A small company heats its building and spends 8000 per year

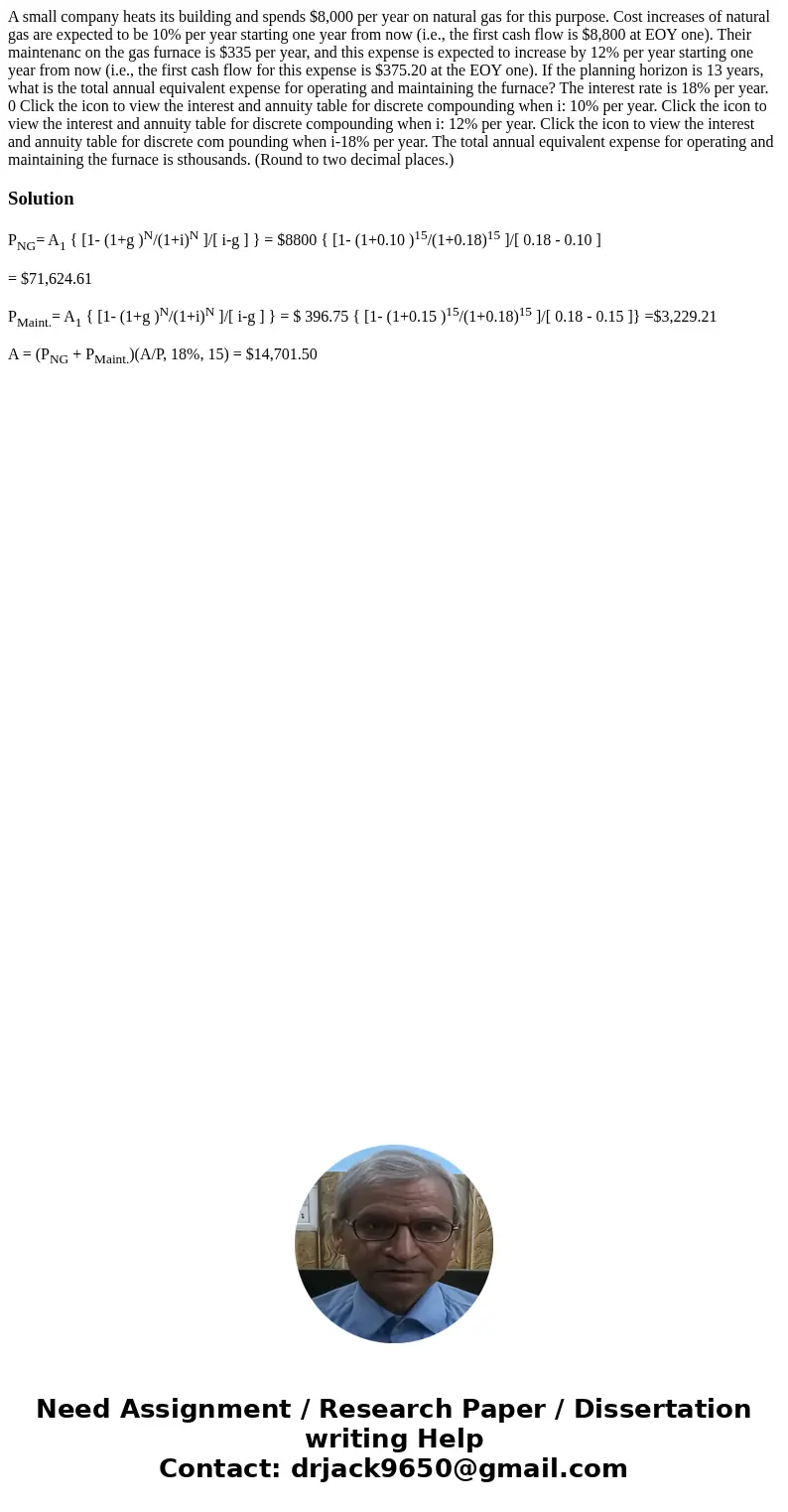

A small company heats its building and spends $8,000 per year on natural gas for this purpose. Cost increases of natural gas are expected to be 10% per year starting one year from now (i.e., the first cash flow is $8,800 at EOY one). Their maintenanc on the gas furnace is $335 per year, and this expense is expected to increase by 12% per year starting one year from now (i.e., the first cash flow for this expense is $375.20 at the EOY one). If the planning horizon is 13 years, what is the total annual equivalent expense for operating and maintaining the furnace? The interest rate is 18% per year. 0 Click the icon to view the interest and annuity table for discrete compounding when i: 10% per year. Click the icon to view the interest and annuity table for discrete compounding when i: 12% per year. Click the icon to view the interest and annuity table for discrete com pounding when i-18% per year. The total annual equivalent expense for operating and maintaining the furnace is sthousands. (Round to two decimal places.)

Solution

PNG= A1 { [1- (1+g )N/(1+i)N ]/[ i-g ] } = $8800 { [1- (1+0.10 )15/(1+0.18)15 ]/[ 0.18 - 0.10 ]

= $71,624.61

PMaint.= A1 { [1- (1+g )N/(1+i)N ]/[ i-g ] } = $ 396.75 { [1- (1+0.15 )15/(1+0.18)15 ]/[ 0.18 - 0.15 ]} =$3,229.21

A = (PNG + PMaint.)(A/P, 18%, 15) = $14,701.50

Homework Sourse

Homework Sourse