $154.88) |

Homework Sourse

Homework Sourse