The following data is available Sales 2400 units Beginning i

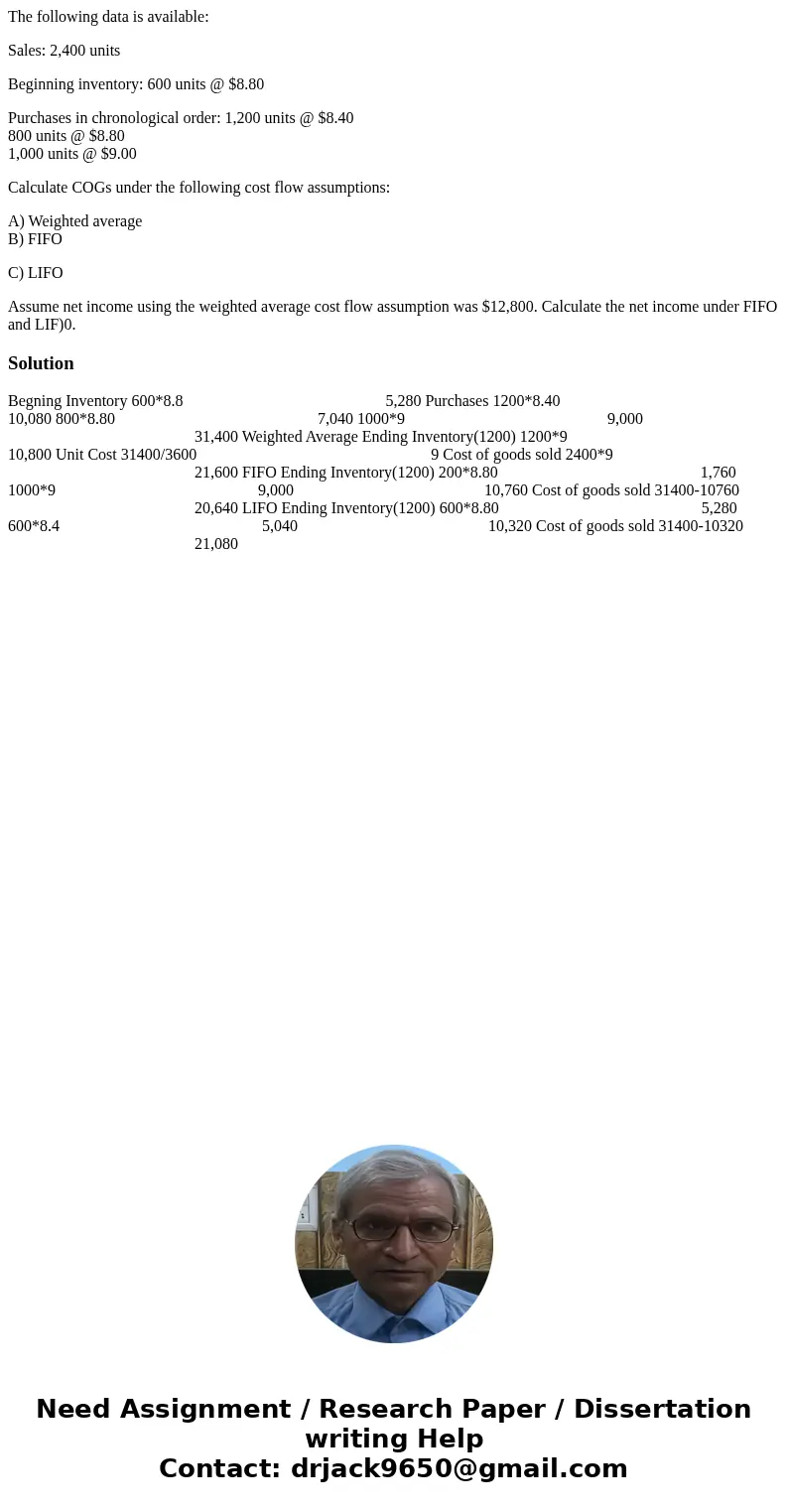

The following data is available:

Sales: 2,400 units

Beginning inventory: 600 units @ $8.80

Purchases in chronological order: 1,200 units @ $8.40

800 units @ $8.80

1,000 units @ $9.00

Calculate COGs under the following cost flow assumptions:

A) Weighted average

B) FIFO

C) LIFO

Assume net income using the weighted average cost flow assumption was $12,800. Calculate the net income under FIFO and LIF)0.

Solution

Begning Inventory 600*8.8 5,280 Purchases 1200*8.40 10,080 800*8.80 7,040 1000*9 9,000 31,400 Weighted Average Ending Inventory(1200) 1200*9 10,800 Unit Cost 31400/3600 9 Cost of goods sold 2400*9 21,600 FIFO Ending Inventory(1200) 200*8.80 1,760 1000*9 9,000 10,760 Cost of goods sold 31400-10760 20,640 LIFO Ending Inventory(1200) 600*8.80 5,280 600*8.4 5,040 10,320 Cost of goods sold 31400-10320 21,080

Homework Sourse

Homework Sourse