on January 1st lion Corporation purchased a 25 Equity invest

on January 1st lion Corporation purchased a 25% Equity investment and Shane Corporation for $150,000. At the cember 31st Shane declared and paid an $80,000 cash dividend and reported net income of $380,000 journalize the transactions.

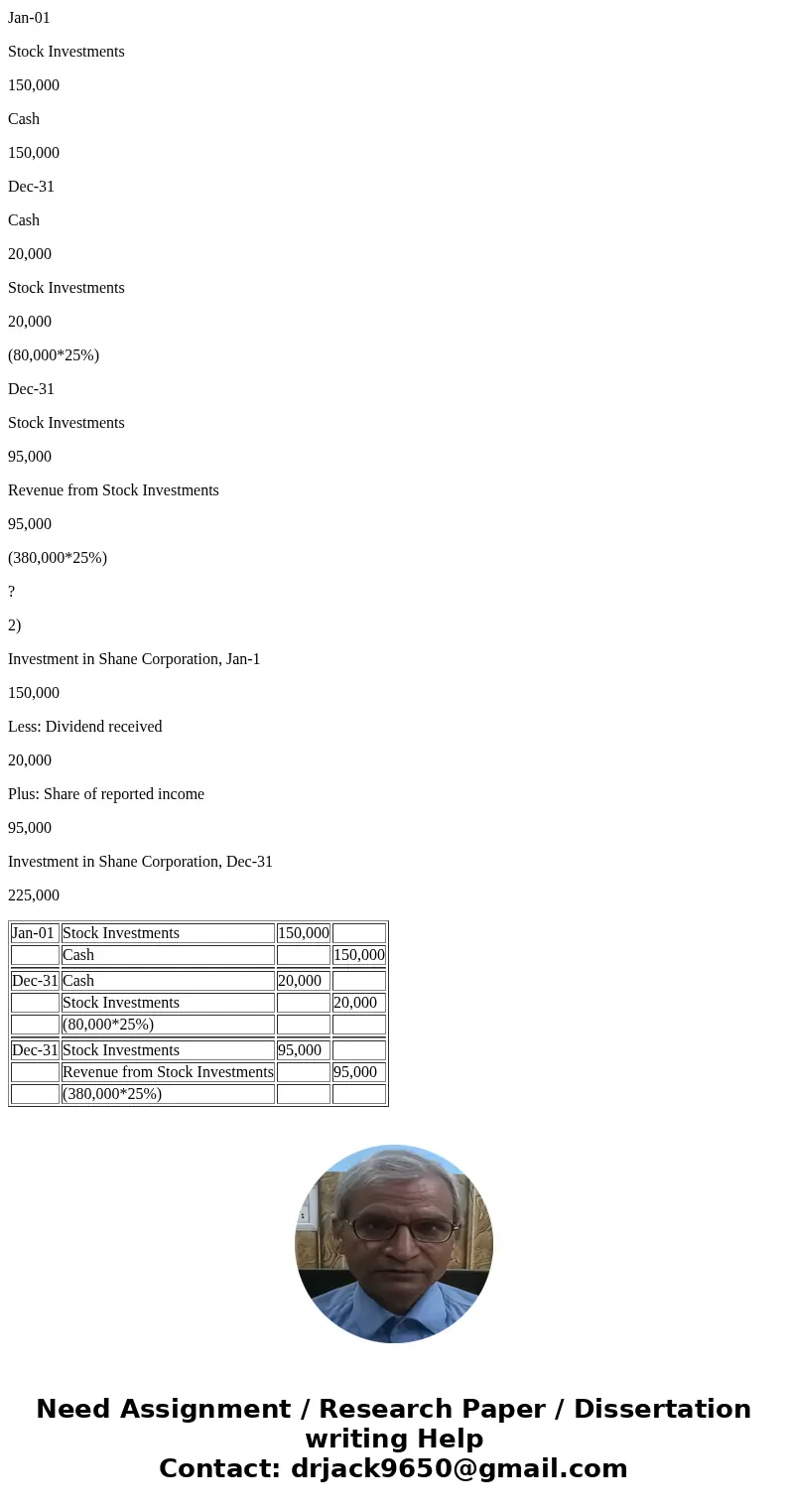

Kimmel, Accounting, 6e Help I System Announcements Exercise H-4 On January 1, Lyon Corporation purchased a 2S% equity investment in Shane Corporation for $150 and reported net income of $380,000. Journalize the transactions. (Credit account titles are automatically indented when the amoun the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record receipt of dividend) (To record revenue from investment) Determine the amount to be reported as an investment in Shane stock at December 31.Solution

1)

Jan-01

Stock Investments

150,000

Cash

150,000

Dec-31

Cash

20,000

Stock Investments

20,000

(80,000*25%)

Dec-31

Stock Investments

95,000

Revenue from Stock Investments

95,000

(380,000*25%)

?

2)

Investment in Shane Corporation, Jan-1

150,000

Less: Dividend received

20,000

Plus: Share of reported income

95,000

Investment in Shane Corporation, Dec-31

225,000

| Jan-01 | Stock Investments | 150,000 | |

| Cash | 150,000 | ||

| Dec-31 | Cash | 20,000 | |

| Stock Investments | 20,000 | ||

| (80,000*25%) | |||

| Dec-31 | Stock Investments | 95,000 | |

| Revenue from Stock Investments | 95,000 | ||

| (380,000*25%) |

Homework Sourse

Homework Sourse