Question 1 The ledger of Whispering Winds Corp on July 31 20

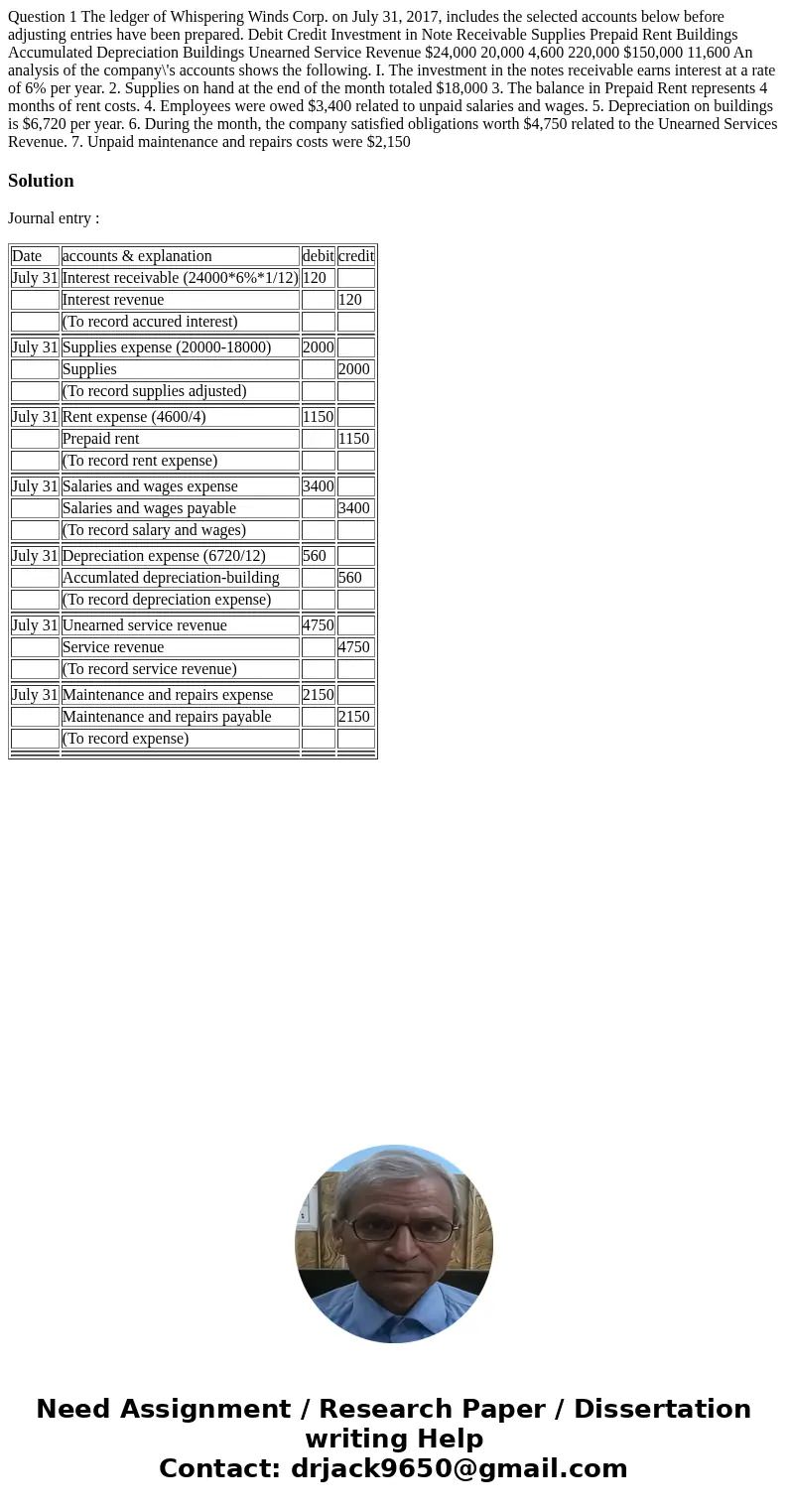

Question 1 The ledger of Whispering Winds Corp. on July 31, 2017, includes the selected accounts below before adjusting entries have been prepared. Debit Credit Investment in Note Receivable Supplies Prepaid Rent Buildings Accumulated Depreciation Buildings Unearned Service Revenue $24,000 20,000 4,600 220,000 $150,000 11,600 An analysis of the company\'s accounts shows the following. I. The investment in the notes receivable earns interest at a rate of 6% per year. 2. Supplies on hand at the end of the month totaled $18,000 3. The balance in Prepaid Rent represents 4 months of rent costs. 4. Employees were owed $3,400 related to unpaid salaries and wages. 5. Depreciation on buildings is $6,720 per year. 6. During the month, the company satisfied obligations worth $4,750 related to the Unearned Services Revenue. 7. Unpaid maintenance and repairs costs were $2,150

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| July 31 | Interest receivable (24000*6%*1/12) | 120 | |

| Interest revenue | 120 | ||

| (To record accured interest) | |||

| July 31 | Supplies expense (20000-18000) | 2000 | |

| Supplies | 2000 | ||

| (To record supplies adjusted) | |||

| July 31 | Rent expense (4600/4) | 1150 | |

| Prepaid rent | 1150 | ||

| (To record rent expense) | |||

| July 31 | Salaries and wages expense | 3400 | |

| Salaries and wages payable | 3400 | ||

| (To record salary and wages) | |||

| July 31 | Depreciation expense (6720/12) | 560 | |

| Accumlated depreciation-building | 560 | ||

| (To record depreciation expense) | |||

| July 31 | Unearned service revenue | 4750 | |

| Service revenue | 4750 | ||

| (To record service revenue) | |||

| July 31 | Maintenance and repairs expense | 2150 | |

| Maintenance and repairs payable | 2150 | ||

| (To record expense) | |||

Homework Sourse

Homework Sourse