Requilred: Ans: Capital Profit Rs. 105,000; Revenuc Profit Rs. 60,000: Minority Interest Rs. 91,250 Capital Reserve Rs. 28,750: Balance Sheet Total Rs. 962,250 Ltd acquired 2,000 shares of S. Ltd. for Rs. 400,000 on 30th June last year. The accounts of both companies are closed on 31st December every year Liabilities 10.000 shares of Rs. 100 each The Balance Sheet of H. Co, as on 31st December, last year was: Rs. Assets Issued & subscribed capta! Rs. 950,000 Fixed assets 1,000,000 Investment Profit & loss A/c 550,000 2,000 shares of Rs. 100 each 150,000 Current assets 400,000 350.000 1,700,000 1.700,000 The other information are . The issued shares of S. Ltd. was 2,500 shares of Rs. 100 each. The current assets and current liabilities of S. Ltd. on 31st December, last year were valued at Rs. 200,000 each and fixed assets Rs. 500,000. The current assets of S. Ltd. includes Accounts . receivable of Rs, 20,000 due from H. Ltd . General Reserve and Profit and Loss Account (credit balance) of S. Co. on 1st Jan, last year was Rs. 100,000 and Rs. 50,000 respectively. The profit earmed by S. Co. during the year was Rs. 100.000 Required: Prepare consolidated balance sheet ascertaining Minority interest and cost of control. 2+2+4-8 Ans: Minority interest Rs. 100,000, Goodwill Rs 40,000 and B/S total Rs 20,20,000

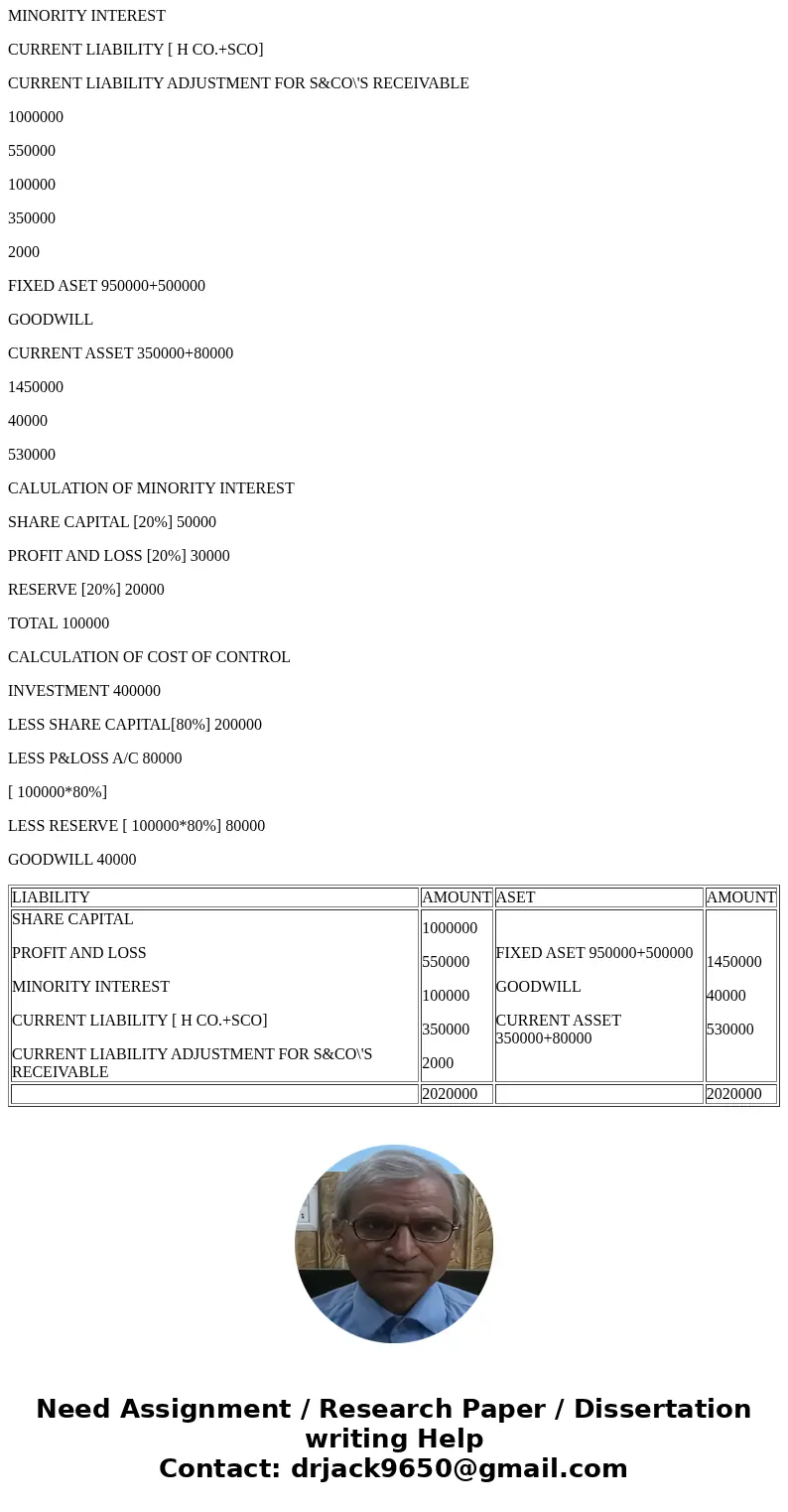

CONSOLIDATED BALANCE SHEET OF H&CO.

SHARE CAPITAL

PROFIT AND LOSS

MINORITY INTEREST

CURRENT LIABILITY [ H CO.+SCO]

CURRENT LIABILITY ADJUSTMENT FOR S&CO\'S RECEIVABLE

1000000

550000

100000

350000

2000

FIXED ASET 950000+500000

GOODWILL

CURRENT ASSET 350000+80000

1450000

40000

530000

CALULATION OF MINORITY INTEREST

SHARE CAPITAL [20%] 50000

PROFIT AND LOSS [20%] 30000

RESERVE [20%] 20000

TOTAL 100000

CALCULATION OF COST OF CONTROL

INVESTMENT 400000

LESS SHARE CAPITAL[80%] 200000

LESS P&LOSS A/C 80000

[ 100000*80%]

LESS RESERVE [ 100000*80%] 80000

GOODWILL 40000

| LIABILITY | AMOUNT | ASET | AMOUNT |

| SHARE CAPITAL PROFIT AND LOSS MINORITY INTEREST CURRENT LIABILITY [ H CO.+SCO] CURRENT LIABILITY ADJUSTMENT FOR S&CO\'S RECEIVABLE | 1000000 550000 100000 350000 2000 | FIXED ASET 950000+500000 GOODWILL CURRENT ASSET 350000+80000 | 1450000 40000 530000 |

| 2020000 | | 2020000 |

Homework Sourse

Homework Sourse