Net Present Value Analysis Anderson Company must evaluate tw

Net Present Value Analysis Anderson Company must evaluate two capital expenditure proposals. Anderson\'s hurdle rate is 12%. Data for the two proposals follow. Proposal X Proposal Y $360,000 $360,000 Required investment Annual after-tax cash inflows After-tax cash inflows at the end of years 3, 6, 9, and 12 Life of project 188,000 2 years 12 years What is the cash payback period for Proposal X? For Proposal Y? Hint: For Proposal Y, in what year (3, 6,9 or 12) will the full original investment be recovered? Round Proposal X answer to one decimal place, if applicable. Proposal X years Proposal Y years

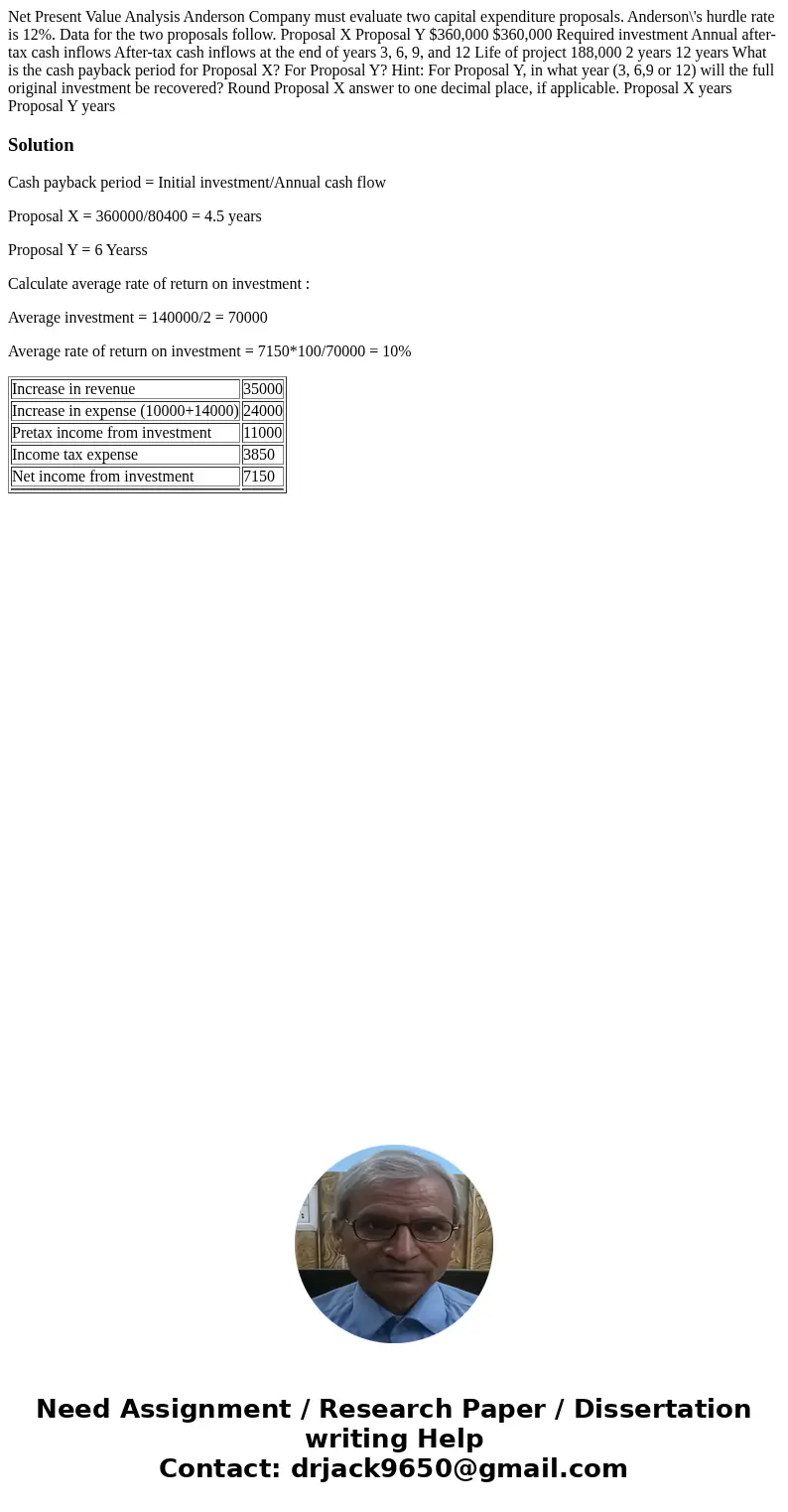

Solution

Cash payback period = Initial investment/Annual cash flow

Proposal X = 360000/80400 = 4.5 years

Proposal Y = 6 Yearss

Calculate average rate of return on investment :

Average investment = 140000/2 = 70000

Average rate of return on investment = 7150*100/70000 = 10%

| Increase in revenue | 35000 |

| Increase in expense (10000+14000) | 24000 |

| Pretax income from investment | 11000 |

| Income tax expense | 3850 |

| Net income from investment | 7150 |

Homework Sourse

Homework Sourse