Each of the four independent situations below describes a sa

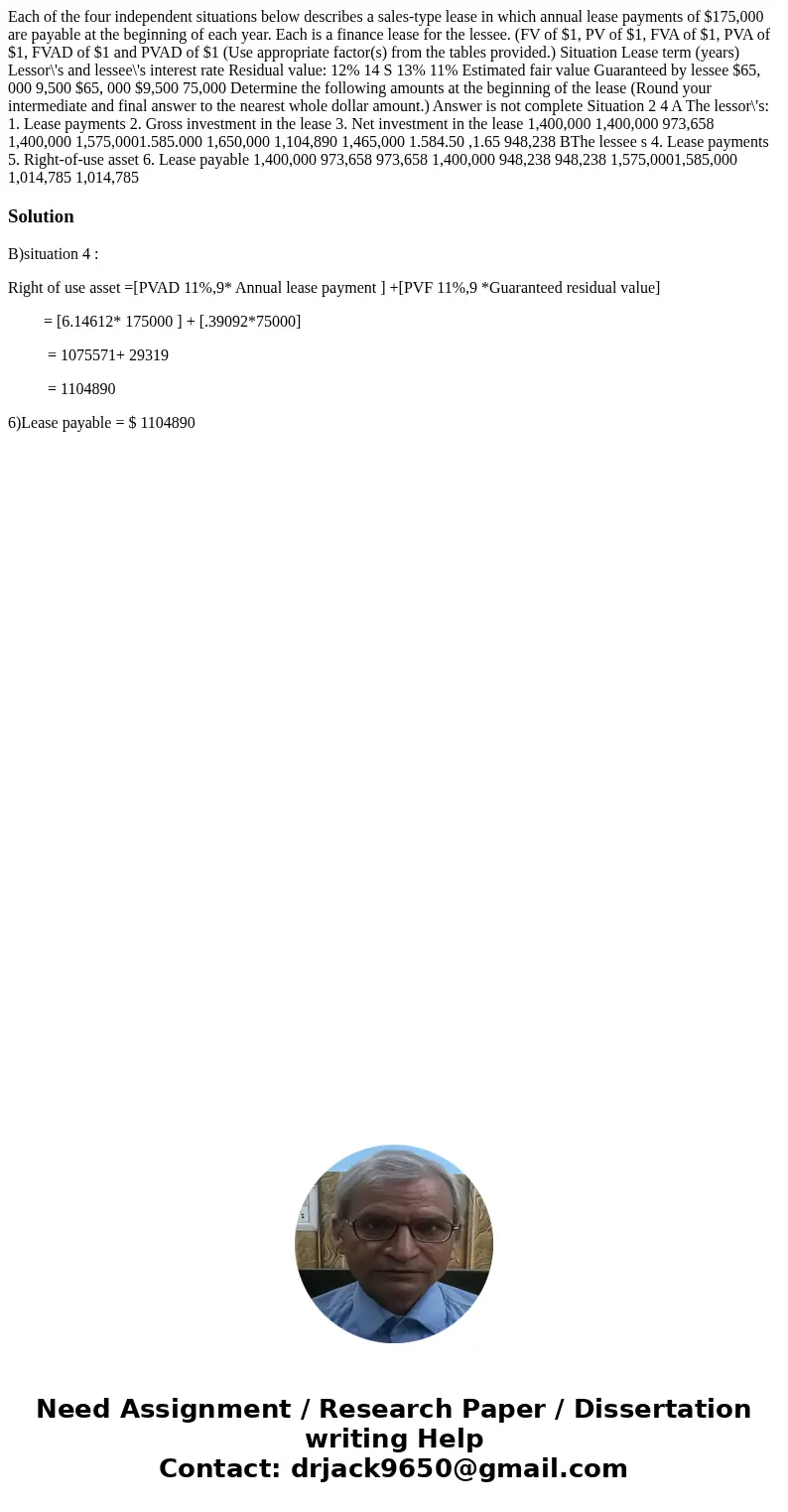

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $175,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Situation Lease term (years) Lessor\'s and lessee\'s interest rate Residual value: 12% 14 S 13% 11% Estimated fair value Guaranteed by lessee $65, 000 9,500 $65, 000 $9,500 75,000 Determine the following amounts at the beginning of the lease (Round your intermediate and final answer to the nearest whole dollar amount.) Answer is not complete Situation 2 4 A The lessor\'s: 1. Lease payments 2. Gross investment in the lease 3. Net investment in the lease 1,400,000 1,400,000 973,658 1,400,000 1,575,0001.585.000 1,650,000 1,104,890 1,465,000 1.584.50 ,1.65 948,238 BThe lessee s 4. Lease payments 5. Right-of-use asset 6. Lease payable 1,400,000 973,658 973,658 1,400,000 948,238 948,238 1,575,0001,585,000 1,014,785 1,014,785

Solution

B)situation 4 :

Right of use asset =[PVAD 11%,9* Annual lease payment ] +[PVF 11%,9 *Guaranteed residual value]

= [6.14612* 175000 ] + [.39092*75000]

= 1075571+ 29319

= 1104890

6)Lease payable = $ 1104890

Homework Sourse

Homework Sourse