Sarah wants to invest 2M Based on her income she is currentl

Sarah wants to invest $2M. Based on her income she is currently in the 28% tax brackets for ordinary income and in the 15% bracket for Long term capital gains. Her tax bracket for state income tax purposes are 5% and 0% on long term capital gains. Requirements: for each of the four situations below, determine NPV of after tax cash flows:

SItuation 1 situation 2 situation 3 situation 4

Type: Corporate bonds municipal bonds corporate stocks municipal bonds

Time horizon: 5 years 7 years 8 years 9 years

Income: 11% interest annually 6.5% interest annually $35,000 dividends 6% interest annualy

Discount rate: 6% 5% 5% 5.5%

Repayment/sale repaid after 5 years repaid after 7 years sold after 8 yrs for $1,850,000 repaid after 9 years

Comments: taxable at ord income rates (non-taxable for fed income tax taxable at long term capital gain rates non-taxable for fed and state income tax

but state income tax of 5% applies)

Solution

Discounting

factor@6%

Discounted

cash flow

Interest income after tax(2 Million*11%) *67%

Notes,

1.The interest you earn from a corporate bond is subject to both federal income tax and state income tax.(28%+5%)

2. An investor can only receive capital gains from a corporate bond if he sells the bond prior to its maturity.

Discounting

factor@5%

Discounted

cash flow

Interest income after tax(2 Million*6.5%) *95%

Notes,

Municipal bonds are commonly tax-free at the federal level, but can be taxable at state under certain circumstances, in present case it is assume that income from these bonds taxable at state level @5%.

Discounting

factor@5%

Discounted

cash flow

Divident Income

Discounting

factor@5.5%

Discounted

cash flow

Interest income after tax(2 Million*6%) *95%

Notes,

Municipal bonds are commonly tax-free at the federal level, but can be taxable at state under certain circumstances, in present case it is assume that income from these bonds taxable at state level @5%.

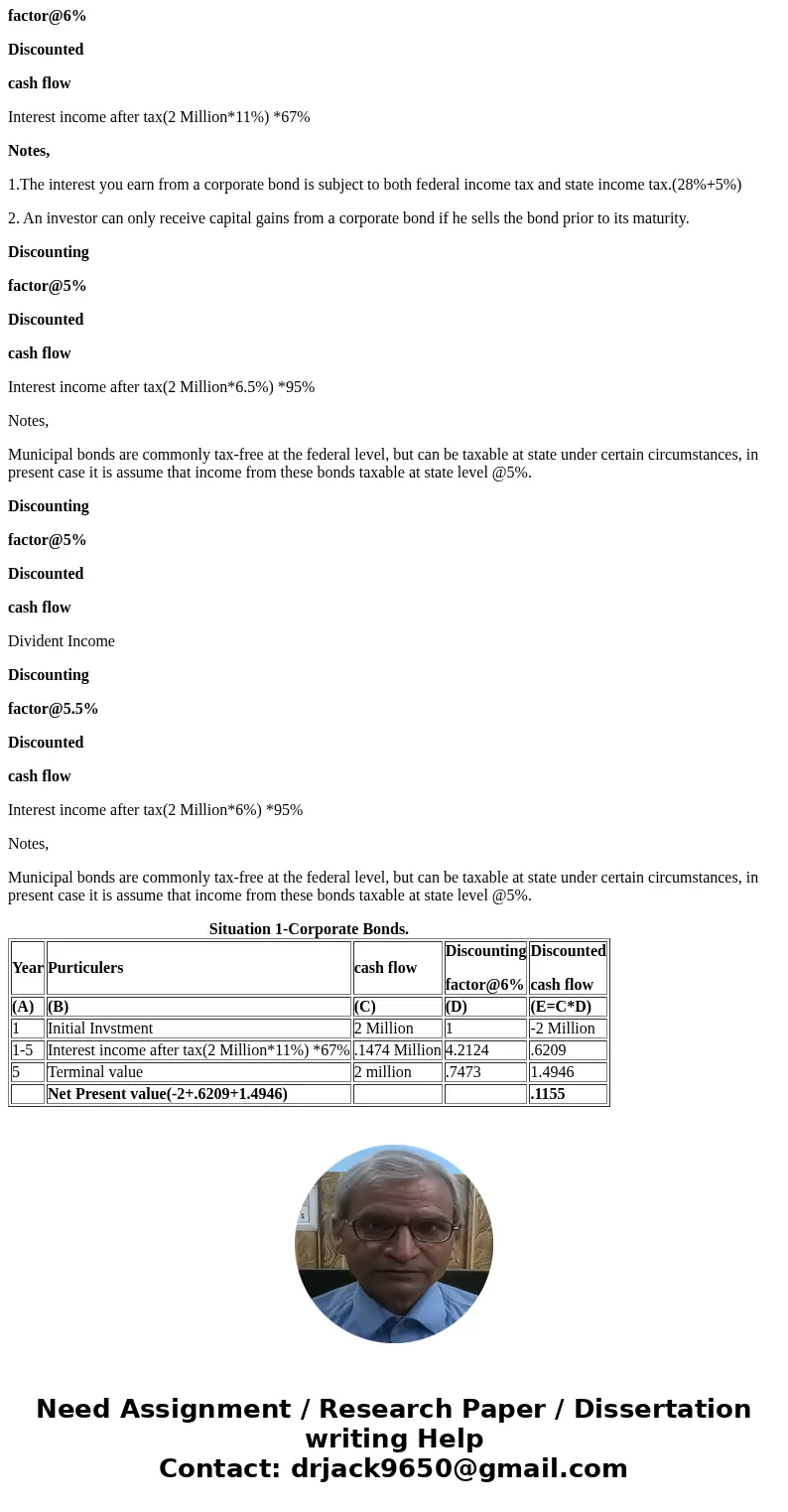

| Year | Purticulers | cash flow | Discounting factor@6% | Discounted cash flow |

| (A) | (B) | (C) | (D) | (E=C*D) |

| 1 | Initial Invstment | 2 Million | 1 | -2 Million |

| 1-5 | Interest income after tax(2 Million*11%) *67% | .1474 Million | 4.2124 | .6209 |

| 5 | Terminal value | 2 million | .7473 | 1.4946 |

| Net Present value(-2+.6209+1.4946) | .1155 |

Homework Sourse

Homework Sourse