FIFO vs average cost method a b Calculate the cost of goods

FIFO vs. average cost method

a)

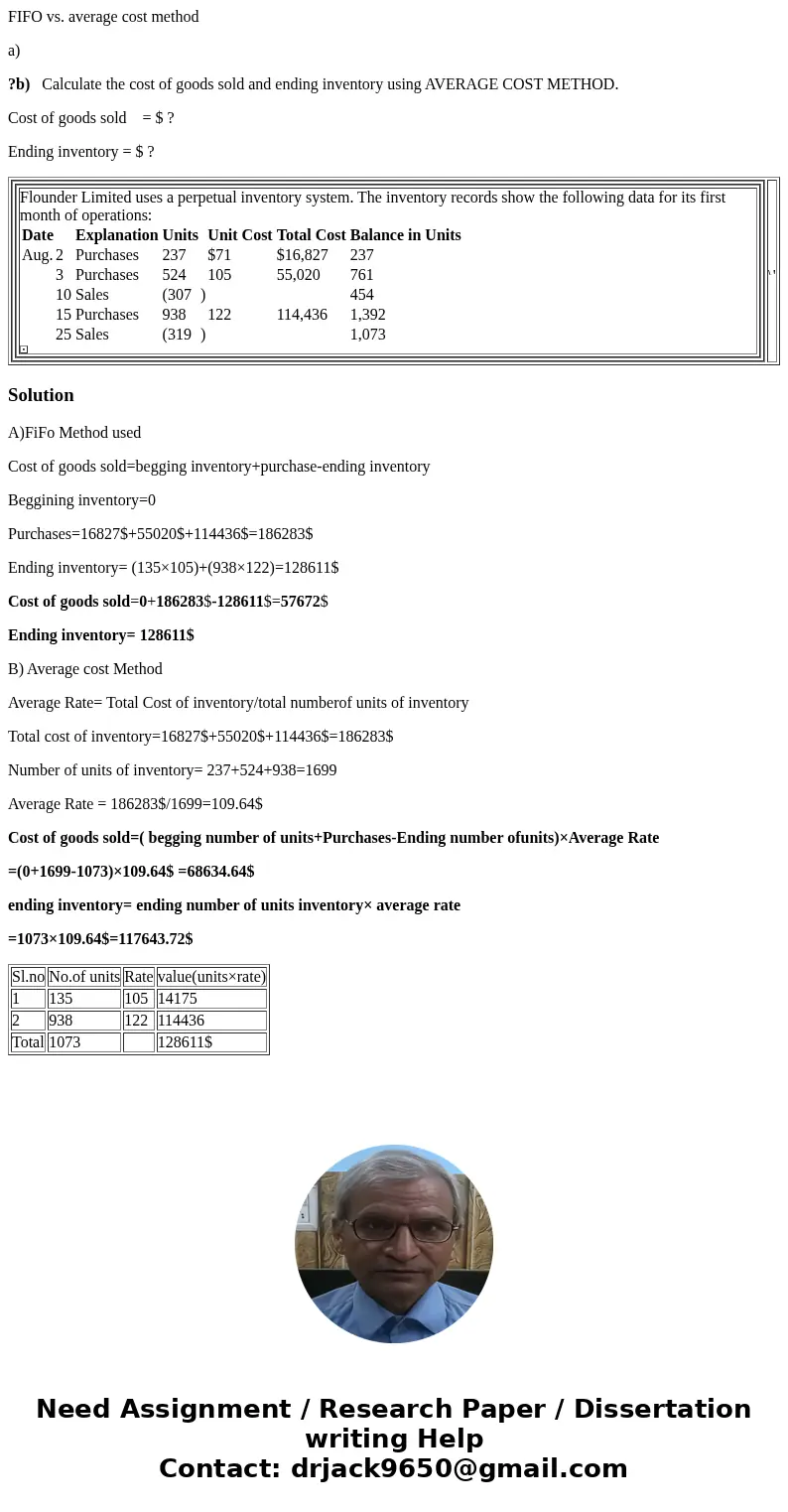

?b) Calculate the cost of goods sold and ending inventory using AVERAGE COST METHOD.

Cost of goods sold = $ ?

Ending inventory = $ ?

|

Solution

A)FiFo Method used

Cost of goods sold=begging inventory+purchase-ending inventory

Beggining inventory=0

Purchases=16827$+55020$+114436$=186283$

Ending inventory= (135×105)+(938×122)=128611$

Cost of goods sold=0+186283$-128611$=57672$

Ending inventory= 128611$

B) Average cost Method

Average Rate= Total Cost of inventory/total numberof units of inventory

Total cost of inventory=16827$+55020$+114436$=186283$

Number of units of inventory= 237+524+938=1699

Average Rate = 186283$/1699=109.64$

Cost of goods sold=( begging number of units+Purchases-Ending number ofunits)×Average Rate

=(0+1699-1073)×109.64$ =68634.64$

ending inventory= ending number of units inventory× average rate

=1073×109.64$=117643.72$

| Sl.no | No.of units | Rate | value(units×rate) |

| 1 | 135 | 105 | 14175 |

| 2 | 938 | 122 | 114436 |

| Total | 1073 | 128611$ |

Homework Sourse

Homework Sourse