Complete the External Factor Evaluation EFE about the GAP Co

Solution

EFE Matrix for Gap Corporation

The EFE Matrix helps us to understand where the company stands in terms of addressing the most important external factors to a form in the industry

EFE Matrix for Gap Corporation shows its current strength in the industry is above average.

External Factor Evaluation (EFE) Matrix

KEY EXTERNAL FACTORS

Weight

Rating

Weighted Score

Opportunities

Green/Organic materials for clothes

0.04

4

0.24

Product design and fashion

0.08

3

0.51

Emerging markets in Asia

0.06

2

0.54

Increasing e-commerce

0.07

3

0.28

Brand building

0.04

2

0.12

Product innovation and technology

0.04

2

0.08

Sustainability

0.05

2

0.1

Expansion into other related products – cosmetics, bags, sunglasses

0.06

3

0.18

Decreasing price of cotton

0.05

3

0.15

New outsourcing possibilities in Asia

0.04

3

0.12

Threats

Economic downturn

0.04

3

0.33

Apparel retail industry is getting highly competitive

0.07

2

0.14

Emerging fast fashion retailers

0.08

1

0.12

Soaring real estate price

0.07

2

0.14

New Asian brands and local players

0.06

2

0.32

Rising costs in outsourcing

0.04

3

0.12

Big box retailers dominance

0.04

3

0.12

counterfeit products

0.03

1

0.03

trade quotas (WTO)

