Due to erratic sales of its sole producta highcapacity batte

Solution

Answers

A

Contribution margin

$ 209,600.00

B

No. of units

13,100

C=A/B

Unit Contribution margin

$ 16.00

D

Sales

$ 524,000.00

E=(A/D) x 100

CM Ratio

40%

F

Fixed expenses

$ 233,600.00

G = F/C

Break Even point in Units

14600

H = F/E or G x $40 sales price

Break Even point in Dollars

$ 584,000.00

A

Increase in Sales

$ 85,000.00

B

CM Ratio

40%

C=A x B

Increase in Contribution margin

$ 34,000.00

D

Increase in Fixed Cost

$ 6,100.00

E = C - D

Net Operating Income INCREASED by

$ 27,900.00

Working

For 13,100 x 2 = 26,200 units

A = ($ 40 - 10%) x 26,200

Sales revenue

$ 943,200.00

B = (314400/13100) x 26200

Variable Cost

$ 628,800.00

C = A - B

Contribution Margin

$ 314,400.00

D = 233,600 existing + $39,000

Fixed Cost

$ 272,600.00

E=C - D

Net Operating Income

$ 41,800.00

A

Existing Unit Contribution margin

$ 16.00

B

Increased packaging cost

$ 0.70

C=A-B

New Unit Contribution will be

$ 15.30

D

Desired profits

$ 4,900.00

E

Fixed Cost

$ 233,600.00

F=D+E

Total contribution required to be earned to earn target profit

$ 238,500.00

G=F/C

Sales unit for earning desired profits

15,588

Part ‘a’

A

Existing Sale price

$ 40.00

B

Existing Variable cost

$ 24.00

C= B x 50%

Variable cost after automation

$ 12.00

D=A - C

New Unit Contribution margin

$ 28.00

E = (D/A) x 100

CM Ratio

70%

F = 233600 + 55000

Fixed cost after automation

$ 288,600.00

G = F/D

Break Even point in Units

10307

H = F/E

Break Even point in dollars

$ 412,286

Part ‘b’

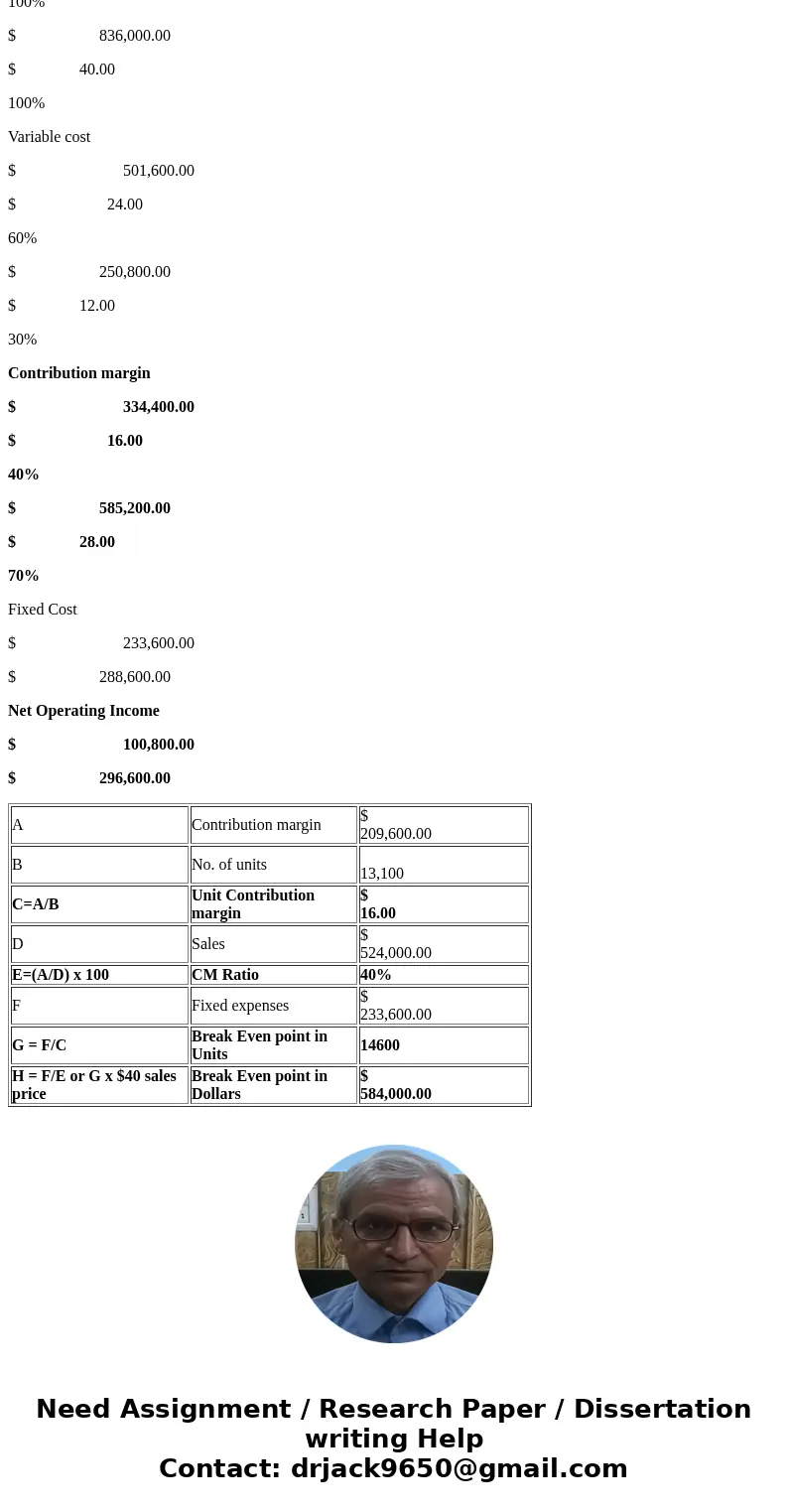

Not Automated

Automated

Total

Per Unit

%

Total

Per Unit

%

Sales Revenue

$ 836,000.00

$ 40.00

100%

$ 836,000.00

$ 40.00

100%

Variable cost

$ 501,600.00

$ 24.00

60%

$ 250,800.00

$ 12.00

30%

Contribution margin

$ 334,400.00

$ 16.00

40%

$ 585,200.00

$ 28.00

70%

Fixed Cost

$ 233,600.00

$ 288,600.00

Net Operating Income

$ 100,800.00

$ 296,600.00

| A | Contribution margin | $ 209,600.00 |

| B | No. of units | 13,100 |

| C=A/B | Unit Contribution margin | $ 16.00 |

| D | Sales | $ 524,000.00 |

| E=(A/D) x 100 | CM Ratio | 40% |

| F | Fixed expenses | $ 233,600.00 |

| G = F/C | Break Even point in Units | 14600 |

| H = F/E or G x $40 sales price | Break Even point in Dollars | $ 584,000.00 |

Homework Sourse

Homework Sourse