McCarver Investments purchased Fields Corp shares as a tradi

McCarver Investments purchased Fields Corp. shares as a trading security on December 16 for $104,000 1. Suppose the Fields Corp. shares decreased in value to $95,000 at December 31. Make the McCarver journal entry to adjust the Investment in Trading Securities account 2. Show how McCarver would report the Investment in Trading Securities on its balance sheet and the unrealized gain or loss on its income statement. to market value 1. Suppose the Fields Corp. shares decreased in value to $95,000 at December 31. Make the McCarver journal entry to adjust the Investment in Trading Securities account to market value. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Accounts Debit Credit Investment in Trading Securities 104000 104000 9000 9000 2. Show how McCarver would report the Investment in Trading Securities on its balance sheet and the unrealized gain or loss on its income statement. (Use parentheses or a minus sign when entering losses.) Balance Sheet Other revenues and gains (losses): 95000 Income Statement Unrealized loss on trading securities 9000

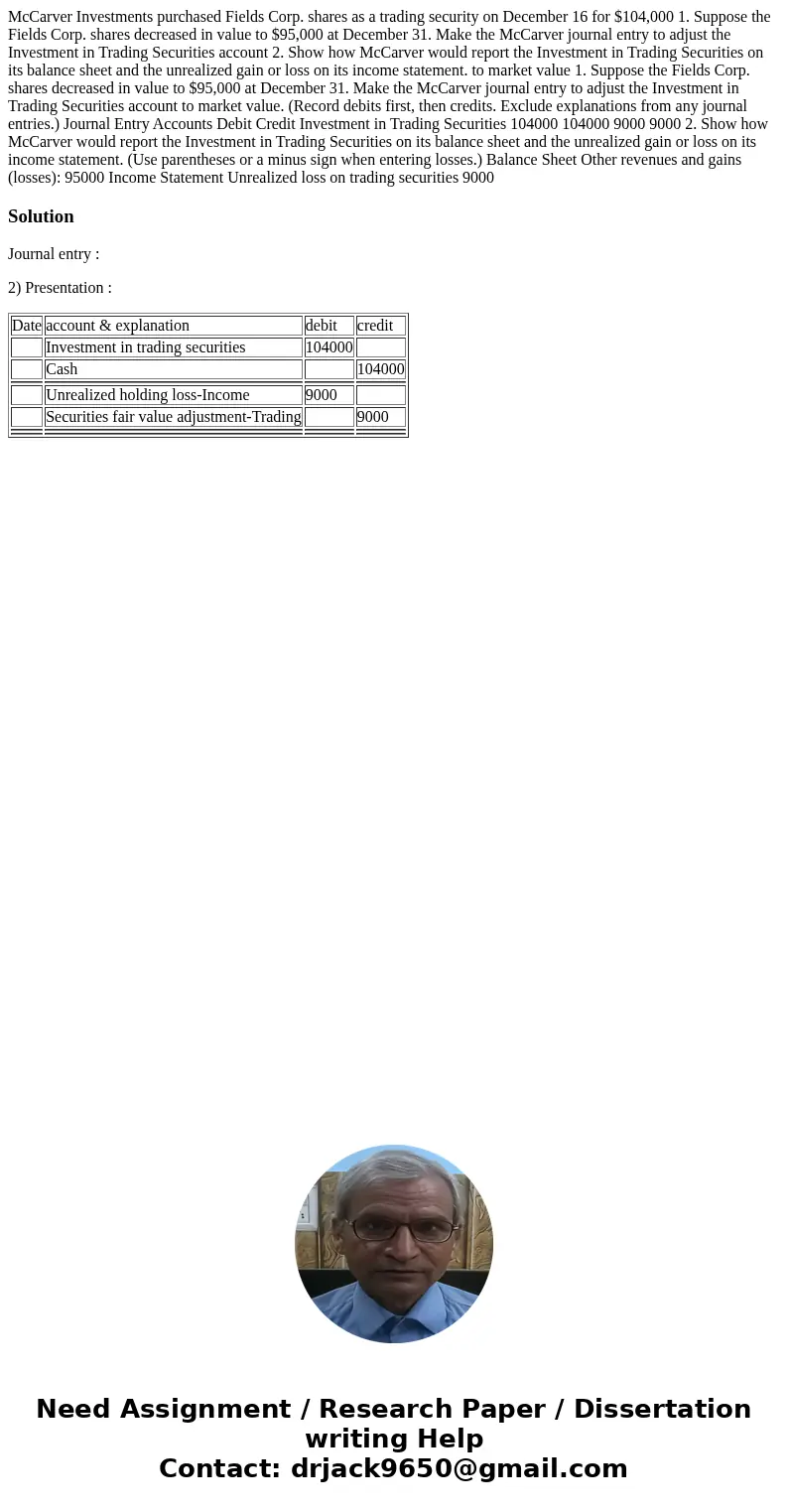

Solution

Journal entry :

2) Presentation :

| Date | account & explanation | debit | credit |

| Investment in trading securities | 104000 | ||

| Cash | 104000 | ||

| Unrealized holding loss-Income | 9000 | ||

| Securities fair value adjustment-Trading | 9000 | ||

Homework Sourse

Homework Sourse