Marathon Running Shoes reports the following Click the icon

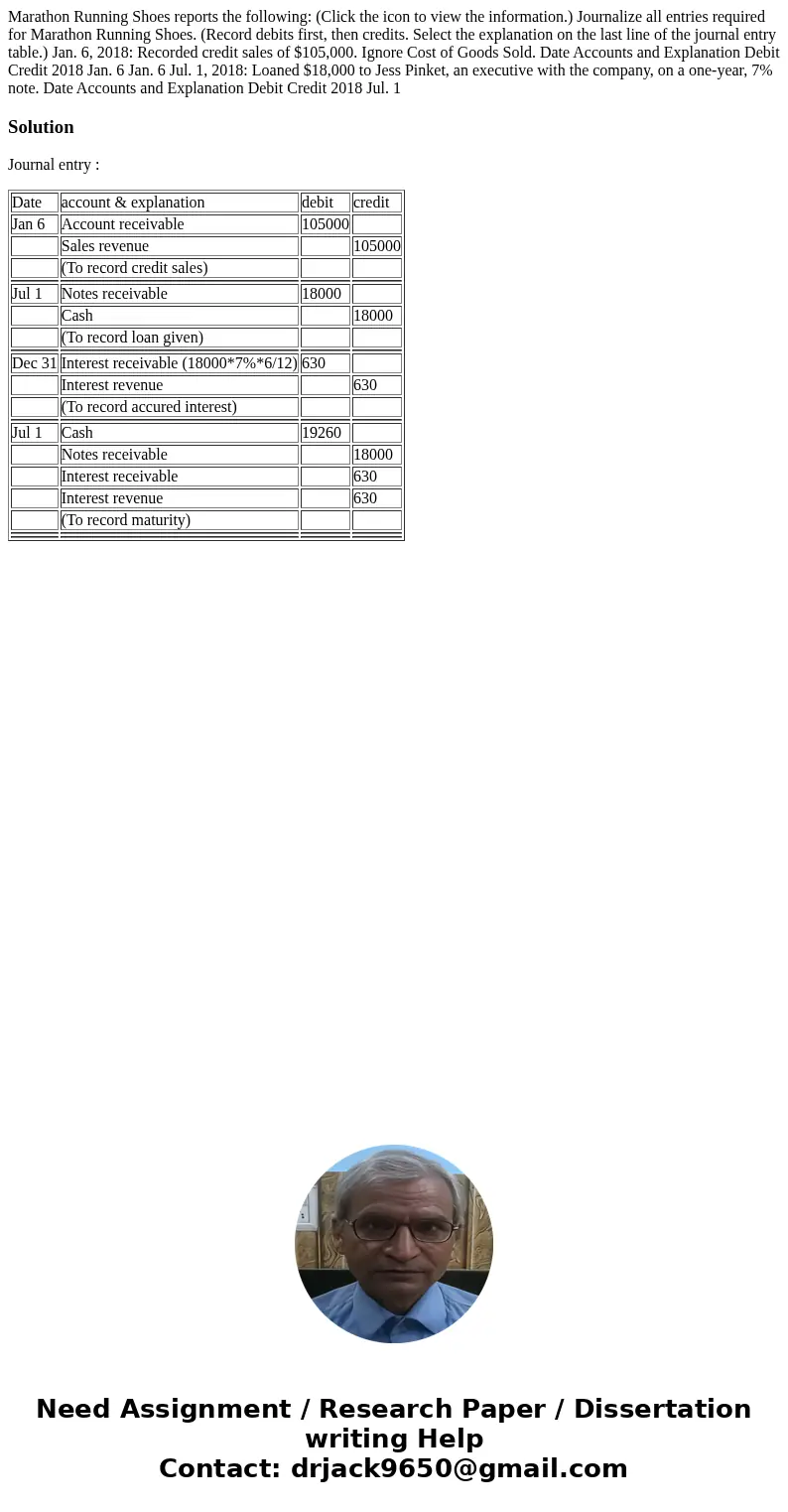

Marathon Running Shoes reports the following: (Click the icon to view the information.) Journalize all entries required for Marathon Running Shoes. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Jan. 6, 2018: Recorded credit sales of $105,000. Ignore Cost of Goods Sold. Date Accounts and Explanation Debit Credit 2018 Jan. 6 Jan. 6 Jul. 1, 2018: Loaned $18,000 to Jess Pinket, an executive with the company, on a one-year, 7% note. Date Accounts and Explanation Debit Credit 2018 Jul. 1

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Jan 6 | Account receivable | 105000 | |

| Sales revenue | 105000 | ||

| (To record credit sales) | |||

| Jul 1 | Notes receivable | 18000 | |

| Cash | 18000 | ||

| (To record loan given) | |||

| Dec 31 | Interest receivable (18000*7%*6/12) | 630 | |

| Interest revenue | 630 | ||

| (To record accured interest) | |||

| Jul 1 | Cash | 19260 | |

| Notes receivable | 18000 | ||

| Interest receivable | 630 | ||

| Interest revenue | 630 | ||

| (To record maturity) | |||

Homework Sourse

Homework Sourse