gross a credit memorandum toward the return of s500 490 net

Solution

Inventory A/C Dr

To Boden Company

Creek And Co. Dr

To Sales

Cost of Goods Sold .Dr

To Inventory

Inventory A/c. Dr

To Cash A/c

(Being Freight paid)

Cash A/c . Dr

To Sales

Cost of Goods Sold . Dr

To Inventory A/c

Inventory A/c . Dr

To Leight Co

Leight Co . Dr

To Inventory

Cash A/c . Dr

To Creek Co

Being amount recieved after discount)

Discount A/c. Dr

To Creek Co

Boden Company A/c. Dr

To Cash A/c

Boden Company A/c Dr.

To Discount Recived

Art Co A/c . Dr

To Sales

Cost Of Goods Sold . Dr

To Inventory A/c

Inventory A/c

To Cost of Goods sold

Sales A/c .Dr

To Art Co

Leight Co A/c Dr.

To cash A/c

Leght Co A/c Dr

To Discount recieved

Cash A/c . Dr

To Art Co A/c

(1200-100=1100*98%)

Discount A/c Dr

To Art Co A/c

Creek Co A/c Dr

To Sales

Cost of Goods Sold . Dr

To Inventory

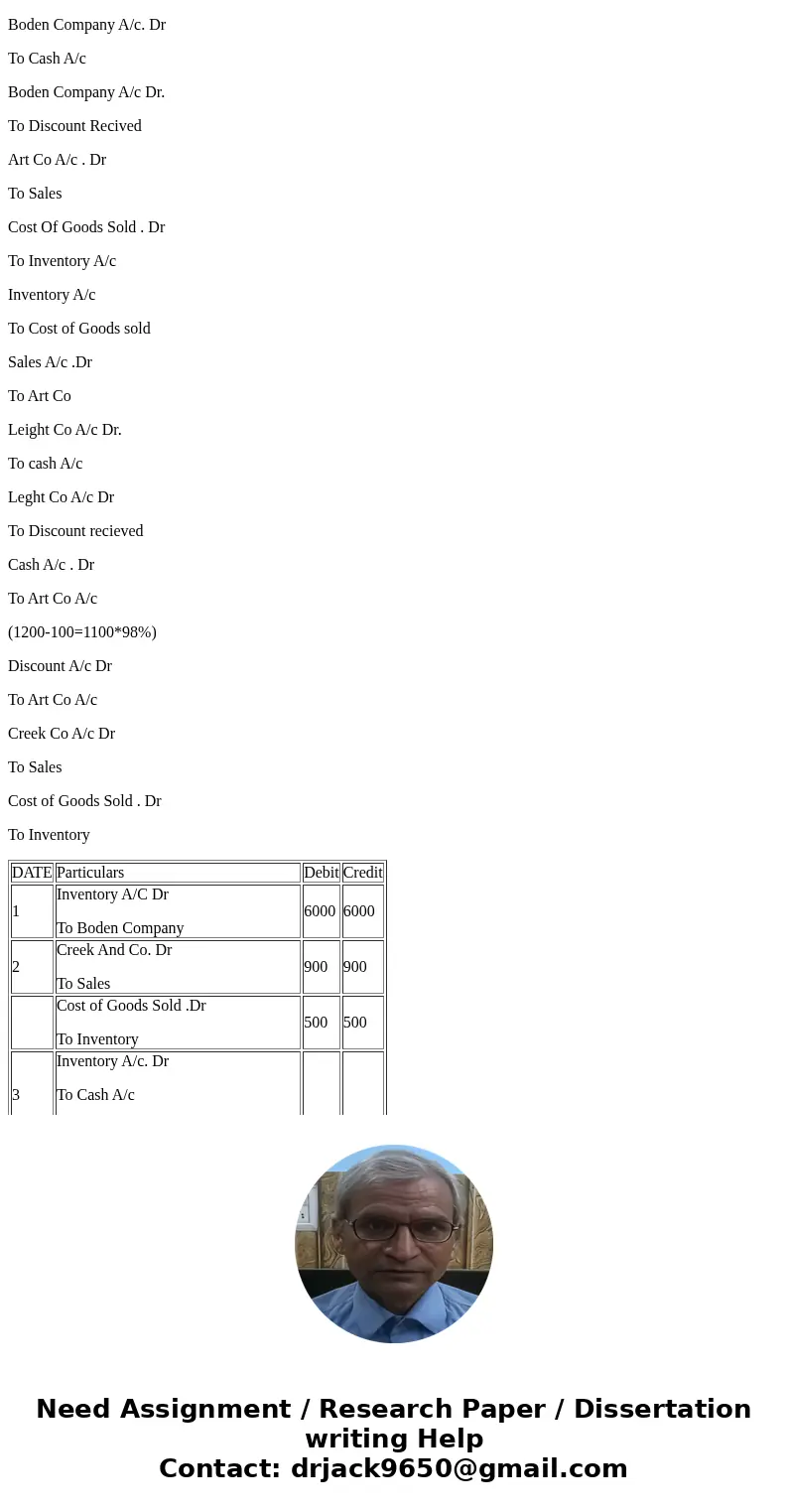

| DATE | Particulars | Debit | Credit |

| 1 | Inventory A/C Dr To Boden Company | 6000 | 6000 |

| 2 | Creek And Co. Dr To Sales | 900 | 900 |

| Cost of Goods Sold .Dr To Inventory | 500 | 500 | |

