On January 1 2018 Ricks Pawn Shop leased a truck from Chumle

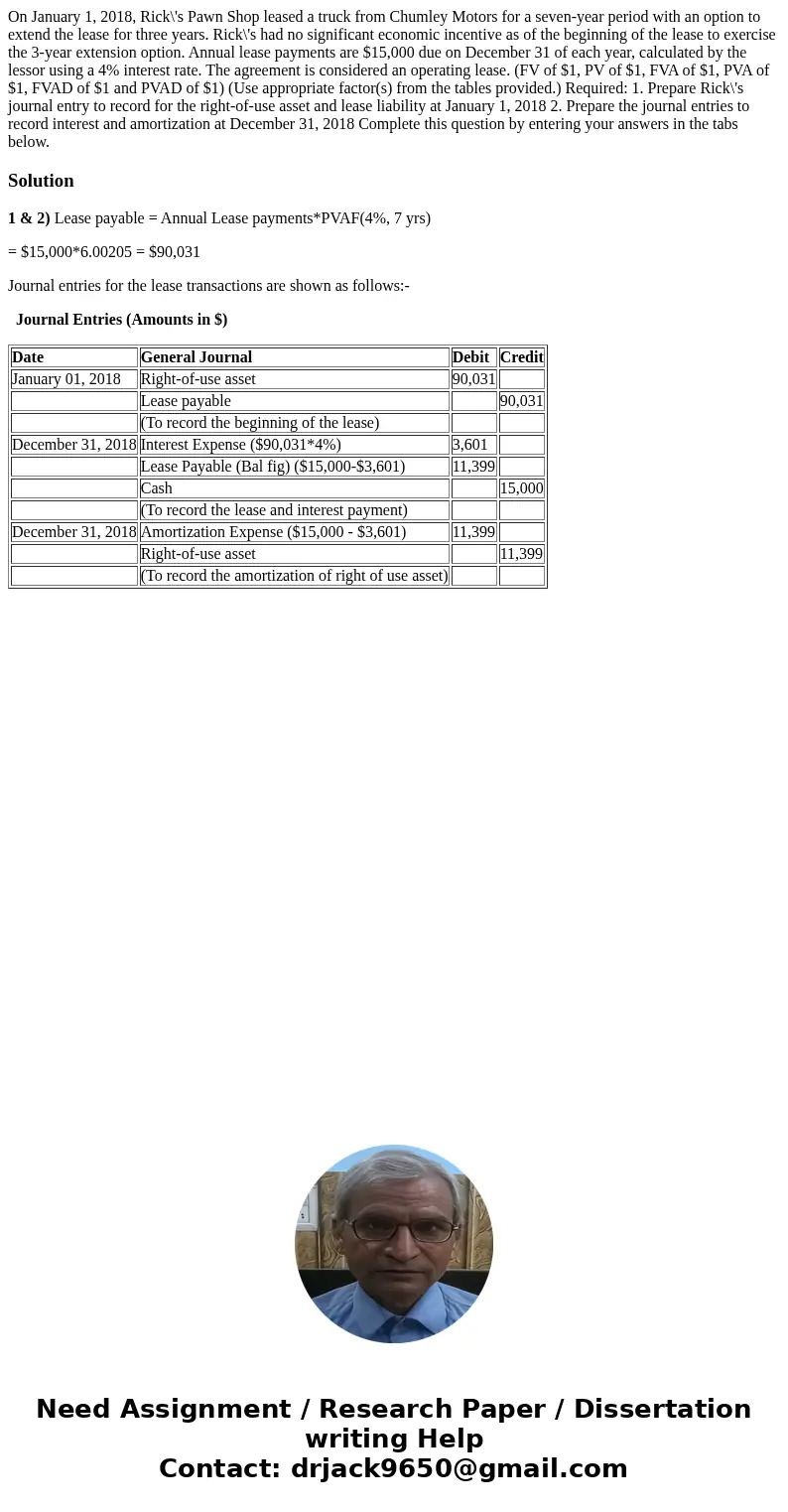

On January 1, 2018, Rick\'s Pawn Shop leased a truck from Chumley Motors for a seven-year period with an option to extend the lease for three years. Rick\'s had no significant economic incentive as of the beginning of the lease to exercise the 3-year extension option. Annual lease payments are $15,000 due on December 31 of each year, calculated by the lessor using a 4% interest rate. The agreement is considered an operating lease. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare Rick\'s journal entry to record for the right-of-use asset and lease liability at January 1, 2018 2. Prepare the journal entries to record interest and amortization at December 31, 2018 Complete this question by entering your answers in the tabs below.

Solution

1 & 2) Lease payable = Annual Lease payments*PVAF(4%, 7 yrs)

= $15,000*6.00205 = $90,031

Journal entries for the lease transactions are shown as follows:-

Journal Entries (Amounts in $)

| Date | General Journal | Debit | Credit |

| January 01, 2018 | Right-of-use asset | 90,031 | |

| Lease payable | 90,031 | ||

| (To record the beginning of the lease) | |||

| December 31, 2018 | Interest Expense ($90,031*4%) | 3,601 | |

| Lease Payable (Bal fig) ($15,000-$3,601) | 11,399 | ||

| Cash | 15,000 | ||

| (To record the lease and interest payment) | |||

| December 31, 2018 | Amortization Expense ($15,000 - $3,601) | 11,399 | |

| Right-of-use asset | 11,399 | ||

| (To record the amortization of right of use asset) |

Homework Sourse

Homework Sourse