Project Year Project A 13500 8900 8100 6700 2100 3600 3100 5

Project Year Project A 13,500 8,900 8,100 6,700 2,100 3,600 3,100 5,500 Calculate the payback period for each project. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Payback Period Proiect A Proiect B 1.81 years 24 yearis Based on the payback period, which project should the company accept? Project B Project A If the appropriate discount rate is 14 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) NPV Proiect A Proiect B

Solution

NPV:- PV of cash inflow - Cash Outflow(Initial investment)

Project A

Amount

PV factor

Present Value

Cash Inflows :-

Year 1

8100

0.87719

7105.239

Year 2

6700

0.76947

5155.449

Year 3

2100

0.67497

1417.437

Net PV of Cash Inflow (A)

13678.125

Cash Outflow (B)

13500

NPV (A –B)

178.125

Project B

Amount

PV factor

Present Value

Cash Inflows :-

Year 1

3600

0.87719

3157.884

Year 2

3100

0.76947

2385.357

Year 3

5500

0.67497

3712.335

Net PV of Cash Inflow (A)

9255.576

Cash Outflow (B)

8900

NPV (A –B)

355.576

Project B is need to be accepted

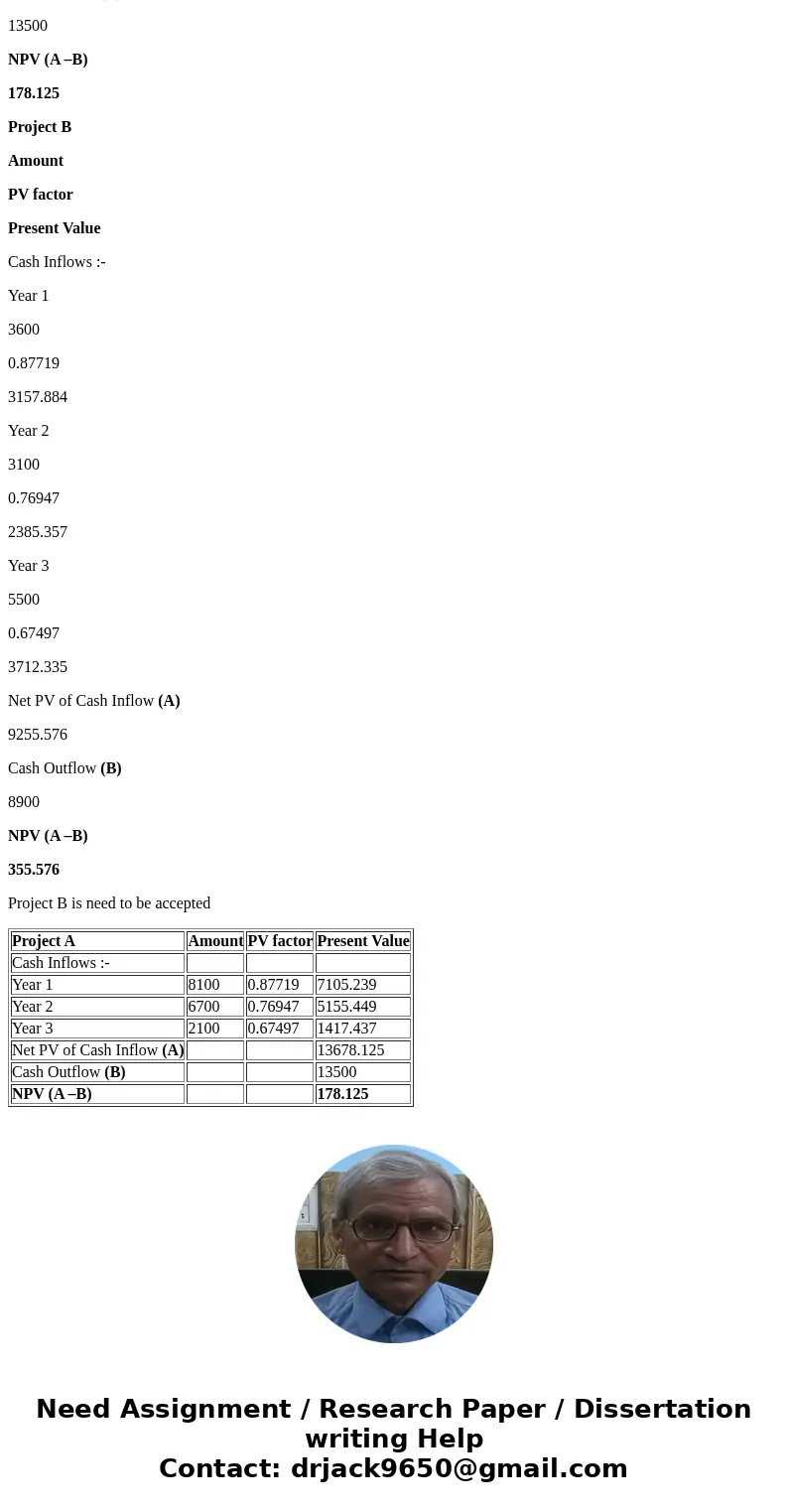

| Project A | Amount | PV factor | Present Value |

| Cash Inflows :- | |||

| Year 1 | 8100 | 0.87719 | 7105.239 |

| Year 2 | 6700 | 0.76947 | 5155.449 |

| Year 3 | 2100 | 0.67497 | 1417.437 |

| Net PV of Cash Inflow (A) | 13678.125 | ||

| Cash Outflow (B) | 13500 | ||

| NPV (A –B) | 178.125 |

Homework Sourse

Homework Sourse