The following information applies to the questions displayed

Solution

HENRY

GRACE

JAMES

SALES

32000

35000

40000

(4800)

(24500)

(24800)

GROSS PROFIT

27200

10500

15200

(5000)

(13100)

(3000)

OPERATING INCOME

22200

(2600)

12200

(2000)

(7000)

0

INCOME BEFORE INCOME TAX

20200

(9600)

12200

(2000)

0

(3000)

NET INCOME /(LOSS)

18200

(9600)

9200

GROSS PROFIT

OPERATING INCOME

INCOME BEFORE INCOME TAX

NET INCOME /(LOSS)

HENRY

27200

22200

20200

18200

GRACE

10500

-2600

-9600

-9600

JAMES

15200

12200

12200

9200

Gross profit ratio calculation

GROSS PROFIT

SALES

GROSSPROFIT = (GROSSPROFIT/SALES)*100

GROSS PROFIT RATIO

HENRY

27200

32000

(27200/32000)*100

85%

GRACE

10500

35000

(10500/35000)*100

30%

JAMES

15200

40000

(15200/40000)*100

38%

Henry company has the most favorable ratio (GROSS PROFIT RATIO = 85%)

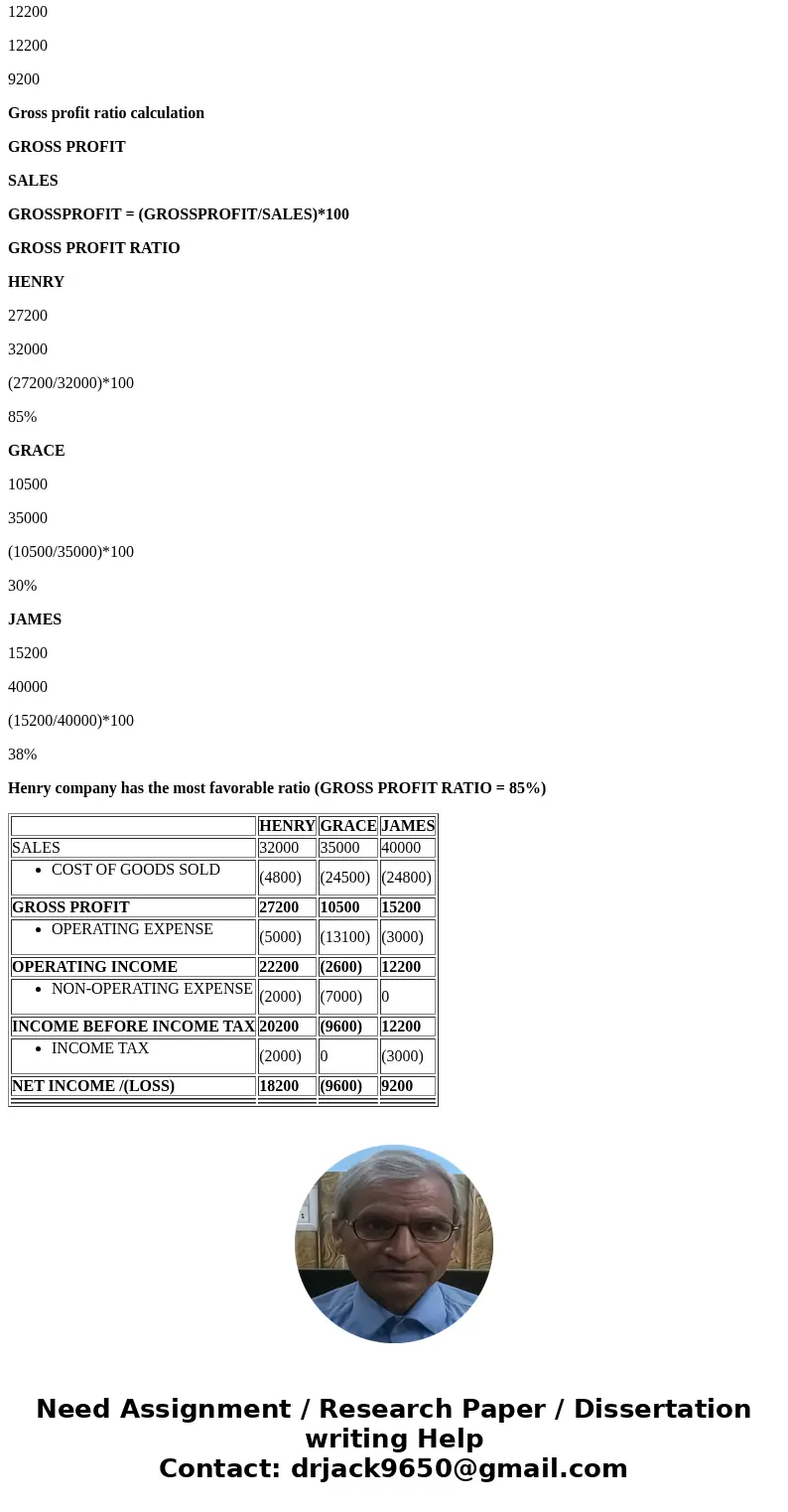

| HENRY | GRACE | JAMES | |

| SALES | 32000 | 35000 | 40000 |

| (4800) | (24500) | (24800) |

| GROSS PROFIT | 27200 | 10500 | 15200 |

| (5000) | (13100) | (3000) |

| OPERATING INCOME | 22200 | (2600) | 12200 |

| (2000) | (7000) | 0 |

| INCOME BEFORE INCOME TAX | 20200 | (9600) | 12200 |

| (2000) | 0 | (3000) |

| NET INCOME /(LOSS) | 18200 | (9600) | 9200 |

Homework Sourse

Homework Sourse