Two mutually exclusive investments have the cash flow of Pro

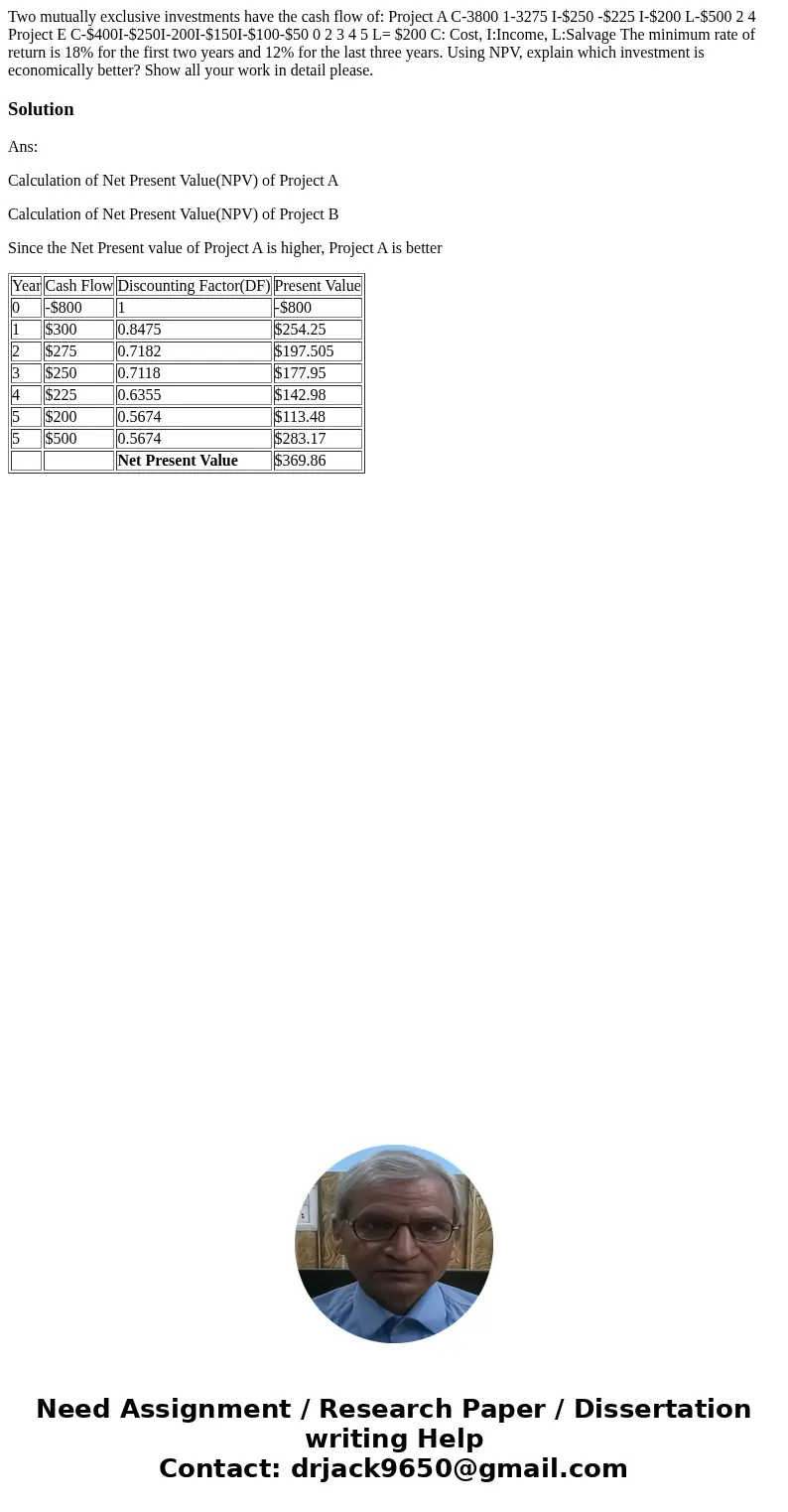

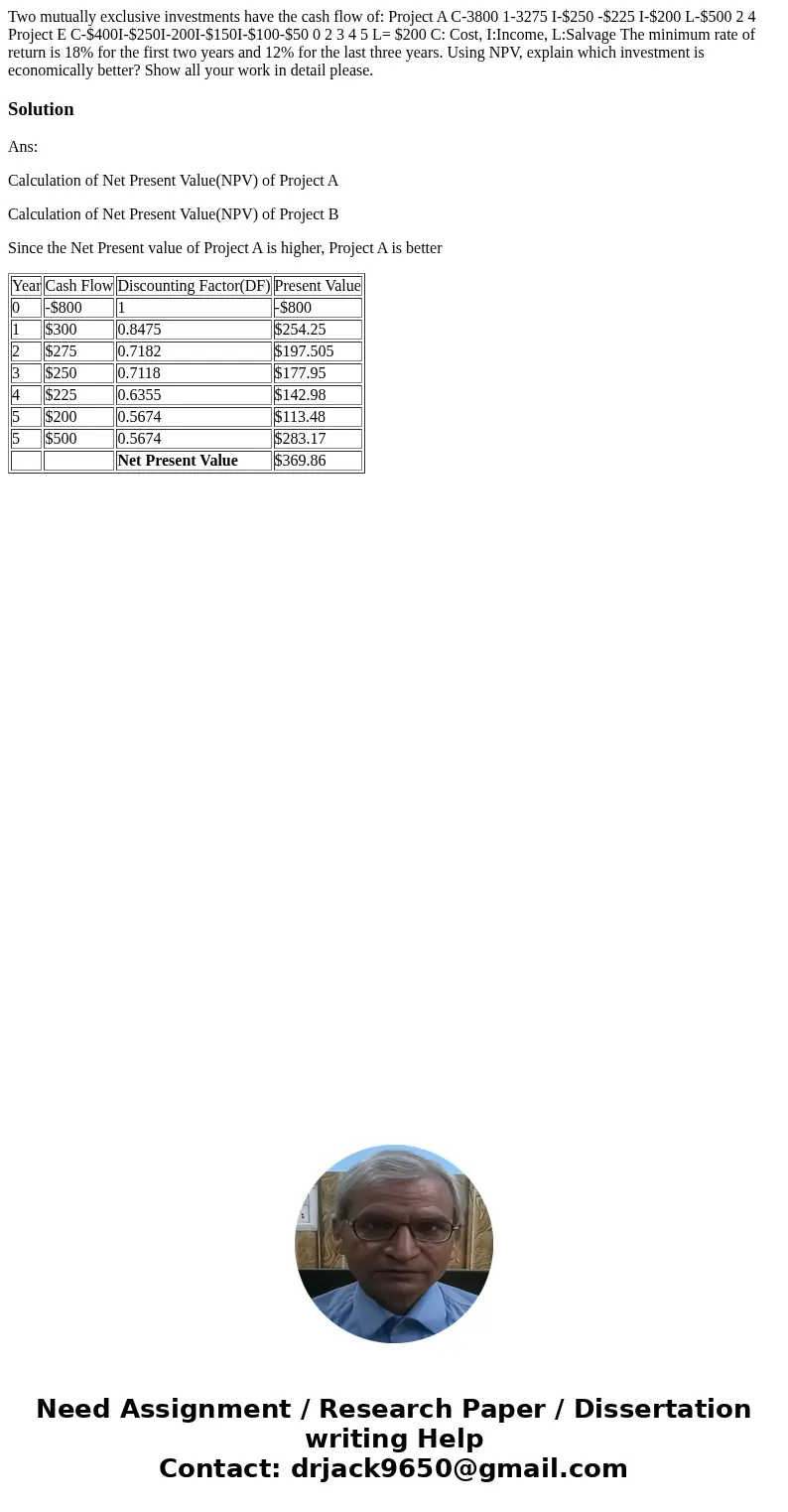

Two mutually exclusive investments have the cash flow of: Project A C-3800 1-3275 I-$250 -$225 I-$200 L-$500 2 4 Project E C-$400I-$250I-200I-$150I-$100-$50 0 2 3 4 5 L= $200 C: Cost, I:Income, L:Salvage The minimum rate of return is 18% for the first two years and 12% for the last three years. Using NPV, explain which investment is economically better? Show all your work in detail please.

Solution

Ans:

Calculation of Net Present Value(NPV) of Project A

Calculation of Net Present Value(NPV) of Project B

Since the Net Present value of Project A is higher, Project A is better

| Year | Cash Flow | Discounting Factor(DF) | Present Value |

| 0 | -$800 | 1 | -$800 |

| 1 | $300 | 0.8475 | $254.25 |

| 2 | $275 | 0.7182 | $197.505 |

| 3 | $250 | 0.7118 | $177.95 |

| 4 | $225 | 0.6355 | $142.98 |

| 5 | $200 | 0.5674 | $113.48 |

| 5 | $500 | 0.5674 | $283.17 |

| Net Present Value | $369.86 |

Homework Sourse

Homework Sourse