The companys product liability insurance coverage with respe

The company\'s product liability insurance coverage with respect to insured events occurring af. ter January 1 of the current year is substantially less than the amount of that insurance available in the recent past. The company is now predominantly self-insured in this area. The reduction in insurance coverage reflects trends in the liability insurance field generally and is not unique to the company. BLEMS-SET A Income Statement Format The following information from Belvidere Company\'s current opera- tions is available: . $73,000 772,000 Loss from operations of discontinued segment. . . . . . . . . . Gain on disposal of discontinued segment . . . . . . . .. . . . . . . 10,000 60,000 40,000 . Income taxes: Amount applicable to ordinary operations . Reduction applicable to loss from operations of discontinued segment Amount applicable to gain on disposal of discontinued segment 60,000 24,000 16,000 .. Requiread a. Prepare a multiple-step income statement. (Disregard earnings per share.)

Solution

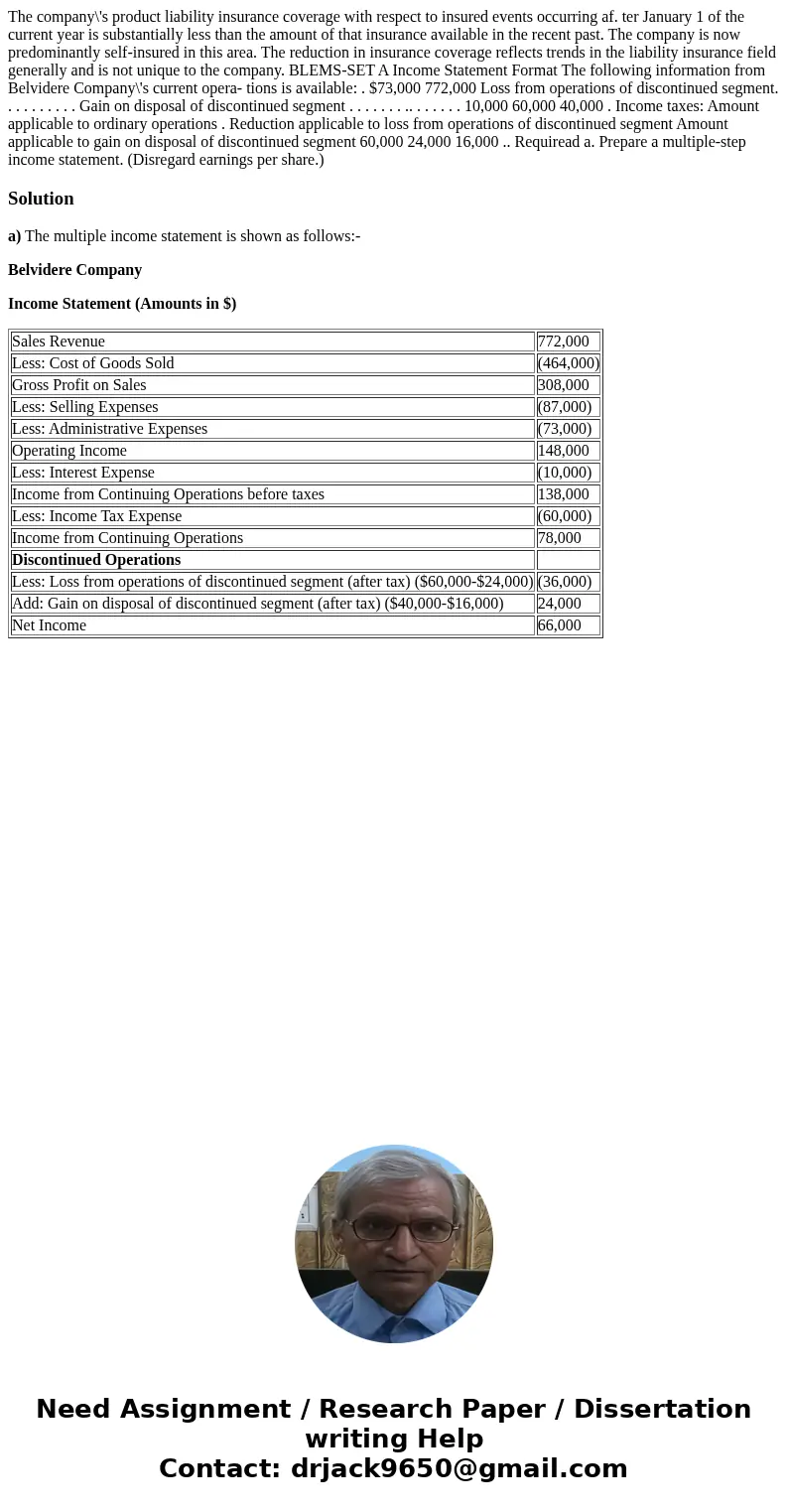

a) The multiple income statement is shown as follows:-

Belvidere Company

Income Statement (Amounts in $)

| Sales Revenue | 772,000 |

| Less: Cost of Goods Sold | (464,000) |

| Gross Profit on Sales | 308,000 |

| Less: Selling Expenses | (87,000) |

| Less: Administrative Expenses | (73,000) |

| Operating Income | 148,000 |

| Less: Interest Expense | (10,000) |

| Income from Continuing Operations before taxes | 138,000 |

| Less: Income Tax Expense | (60,000) |

| Income from Continuing Operations | 78,000 |

| Discontinued Operations | |

| Less: Loss from operations of discontinued segment (after tax) ($60,000-$24,000) | (36,000) |

| Add: Gain on disposal of discontinued segment (after tax) ($40,000-$16,000) | 24,000 |

| Net Income | 66,000 |

Homework Sourse

Homework Sourse