al TMobile LTE 855 AM 99 Done 11 of 11 many a an opportunity

Solution

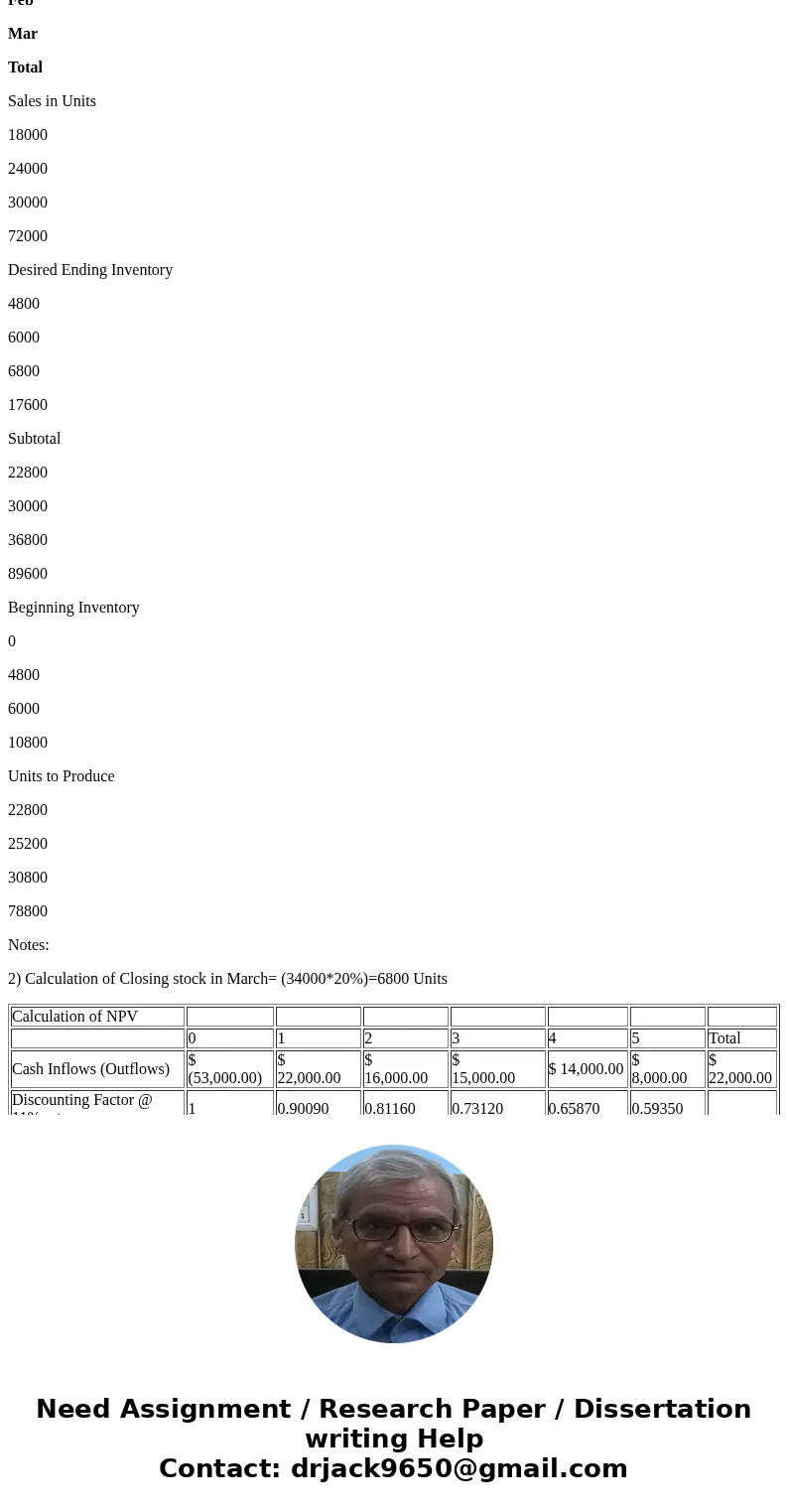

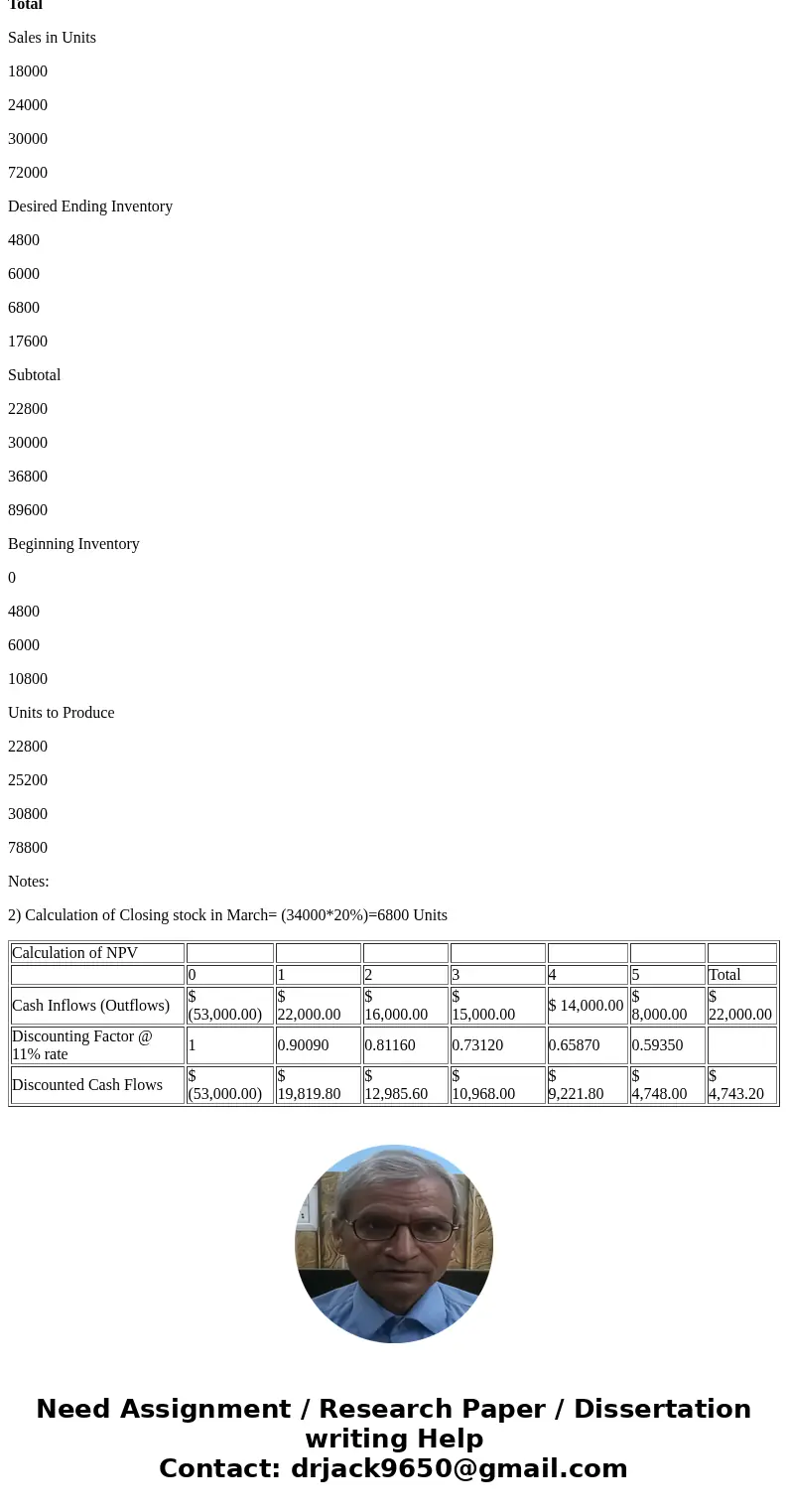

Calculation of NPV

0

1

2

3

4

5

Total

Cash Inflows (Outflows)

$ (53,000.00)

$ 22,000.00

$ 16,000.00

$ 15,000.00

$ 14,000.00

$ 8,000.00

$ 22,000.00

Discounting Factor @ 11% rate

1

0.90090

0.81160

0.73120

0.65870

0.59350

Discounted Cash Flows

$ (53,000.00)

$ 19,819.80

$ 12,985.60

$ 10,968.00

$ 9,221.80

$ 4,748.00

$ 4,743.20

Net Present Value of the Project

$ 4,743.20

Project is Acceptable.

Notes:

Budget

Sales Budget

jan

Feb

Mar

Total

Unit Sales

18000

24000

30000

72000

Price

$ 14.00

$ 14.00

$ 14.00

$ 14.00

Sales Revenue

$ 252,000.00

$ 336,000.00

$ 420,000.00

$ 1,008,000.00

Production Budget

jan

Feb

Mar

Total

Sales in Units

18000

24000

30000

72000

Desired Ending Inventory

4800

6000

6800

17600

Subtotal

22800

30000

36800

89600

Beginning Inventory

0

4800

6000

10800

Units to Produce

22800

25200

30800

78800

Notes:

2) Calculation of Closing stock in March= (34000*20%)=6800 Units

| Calculation of NPV | |||||||

| 0 | 1 | 2 | 3 | 4 | 5 | Total | |

| Cash Inflows (Outflows) | $ (53,000.00) | $ 22,000.00 | $ 16,000.00 | $ 15,000.00 | $ 14,000.00 | $ 8,000.00 | $ 22,000.00 |

| Discounting Factor @ 11% rate | 1 | 0.90090 | 0.81160 | 0.73120 | 0.65870 | 0.59350 | |

| Discounted Cash Flows | $ (53,000.00) | $ 19,819.80 | $ 12,985.60 | $ 10,968.00 | $ 9,221.80 | $ 4,748.00 | $ 4,743.20 |

Homework Sourse

Homework Sourse