E1015 Supplement 10B Recording the Effects of a Discount Bon

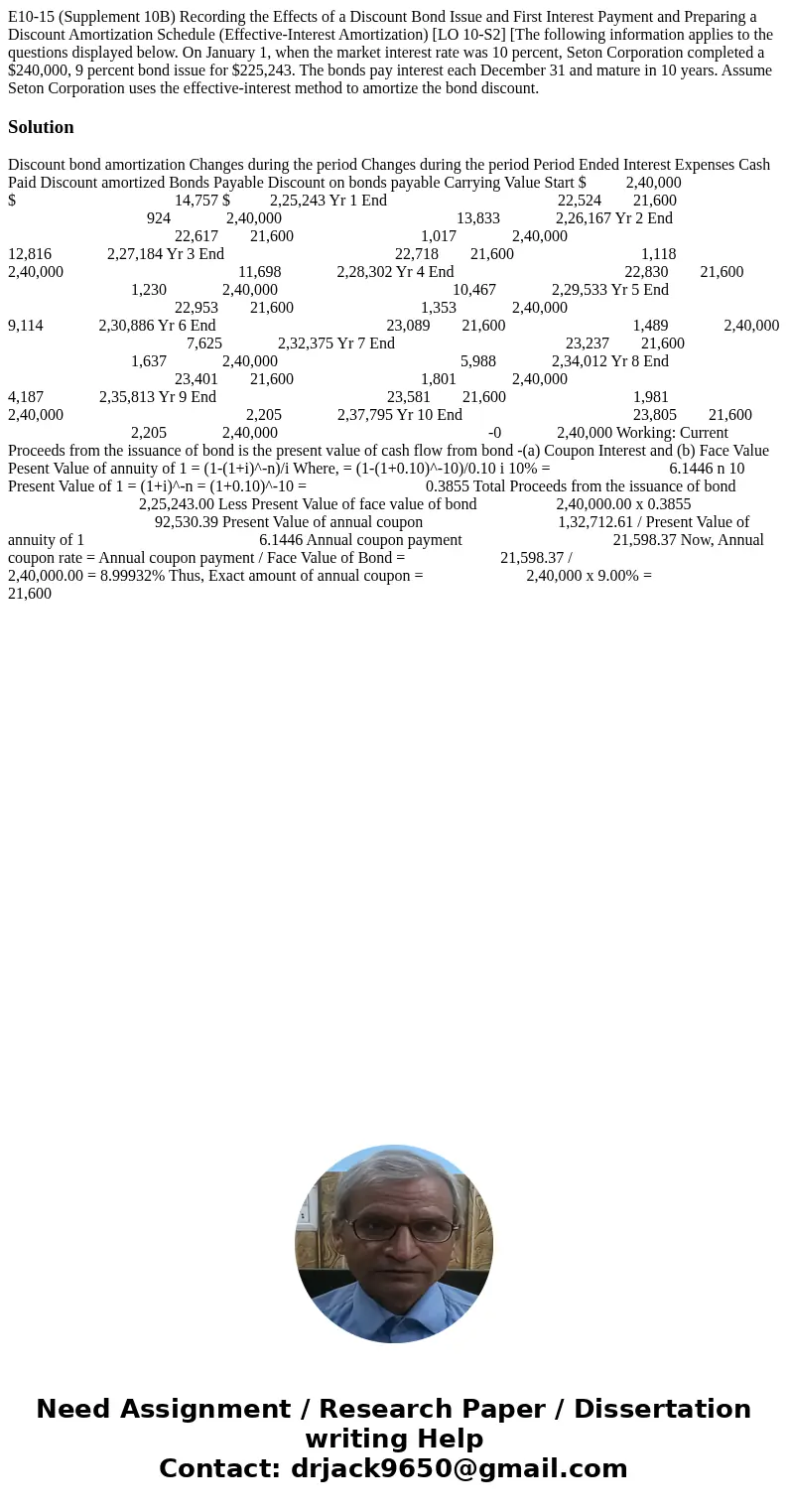

E10-15 (Supplement 10B) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Effective-Interest Amortization) [LO 10-S2] [The following information applies to the questions displayed below. On January 1, when the market interest rate was 10 percent, Seton Corporation completed a $240,000, 9 percent bond issue for $225,243. The bonds pay interest each December 31 and mature in 10 years. Assume Seton Corporation uses the effective-interest method to amortize the bond discount.

Solution

Discount bond amortization Changes during the period Changes during the period Period Ended Interest Expenses Cash Paid Discount amortized Bonds Payable Discount on bonds payable Carrying Value Start $ 2,40,000 $ 14,757 $ 2,25,243 Yr 1 End 22,524 21,600 924 2,40,000 13,833 2,26,167 Yr 2 End 22,617 21,600 1,017 2,40,000 12,816 2,27,184 Yr 3 End 22,718 21,600 1,118 2,40,000 11,698 2,28,302 Yr 4 End 22,830 21,600 1,230 2,40,000 10,467 2,29,533 Yr 5 End 22,953 21,600 1,353 2,40,000 9,114 2,30,886 Yr 6 End 23,089 21,600 1,489 2,40,000 7,625 2,32,375 Yr 7 End 23,237 21,600 1,637 2,40,000 5,988 2,34,012 Yr 8 End 23,401 21,600 1,801 2,40,000 4,187 2,35,813 Yr 9 End 23,581 21,600 1,981 2,40,000 2,205 2,37,795 Yr 10 End 23,805 21,600 2,205 2,40,000 -0 2,40,000 Working: Current Proceeds from the issuance of bond is the present value of cash flow from bond -(a) Coupon Interest and (b) Face Value Pesent Value of annuity of 1 = (1-(1+i)^-n)/i Where, = (1-(1+0.10)^-10)/0.10 i 10% = 6.1446 n 10 Present Value of 1 = (1+i)^-n = (1+0.10)^-10 = 0.3855 Total Proceeds from the issuance of bond 2,25,243.00 Less Present Value of face value of bond 2,40,000.00 x 0.3855 92,530.39 Present Value of annual coupon 1,32,712.61 / Present Value of annuity of 1 6.1446 Annual coupon payment 21,598.37 Now, Annual coupon rate = Annual coupon payment / Face Value of Bond = 21,598.37 / 2,40,000.00 = 8.99932% Thus, Exact amount of annual coupon = 2,40,000 x 9.00% = 21,600

Homework Sourse

Homework Sourse