0.02

3

0.06

fluctuating currency exchange rate

0.02

3

0.06

TOTAL

1

3.76

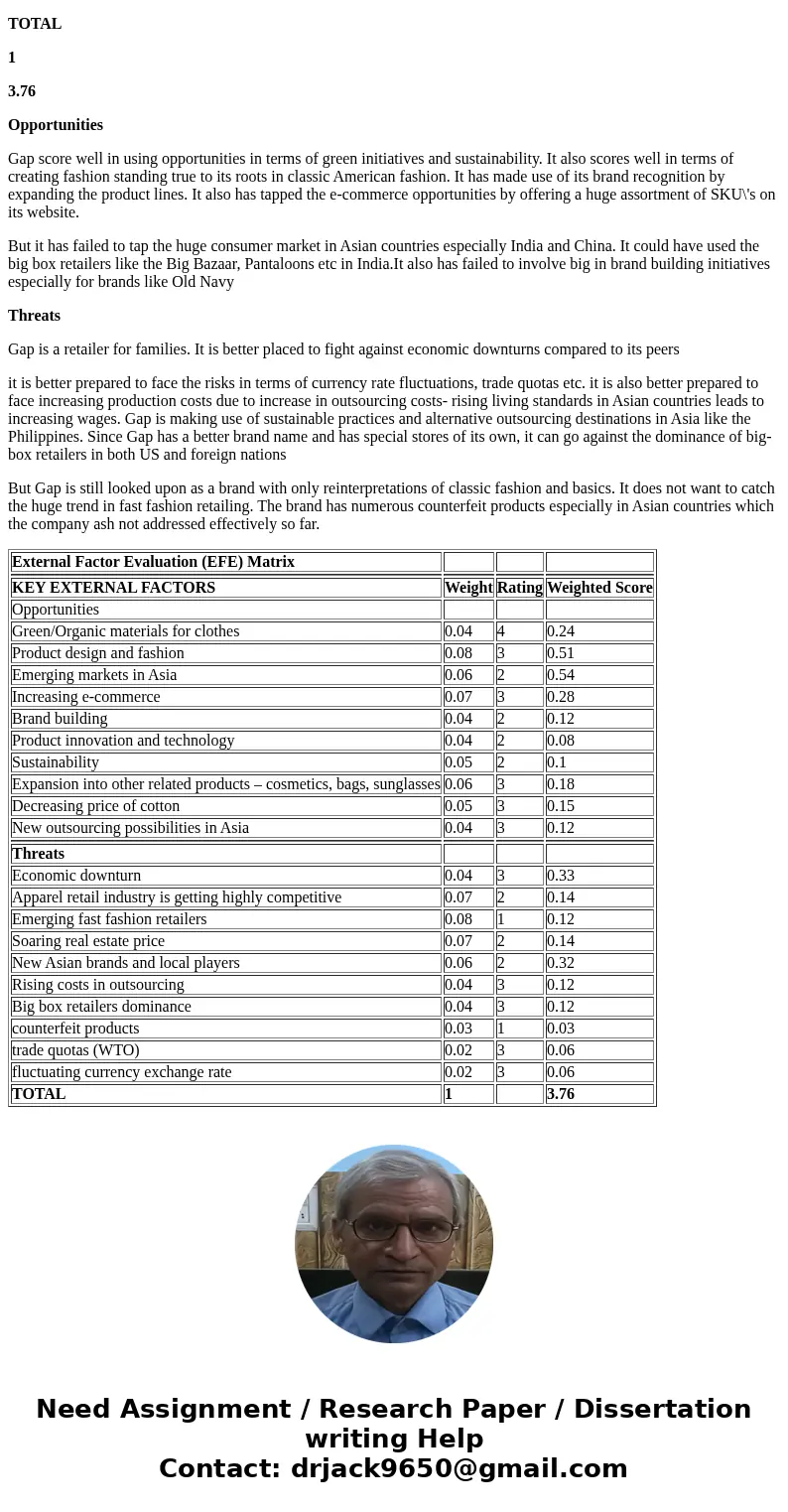

Opportunities

Gap score well in using opportunities in terms of green initiatives and sustainability. It also scores well in terms of creating fashion standing true to its roots in classic American fashion. It has made use of its brand recognition by expanding the product lines. It also has tapped the e-commerce opportunities by offering a huge assortment of SKU\'s on its website.

But it has failed to tap the huge consumer market in Asian countries especially India and China. It could have used the big box retailers like the Big Bazaar, Pantaloons etc in India.It also has failed to involve big in brand building initiatives especially for brands like Old Navy

Threats

Gap is a retailer for families. It is better placed to fight against economic downturns compared to its peers

it is better prepared to face the risks in terms of currency rate fluctuations, trade quotas etc. it is also better prepared to face increasing production costs due to increase in outsourcing costs- rising living standards in Asian countries leads to increasing wages. Gap is making use of sustainable practices and alternative outsourcing destinations in Asia like the Philippines. Since Gap has a better brand name and has special stores of its own, it can go against the dominance of big-box retailers in both US and foreign nations

But Gap is still looked upon as a brand with only reinterpretations of classic fashion and basics. It does not want to catch the huge trend in fast fashion retailing. The brand has numerous counterfeit products especially in Asian countries which the company ash not addressed effectively so far.

| External Factor Evaluation (EFE) Matrix | |||

| KEY EXTERNAL FACTORS | Weight | Rating | Weighted Score |

| Opportunities | |||

| Green/Organic materials for clothes | 0.04 | 4 | 0.24 |

| Product design and fashion | 0.08 | 3 | 0.51 |

| Emerging markets in Asia | 0.06 | 2 | 0.54 |

| Increasing e-commerce | 0.07 | 3 | 0.28 |

| Brand building | 0.04 | 2 | 0.12 |

| Product innovation and technology | 0.04 | 2 | 0.08 |

| Sustainability | 0.05 | 2 | 0.1 |

| Expansion into other related products – cosmetics, bags, sunglasses | 0.06 | 3 | 0.18 |

| Decreasing price of cotton | 0.05 | 3 | 0.15 |

| New outsourcing possibilities in Asia | 0.04 | 3 | 0.12 |

| Threats | |||

| Economic downturn | 0.04 | 3 | 0.33 |

| Apparel retail industry is getting highly competitive | 0.07 | 2 | 0.14 |

| Emerging fast fashion retailers | 0.08 | 1 | 0.12 |

| Soaring real estate price | 0.07 | 2 | 0.14 |

| New Asian brands and local players | 0.06 | 2 | 0.32 |

| Rising costs in outsourcing | 0.04 | 3 | 0.12 |

| Big box retailers dominance | 0.04 | 3 | 0.12 |

| counterfeit products | 0.03 | 1 | 0.03 |

| trade quotas (WTO) | 0.02 | 3 | 0.06 |

| fluctuating currency exchange rate | 0.02 | 3 | 0.06 |

| TOTAL | 1 | 3.76 |

Homework Sourse

Homework Sourse