Computer equipment office equipment purchased 6 12 years ago

Solution

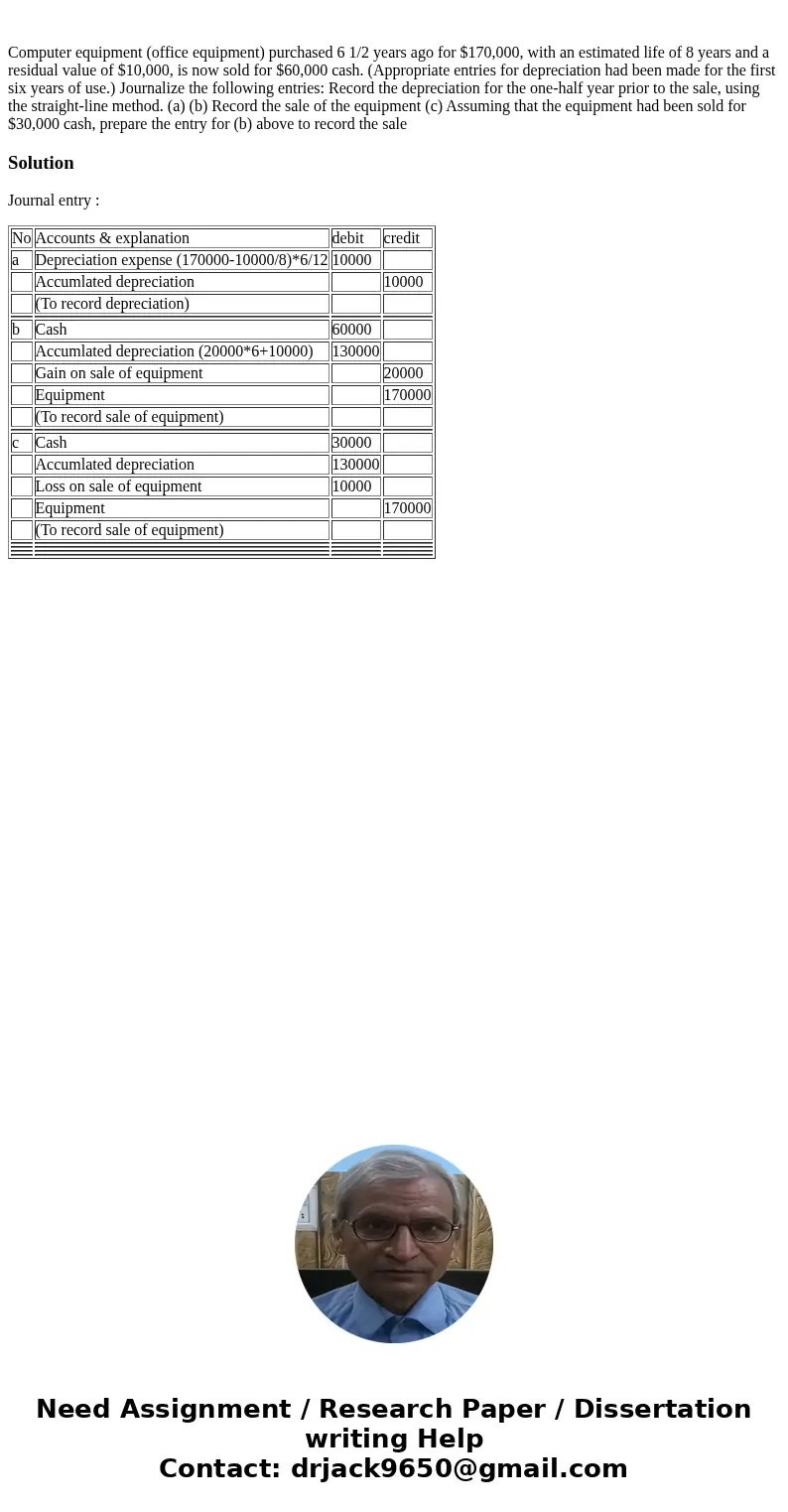

Journal entry :

| No | Accounts & explanation | debit | credit |

| a | Depreciation expense (170000-10000/8)*6/12 | 10000 | |

| Accumlated depreciation | 10000 | ||

| (To record depreciation) | |||

| b | Cash | 60000 | |

| Accumlated depreciation (20000*6+10000) | 130000 | ||

| Gain on sale of equipment | 20000 | ||

| Equipment | 170000 | ||

| (To record sale of equipment) | |||

| c | Cash | 30000 | |

| Accumlated depreciation | 130000 | ||

| Loss on sale of equipment | 10000 | ||

| Equipment | 170000 | ||

| (To record sale of equipment) | |||

Homework Sourse

Homework Sourse