| 3 | Inventory A/c. Dr To Cash A/c (Being Freight paid) | ||

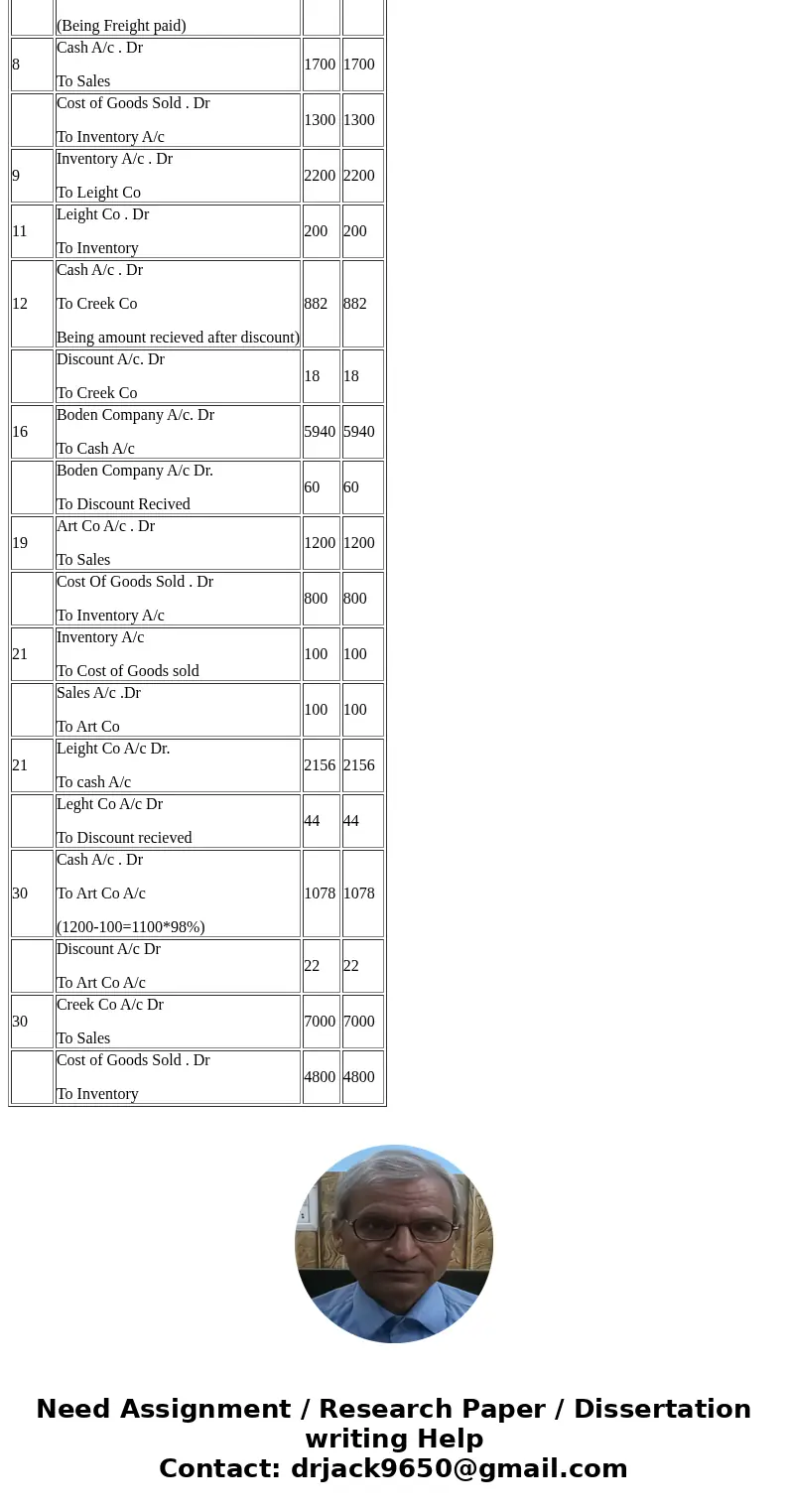

| 8 | Cash A/c . Dr To Sales | 1700 | 1700 |

| Cost of Goods Sold . Dr To Inventory A/c | 1300 | 1300 | |

| 9 | Inventory A/c . Dr To Leight Co | 2200 | 2200 |

| 11 | Leight Co . Dr To Inventory | 200 | 200 |

| 12 | Cash A/c . Dr To Creek Co Being amount recieved after discount) | 882 | 882 |

| Discount A/c. Dr To Creek Co | 18 | 18 | |

| 16 | Boden Company A/c. Dr To Cash A/c | 5940 | 5940 |

| Boden Company A/c Dr. To Discount Recived | 60 | 60 | |

| 19 | Art Co A/c . Dr To Sales | 1200 | 1200 |

| Cost Of Goods Sold . Dr To Inventory A/c | 800 | 800 | |

| 21 | Inventory A/c To Cost of Goods sold | 100 | 100 |

| Sales A/c .Dr To Art Co | 100 | 100 | |

| 21 | Leight Co A/c Dr. To cash A/c | 2156 | 2156 |

| Leght Co A/c Dr To Discount recieved | 44 | 44 | |

| 30 | Cash A/c . Dr To Art Co A/c (1200-100=1100*98%) | 1078 | 1078 |

| Discount A/c Dr To Art Co A/c | 22 | 22 | |

| 30 | Creek Co A/c Dr To Sales | 7000 | 7000 |

| Cost of Goods Sold . Dr To Inventory | 4800 | 4800 |

Homework Sourse

Homework Sourse