p MailJamesyarbrougho x YeChegg Study Guided So Connect X

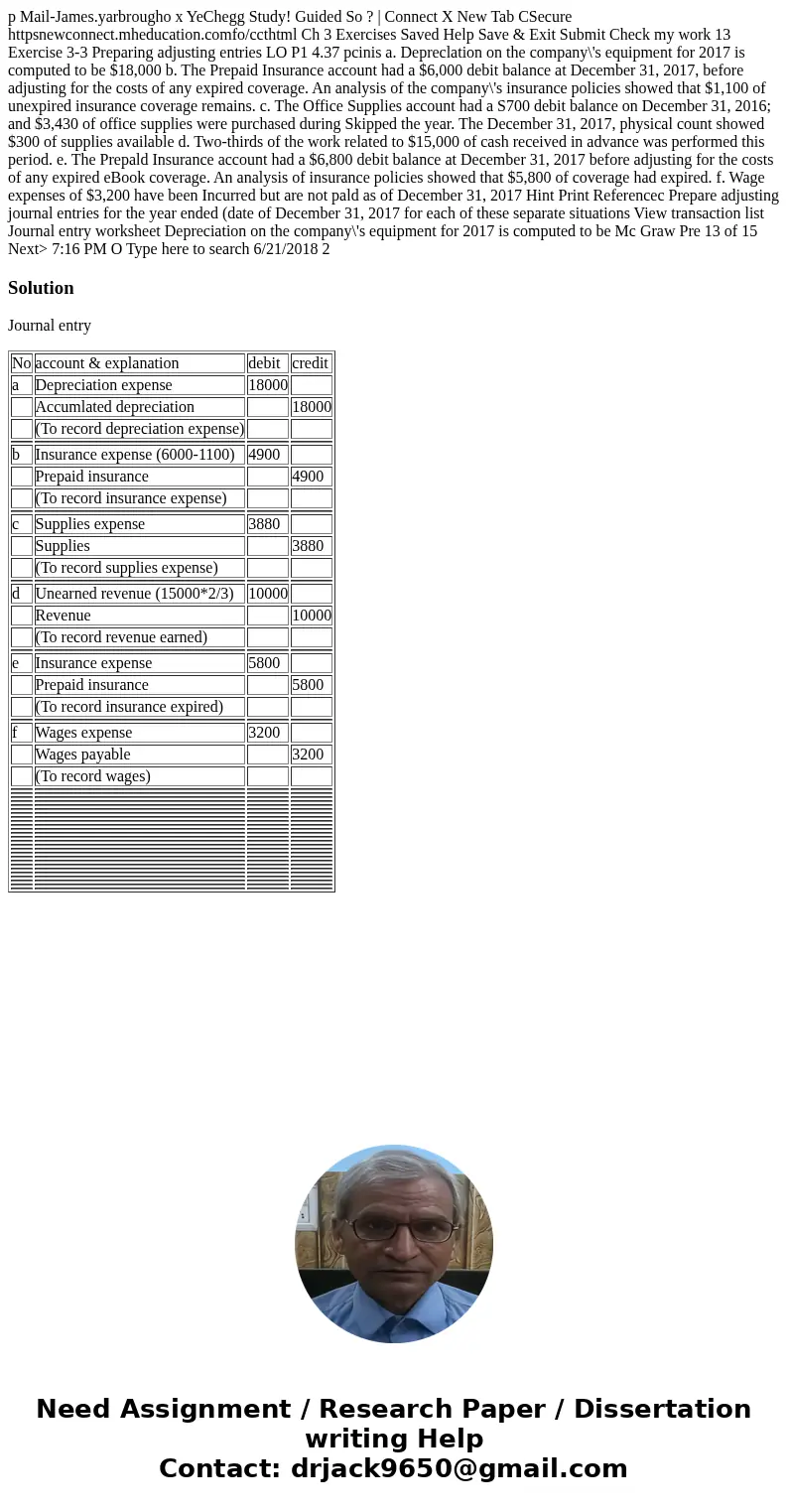

p Mail-James.yarbrougho x YeChegg Study! Guided So ? | Connect X New Tab CSecure httpsnewconnect.mheducation.comfo/ccthtml Ch 3 Exercises Saved Help Save & Exit Submit Check my work 13 Exercise 3-3 Preparing adjusting entries LO P1 4.37 pcinis a. Depreclation on the company\'s equipment for 2017 is computed to be $18,000 b. The Prepaid Insurance account had a $6,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of the company\'s insurance policies showed that $1,100 of unexpired insurance coverage remains. c. The Office Supplies account had a S700 debit balance on December 31, 2016; and $3,430 of office supplies were purchased during Skipped the year. The December 31, 2017, physical count showed $300 of supplies available d. Two-thirds of the work related to $15,000 of cash received in advance was performed this period. e. The Prepald Insurance account had a $6,800 debit balance at December 31, 2017 before adjusting for the costs of any expired eBook coverage. An analysis of insurance policies showed that $5,800 of coverage had expired. f. Wage expenses of $3,200 have been Incurred but are not pald as of December 31, 2017 Hint Print Referencec Prepare adjusting journal entries for the year ended (date of December 31, 2017 for each of these separate situations View transaction list Journal entry worksheet Depreciation on the company\'s equipment for 2017 is computed to be Mc Graw Pre 13 of 15 Next> 7:16 PM O Type here to search 6/21/2018 2

Solution

Journal entry

| No | account & explanation | debit | credit |

| a | Depreciation expense | 18000 | |

| Accumlated depreciation | 18000 | ||

| (To record depreciation expense) | |||

| b | Insurance expense (6000-1100) | 4900 | |

| Prepaid insurance | 4900 | ||

| (To record insurance expense) | |||

| c | Supplies expense | 3880 | |

| Supplies | 3880 | ||

| (To record supplies expense) | |||

| d | Unearned revenue (15000*2/3) | 10000 | |

| Revenue | 10000 | ||

| (To record revenue earned) | |||

| e | Insurance expense | 5800 | |

| Prepaid insurance | 5800 | ||

| (To record insurance expired) | |||

| f | Wages expense | 3200 | |

| Wages payable | 3200 | ||

| (To record wages) | |||

Homework Sourse

Homework Sourse